In the securities settlement markets, we’ve spent years trying to break down barriers to clearing and settlement ... and most of those barriers are still there.

We wonder what to do about it?

And regulation seems the only answer.

Or is it?

As we look at innovations in payments (retail, commercial covered in last two posts), this week is the final thoughts on this as we study payments in the trading room and investment markets.

There are clearly some things afoot which will change things.

The first is that everything is real-time or supra real-time.

Sure, we talk about fast and scalable systems, but in the trading arena we’re talking not just fast but super fast.

What’s super fast?

Well, a human blink of an eye takes about 200 milliseconds or a fifth of one second.

Today’s trading systems trade in under 200 microseconds.

There are 1,000 microseconds in a millisecond, so we can trade 1,000 times faster than the blink of an eye.

That's super fast.

This is the world of latency, which I’ve blogged about often.

But latency really does bring in a new focus on real-time.

For example, I spent last week at a fascinating open day for Deutsche Bourse’s IT and intend to write a detailed update through this week on what came out of that day.

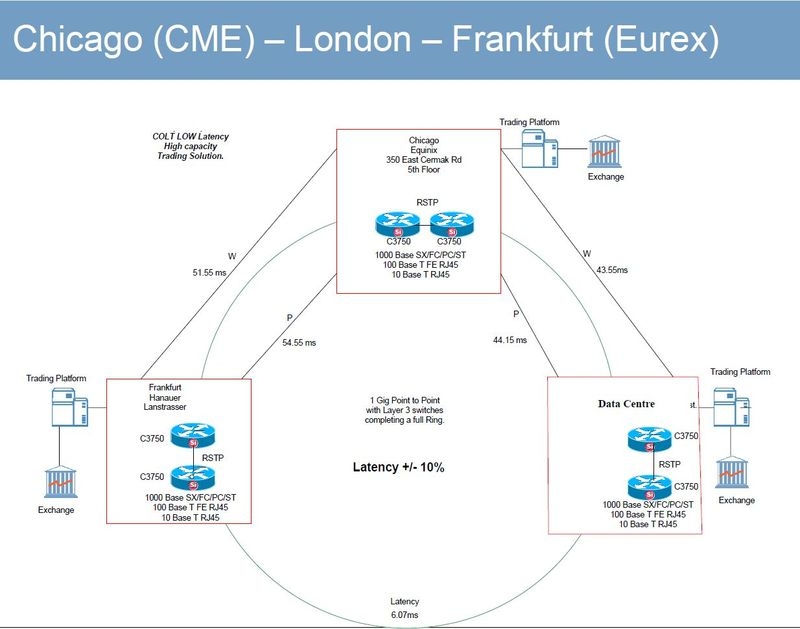

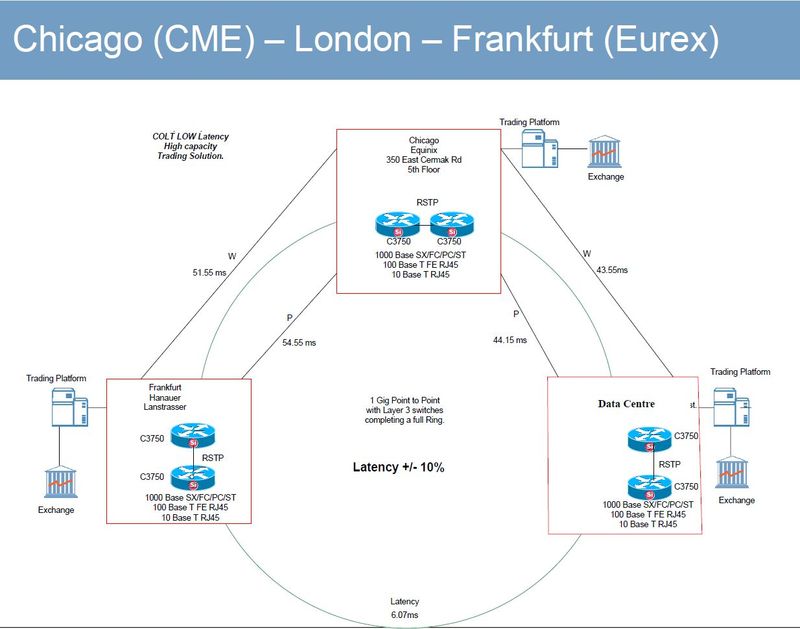

To start with, here’s a chart (double click to enlarge):

This was presented by Colt Telecom and shows linkages between London, Frankfurt and Chicago, with latency of 50 milliseconds or thereabouts. In other words, four messages can move between Frankfurt and Chicago in the time it took you to blink.

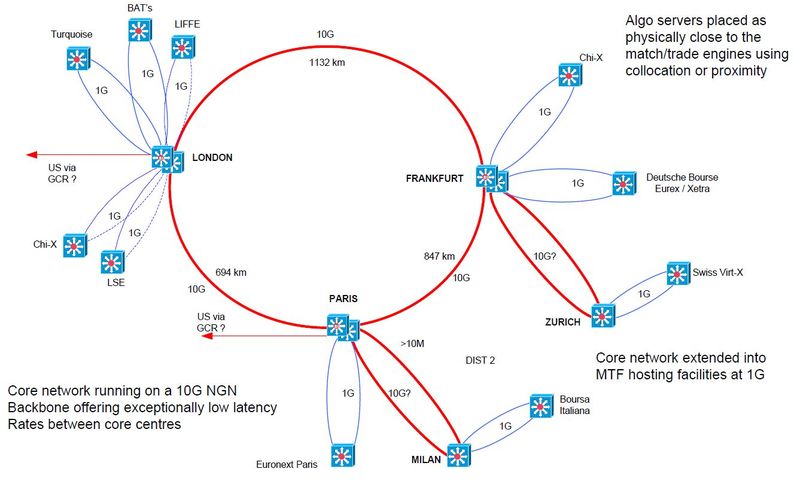

Here’s another picture:

This shows how all the exchanges are linked via high speed dark fibre 1 gigabit per second (1G) and up to 10G. The view is that, by 2011, these lines will be moving data at 6.4 terrabits per second (t/s).

6.4 t/s!

This means we will be moving from a world where it takes about 0.5 seconds to send a message right around the world once (two blinks), to one where that global transaction of data could move around the world in a complete cycle in under one millisecond (blink and you miss it).

This is the real-time world.

Now think about liquidity, risk, clearing and settlement and imagine a world where, as you trade.

Your complete picture of liquidity positions are transparent to all traders internally.

Your liquidity risk exposures, market and credit risk exposures and more are visible to all counterparties in real-time.

Your trade reporting and pricing is visible to all regulatory and supervisory authorities in real-time.

And real-time clearing takes place as part of trade execution.

This world is not a future vision but a reality.

Eurex, for example, thanks to being tightly coupled with a clearing system (Eurex Clearing), are already offering real-time clearing.

Meanwhile, we have regulators moving further and further towards information reporting duties that go far beyond today’s methods.

That is why real-time trade and risk reporting will be a reality in the near-term.

End of day just doesn’t cut it.

Intra-day doesn’t manage it.

Real-time everything.

That’s the future of investment markets.

Real-time visibility and transparency for all counterparties to manage risk.

Mmmm ... now it gets interesting.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...