It's been a while since I wrote about MiFID and so, when I was asked to provide an update recently, here's what my take on the world of European trading is like two years on.

Two years after the Market in Financial Instruments Directive (MiFID) came into force in Europe and not a great deal has changed ... or has it? There are certainly new exchanges and new clearing systems, but the general landscape of Europe dominated by the three largest exchanges – Deutsche Bourse, NYSE Euronext and the London Stock Exchange – remains unfazed ... or are they? Certainly there are many pretenders to these giants’ thrones, but are any of them really up to the job?

In November 2007, MiFID’s rules on transparency of trading came into force. The idea was that we would have a pan–European investment market that would be as open and seamless as the US markets. Various players threw their hat into the ring to shake things up and, two years later, only one is making any major inroads: the Instinet subsidiary, Chi–X. Meanwhile, the other pillar of MiFID’s intent lies untested and unchallenged, namely the focus upon best execution. However, for anyone to believe that MiFID is a damp squib would be wrong. It has shaken the foundations of the European investment industry by bringing in new technologies, new focus and new pricing systems that, over time, will demonstrate a radical restructuring of the European markets.

Before we delve deep into this territory, let’s look at the new competition first.

The first mover to leverage MiFID’s opportunities was Chi–X, the pan–European equities exchange geared towards algorithmic trading. The fact that Chi–X was first mover, opening for business in April 2007, meant that by the time the second movers came into the market – Turquoise and NASDAQ OMX started trading effectively in September 2008 – there had been an 18 month cycle of gaining liquidity which has proven hard to break.

Under MiFID’s rules, there is meant to be a requirement for best execution based upon the price, speed and cost of processing, but this rule has never been tested and, more often than not, trades flow to where the market knows. Therefore, Deutsche Bourse, NYSE Euronext and the LSE are still thriving, and the only new entrant to make any headway has been Chi–X.

Chi–X do claim that this is based upon more than just being first mover, as they do offer very low latency (high speed) capabilities for high frequency traders. For example, the cycle time to process an order through Chi–X is around two milliseconds, compared to around six for Turquoise and significantly slower cycles through the traditional exchanges.

This low latency capability has been critical for the main market makers, who see speed of trading as a key factor for exploiting market opportunities and leveraging their algorithmic trading systems.

In addition, the second movers launch in September 2008 was just bad timing as this coincided with the market crash caused by Lehman Brothers collapse. Launching new equities exchanges just as all market trading volumes declined significantly was just poor timing.

It does not mean that the new entrants and market restructuring has finished though, as other trading facilities have launched since September 2008 including Equiduct, BATS and Quote MTF. In fact, according to the Council of European Securities Regulators (CESR, soon to become the European Securities Authority), there are 125 Multilateral Trading Facilities (MTF) that have registered for licence with them since MiFID came into force.

And most of these facilities have one thing in common: low latency technologies at low cost.

For example, the average order cycle, including clearing, is 10 basis points on the new exchanges, compared with 70 or more on the old exchanges. They also have a model based upon a higher fee for those who take liquidity versus those who bring liquidity. Finally, they are highly geared towards dark pool trading activities and electronic liquidity providers through advanced technology services.

This last point is a key one as, alongside new equities exchanges, the other major change in European trading has been the rise of dark pools, where orders can sit waiting to be filled unseen. Turquoise was the first aggressive play in this space, backed as it is by the major market makers. Since Turquoise launched, we have seen several others rise including Smartpool from NYSE Euronext and Baikal from the LSE.

Nevertheless, these dark pools may encounter a few issues in the future as the USA is the model they are based upon, and Wall Street traders have recently found themselves in hot water over the use of dark pools and low latency to potentially manipulate the markets using flash trades, also known as ‘gaming’. The way this works is that, through the automated systems for trading, dealers can see a large order entering an exchange a half a second before it is filled. That half a second allows them to rapidly process hundreds of orders for the shares about to be traded using algorithmic low latency processing. The result is that by the time the buyers’ order is filled, the pirce has risen by a cent. Perform such trading regularly through the day, and those cents soon add up to a tidy profit for the brokers and dealers using such trading facilities.

These practices are about to be banned by the SEC, although NASDAQ has already said it will not allow them. Just as NASDAQ makes this announcement, NYSE Euronext's new data centre to support high frequency trading facilities is soon to open in the USA. Therefore, the market will move to support liquidity, and if the liquidity is legitimate then there will always be at least one exchange who will support it.

This is concerning the European Commission, even more so with the fact that pricing has become fragmented across so many pools of liquidity, many of which are dark. This is potentially the rule of unintended consequences and the rumours of a MiFID II to resolve these issues abound.

Meanwhile, all of this fragmentation and dark trading is having a major impact on the traditional exchanges.

The traditional exchanges spent many years protected by concentration rules that forced traders in each country to process orders through their national exchange. These rules were removed on November 1st 2007, when MiFID came into force, and has opened the exchanges to major new competitive forces unseen before.

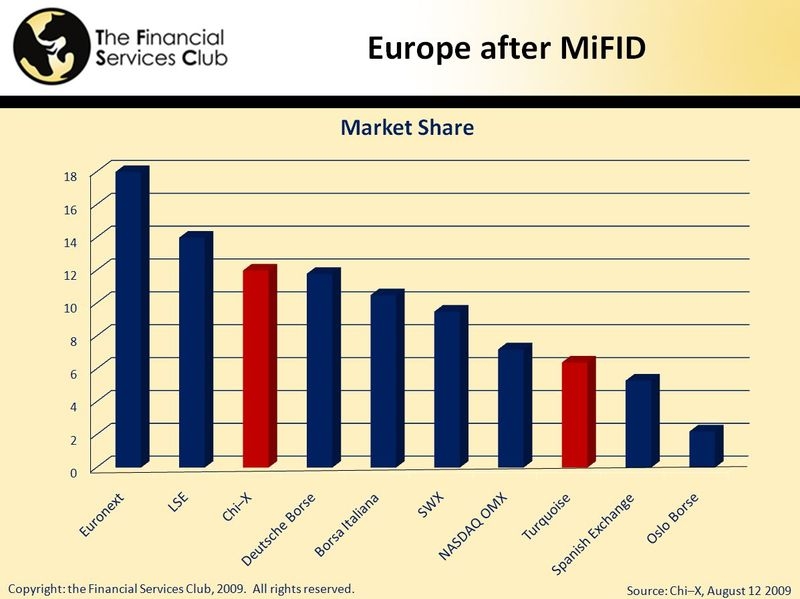

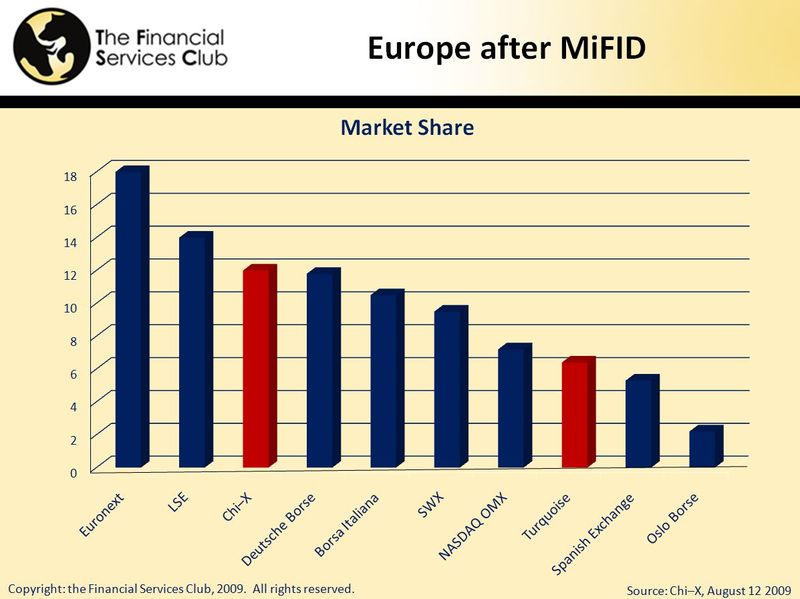

Although these new competitors have struggled to take liquidity, the fact is that some are. Chi–X for example, is processing an average 20% of FTSE 100, DAX 30 and CAC40 shares these days, and Turquoise claims a further 5%, even nearing 10% of the FTSE 100.

A quarter or more of the most liquid shares trading on the traditional exchanges moving to the new exchanges in a couple of years is a concern, and each exchange has taken a different route to meet these concerns.

Deutsche Bourse saw a 7% drop in Xetra and 14% decline on Eurex trading in Q2 2009 compared with Q2 2008, with only Clearstream’s custodial services delivering a bright spot. NYSE Euronext made a $182 million loss in Q2, mainly due to severance costs with LCH.Clearnet over their acquisition of LIFFE, the London–based derivatives exchange. And the LSE is in a right muddle, with former leader Dame Clara Furse leaving in a cloud of issues over their strategy and new CEO Xavier Role announcing a radical departure in approach.

The last point was the most shocking in fact, as ex–Lehman banker Xavier Role intimated that he was going to dump their flagship system, TradElect. TradElect was developed by Accenture and Microsoft as a next generation trading system that went live in the summer of 2007 at a cost of £40 million. The system was developed before the impact of dark pool and low latency trading however, and has never been able to compete

with the order speeds of Chi–X and their clan.

Therefore, after only two years, the system looks to have had time called in order to create a real next generation trading service that processes at lightspeed.

Even so, one fact about the system has proven how difficult it is to take liquidity away from a trusted venue. Just before Lehman Brothers collapse, the LSE had a software failure for several hours on September 8th 2008. During this period, it should have led to major moves to the new exchanges as trading was stymied on the LSE for almost a day. It didn’t happen however, because most of the pricing feeds at that time were tied to pricing on the LSE and, with no price feed from the LSE, there were no pricing deals to be done on the alternative exchanges.

This will change in due course, as the new players find their niche, but today it is still the case that most traditional exchanges own their markets, or a large part of their markets. Yes, it is being eroded, but only slowly.

Which brings me to a final point. The erosion of tradition exchanges dominance of their country’s investments and trading is tied heavily to the openness and access to clearing and settlement in each constituency. Without easy securities settlement at the post–trade end of the process, the new exchanges are effectively frozen out of the markets.

The new exchanges have achieved a fair amount in resolving this issue, with new Central Counterparty (CCP) clearing systems from the USA, in the form of the EuroCCP a subsidiary of the DTCC, and in Europe with Fortis’s European Multilateral Clearing Facility (EMCF). But there are still many issues in interoperability and access to clearing and settlement in many countries, as evidenced possibly by the strong results of Clearstream in the Deutsche Bourse’s reporting this year.

Until the European Commission eradicates the Giovannini barriers – the barriers to cross–border securities settlement identified way back in 2003 and still unresolved today – and create a truly open and transparent post–trade system for Europe, the pre–trade equities exchanges can make inroads, but they will only be narrow roads rather than expressways.

In conclusion, two years after MiFID, Europe has a buoyant and lively marketplace for trading and investment that is gradually moving towards the European Commission’s vision of an open and transparent pan–European trading regime. The new MTFs have managed to gain a quarter of the most liquid stocks trading activity, and this will grow even further over time. Meanwhile, the traditional exchanges are rethinking and redeploying new technologies to compete.

The result at this stage is that the liquidity pools of Europe are running deep ... and dark.

A useful chart (doubleclick to enlarge):

For those interested, the book on MiFID gives a comprehensive review of the Directive with chapters written by many of the market experts. This article is also a useful backdrop to compare the state of the MiFID markets in April 2009.

*

The Finanser is sponsored by Vocalink and Cisco:

For details of sponsorship email us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...