We enjoyed a meeting of the Financial Services Club this week with Bob Bayman, a director with i-am associates. i-am associates are design fiends and work extensively on bank branch designs, so Bob’s presentation looked at how to make a bank cool based upon cool branch designs.

After my recent tirade against branch-based banking, you may wonder why we would have a branch design discussion at the Club.

Answer: branches are still required, just in a different way.

As Bob put it: “the branch is dead, long live the branch”, and illustrated this by saying how he was taking note that the new CEO of Royal Bank of Scotland (RBS) Retail Banking “gets it”.

“Gets what?” I ask.

“Gets the internet”, Bob replied. “Just in the first few weeks of arriving at RBS, he’s made it clear that the internet is the network and the branches sit on the network, rather than the other way around. That’s a fundamental mind shift for most people. To realise that the internet is the core network connection and everything else sits on top of that infrastructure.”

I had to smile as I got into a big debate with one reader two years ago, who thought I was trying to promote replacing all humans with machines. What I actually said was that the internet is the foundation of all banking, from mobile through call centre and branch, and that banks must redesign from the internet network base foundations, rather than the branch-based foundations of the past.

Here’s that debate:

- Part One: Bank strategies are fundamentally flawed

- Part Two: To dump or not to dump the branch

- Part Three: Bank designs versus architecture

This builds on the other recent entries made about branch-based banking (parts one and two).

The core point in all of this is that branches are still going to be needed to connect, sell, advise and engage in real human contact. The question is how many branches and how they are structured.

I’ve made the contention that it will be a tenth of today’s volume of branches, and the ones that are left will be super sales centres. The rest will be satellite footprints that are there for automated services such as this automated booth from Garanti Bank in Turkey:

This was one of several examples Bob highlighted of new bank structures and he proceeded to cite several examples of ‘cool bank branches’ including Garaniti in Turkey, Che Banca in Italy, Caja Navarro in Spain, Deutsche Bank in Berlin, Jyske Bank in Denmark, HSBC worldwide and Barclays showcase Piccadilly branch in London.

I will present more details of those discussions here next week due to time limitations. Suffice to say, the big point that came up is that banks aren’t retailers. They offer retail banking, but do not understand bank retailing.

Retail is a mentality that some are superb at delivering. We think of brands like Virgin, Nike, Sony, Apple and note their leadership in branding, distribution and retail. Then we try to think of a bank that comes close ... and struggle.

There are a few – Commerce Bank in America being the name that usually comes to mind - but these are few and far between.

Bob summed it up well by using the example of Nike and football.

Earlier this year, Man United were beaten by Barcelona in the European Champions League Cup.

Nike made a point of their association with the teams by dressing their flagship branch in Oxford Circus, London, in new livery the morning after the final:

This was at 8:45 the morning after the final. Similarly, they altered their website to suit.

These are fundamentals of retailing: you leverage your brand and your retail associations through your key sponsorships and links to your product.

So, what does a bank do?

Barclays Bank sponsor the UK Football Premiership Division.

That’s the one that is dominated by Manchester United, with close rivals Arsenal, Chelsea and Liverpool.

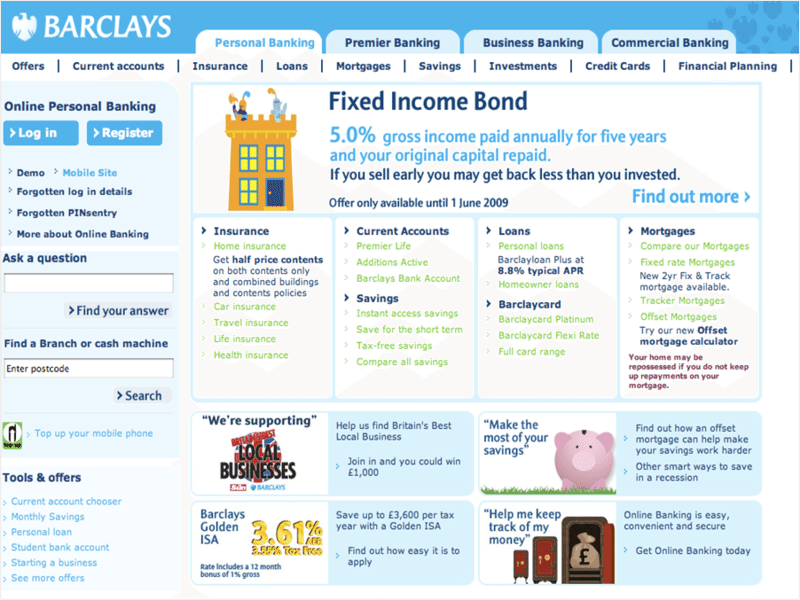

So what did the Barclays Bank website look like the day after Man United won the Premiership:

Mmmm ... a nice, glitzy, showcase of a futuristic branch in London is ok but retailing is a complete branding and distribution mix and, on this evidence, bankers are guilty as charged m’lud.

p.s. in case you don't read comments, Vivek asks: "you sure

you've got the right screenshot of the Barclay's website ? Nothing

specific to football or Man U in the screenshot unless i missed

something obvious.."

That is the point however Vivek. Barclays spend millions to sponsor the UK Football Premiership and don't even reference it on their website the day after the season ended. This is why banks don't get retailing.

p.p.s. it occured to me after this that we also think of retailing as being 'sales' which is also wrong. Retailing is about attracting and retaining profitable customers, not burning a big hole in the bank's balance sheet by selling loans at high margins with high risks ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...