I had a chat with a couple of people last week about the hot topics in capital markets. Along with our regular talk about liquidity risk, new EU regulations and USA and EU focus upon OTC Derivatives, clearing and settlement, another subject has recently come to the fore.

The use of broker–dealer capabilities to leverage latency and electronic liquidity to gain a buck at the expense of the buy–side, better known as ‘flash trading’.

This has become a hot topic because the regulators recently learnt that this can cause issues, especially when we’re talking about dark pools where large block order trades can be executed with zero visibility to the wider markets.

It's also been a focus of conversation for a while. For example, at TradeTech in April we talked about 'gaming' using the buyer’s key indicators of trading activity electronically. These are based upon two messages: an Indication of Interest (IOI) and Immediate or Cancel Order (IOC); and these are the source of concern within the industry.

“The misuse of IOIs and IOCs is a hot debate topic, as many dark pools use this information badly to allow leakage and hence ‘gaming’. For example, you receive 16 orders for 62,500 IBM shares from one fund manager or broker dealer and you know that a million shares are moving, probably on the basis of news or views of one player.

“Using IOIs and IOCs, other traders can then game those IBM shares, moving prices using dark pools. Then combine IOIs and IOCs with latency arbitrage and you can see how complicated this all gets.”

Before we get too complicated, it is probably best to explain some of the lingo used here.

The IOI is the buyer’s message saying that they might want to place an order for so many shares in a stock and the IOC is used to cancel the order.

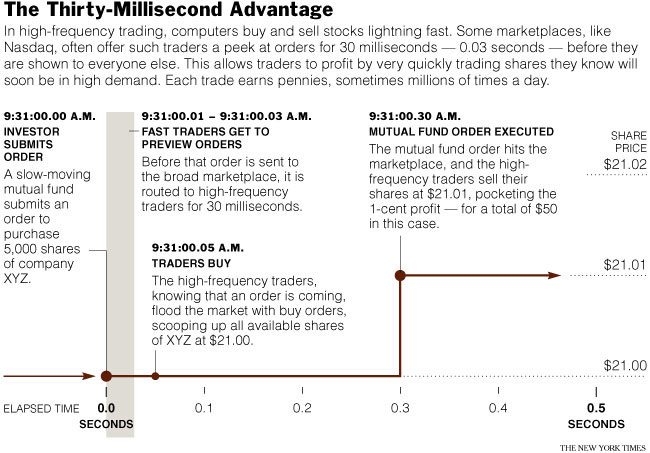

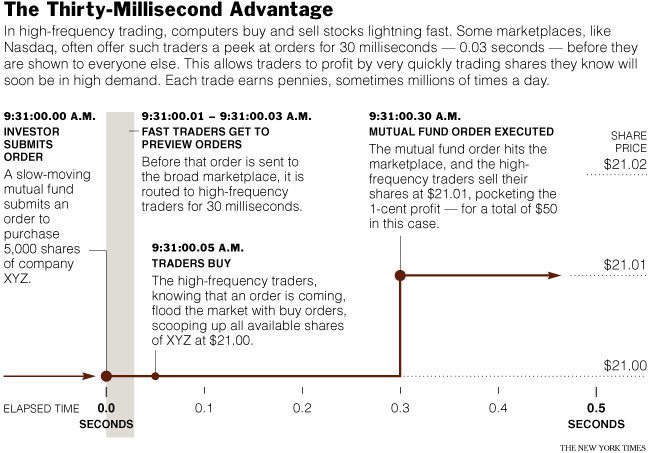

In the case of flash trading, the high speed processing means that some brokers can use systems to see a trade coming into the market, and raise the price artificially by processing a series of other buy requests before the order is executed.

The New York Times explains flash trading well in this chart (doubleclick chart to see larger version):

And another chart in the Wall Street Journal provides further insight:

In other words, the combination of high frequency trading using super fast, low latency systems that are highly automated, allow the market making firms to use a ‘flash’ order which is visible for let’s say half a second, to make a few dollars.

Half a second is 500 milliseconds or 500,000 microseconds (there are 1000 milliseconds in 1 second; 1000 microseconds in 1 millisecond; and so on) which is why speed is so important, and the automated market-making firms with naked access can use a flash order to advantage for this reason.

This has been discussed by the Finanser before, as well as at the Financial Services Club, with a panel last March explaining why low latency is so important.

But it’s not just low latency.

It’s the use of technology, algorithmic trading, co–location and proximity-hosted, high frequency, low value trading, combined with low latency that makes this all so darned complicated ... and the more complicated, the more likely and capable are those who understand the markets able to make a buck.

That’s why Goldman Sachs were so worried when they lost one of their programmers, and potentially their program code, last month.

This has now raised the regulatory radar, with the USA the first to crack down.

According to several reports last week, the SEC is making moves to ban flash trades, and NASDAQ and BATS are also moving to block flash trades.

That’s all well and good.

However, all exchanges are struggling to find volume and liquidity right now and just as some may introduce restrictive practices, others – such as Euronext - build new capabilities to incentivise high frequency traders and trading.

Result: there will be more moves to restrict this type of trading using regulatory restraints.

Result + 1: the market makers and exchanges will create even more convoluted technologies and program trading capabilities to evade these restraints.

And so the cycle goes ...

*

The Finanser is sponsored by Vocalink and Cisco:

For details of sponsorship email us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...