Each year, I try to start the year with a few predictions of what will happen. Last year proved to be pretty accurate, although it was playing fairly safe. This year is fuzzier in outlook, with not a great deal of obvious trends emerging. But a few that seem likely are:

- Certainty in the economy returns

- Banking markets return to normality

- Too big to fail restructures the industry

- Too big to succeed becomes a problem

- The world’s biggest banks will stop politicians over-regulating

- Asian financial markets will show their muscle

- American and European banks that faltered will stabilise

Certainty in the economy returns

During 2009, we all wondered whether this was an L-shaped, U-shaped, V-shaped, LUV-shaped or WWW-shaped recession. That uncertainty ends in 2010.

It doesn’t mean we’re back to boom times – I stated a year ago that the boom times won’t return until 2014 – but it does fulfil the first criteria on my list, which is to get back to stabilisation.

The IMF is saying that the global economy is stable, although still vulnerable, and reckons that the old model of growth fuelled by American consumerism and leadership has ended. I agree to an extent, although I disagree with the notion that consumerism has ended as a source of growth. There are a billion new consumers out there from China to Chile, India to Indonesia and Brazil to Bolivia, so my view is that there will be a consumer-fuelled demand bubble brewing nicely again by 2014. We shall see.

Banking markets return to normality

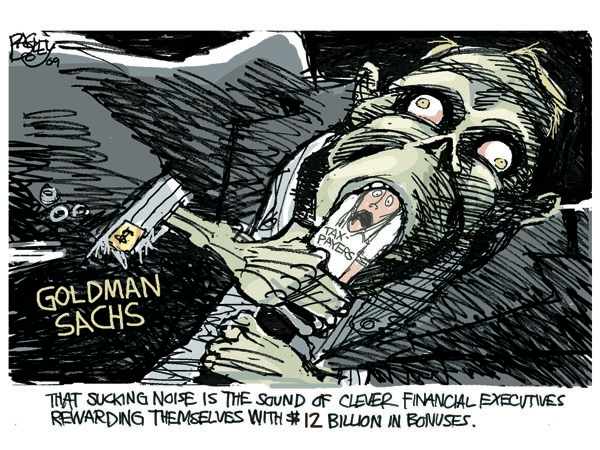

A certain economy is good for the central banks, who will end their quantitative easing programmes, and it is good for the banking sector as this indicates a sign of the sector returning to some form of normality. The key phrase here is ‘some form of normality’. It is clear that, on the one hand, banks have learned a very hard lesson about leverage and liquidity; it is also clear that, on the other hand, banking practices around bonuses and the profit-focused culture will continue.

In terms of leverage and liquidity, banks will continue to look at their liquidity and leverage across the markets in order to avoid ever being caught short again. The idea that a bank could have $37 in leveraged instruments for every dollar of capital, as was the case with Lehmans when it collapsed, is seen in retrospect as ridiculous. Hindsight is a wonderful thing. So banks will be highly cautious about leverage and will want to keep far higher levels of liquid instrument holdings and capital reserves than ever before.

For this reason, lending will still be tight in 2010 but it will, at least, be slightly easier than in 2009.

In terms of the banking practices around bonuses and profits, of course that will continue. Banks are there for their shareholders and shareholder returns and any government that thinks they can slap a bank into kow-towing to their wishes will be rebuffed.

Too big to fail restructures the industry

Admittedly, banks with practices that focus purely upon shareholder returns does not pass the political or taxpayers test when banks are integral to the economies of the world. This means that the ‘too big to fail’ question will be addressed by the return of Glass-Steagall and ‘narrow banking’.

Governments will begin to view banking as being more like electricity. You have to keep the lights on and the national grid will be operated as a nationalised industry. That is how core financial infrastructures will in the future, as governments will see payments and processing as being the part that cannot fail.

But a bank that takes erroneous risks in financial markets with their depositors’’ capital? That should be left to those who want to gamble. As a result legislation will be introduced to stop banks taking bets with depositors’ or taxpayers’ assets, and restrict such practices to purely institutional and retail investors who sign a declaration that they understand the risks being taken and are comfortable with the level of those risks.

This means that best execution, suitability, know your client and appropriateness tests in investment markets will get a critical focus. Investing will become a minefield of advice and fitness of purpose test.

On the other end of the scale, retail and commercial banking will continue much as it did before, open to competitive forces as long as you can get a banking licence, which is actually the main barrier to true, free market completion.

In summary, the likelihood is that legislation will lead to a triumvirate of banking structures – core infrastructures which are like the national grid and therefore nationalised; investment markets which are subject to high level of scrutiny but left to freefall and operate as pure casino capitalism; and retail and commercial banking which is subject to high levels of health and safety measures, but open to competition and self-regulation.

Too big to succeed becomes a problem

On the opposite end of the scale are the banks that have become so big that some might wonder if they can continue to succeed, especially should narrow banking or a Glass-Steagall approach come into force. These banks are the select few global names such as JPMorgan Chase, Citi, Goldman Sachs, RBS (ABN AMRO), Barclays, Deutsche Bank and a few others. The reason why questions would be asked of these banks will be down to the fact that they have such extensive operations globally, integrated and blurred across boundaries of retail, commercial, investment and infrastructure, that the idea of splitting these banks into pieces would be a little too challenging to consider.

Or is it?

Citigroup has already been ungrouped, with much of the investment and overseas operations being sold off:

- April 2008: Diners Club International Ltd. was sold to Discover Financial Services Co. for $165 million; CitiCapital Assets were purchased by GE Capital Corp. for an undisclosed price.

- July 2008: Citibank Privatkunden AG & Co. KGaA was acquired by Credit Mutuel-CIC for for $7.7 billion.

- October 2008 Citigroup Global Services Ltd. was sold to Tata Consultancy Services Ltd. for $512 million.

- December 2008: Citi Technology Services Ltd. was sold to Wipro Technologies for $127 million.

- January 2009: a 51% of Smith Barney was sold to Morgan Stanley (NYSE:MS) for $2.75 billion.

- February 2009: Citigroup sold a 13.4% portion of its Brazilian credit card company Redecard SA for $984.80 million.

- May 2009: Nikko Cordial Securities Inc. brokerage and parts of the Nikko Citigroup Ltd. investment bank were sold to Sumitomo Mitsui Financial Group Inc. for about $5.6 billion.

- August 2009: Citi sold $1.3 billion of across three credit card books to U.S. Bancorp.

- September 2009: the rest of Smith Barney was sold to Morgan Stanley.

- October 2009: Nikko Asset Management was sold to Sumitomo Trust for $8.7 billion; and Phibro commodities trading unit was sold to Occidental Petroleum.

- November 2009: Diners Club North America was sold to BMO; Bellsystem24, a Japanese call centre operation, was sold to Bain Capital for $1.1 billion; and Primerica, Citi’s life assurance division, was listed for IPO.

There are still several other deals not yet completed, including the sales of the Citi Financial consumer finance division and Monex Group, their online Japanese broker.*

As can be seen, a bank that grows into a global powerhouse representing a strong universal banking portfolio can therefore, just as quickly, be returned to a smaller, domestically oriented bank with a narrow focus.

This is what the legislators are grappling with and the retrenchment of large banks to smaller ones could be applied or considered for any bank ... even JPMorgan Chase.

The world’s biggest banks will stop politicians over-regulating

This is why the banks that avoided TARP funds, bailouts, taxpayer funding, government interference and more, are all going to be applying massive pressure to Barack Obama, José Manuel Barroso, Gordon Brown, Angela Merkel, Nicolas Sarkozy, Michel Barnier and more, in order to avoid being over-regulated or broken up. So yes, there will be a return to separation of banking services, but not one that prohibits a banking group from being involved in all three.

A clear example as to how this would work was illustrated by Jamie Dimon, the Chief Executive of JPMorgan, over the Christmas break:

“JP Morgan, the giant US investment bank, has warned the Chancellor it may scrap plans to build a £1.5bn flagship European headquarters in Canary Wharf if politicians don't rein in their attacks on the City.”

The key here is that, unless the G20 act in a co-ordinated manner, then any bank will locate itself in the centre that is most favourable to hiring and retaining top talent whilst minimising tax liabilities. Historically, that has been London but the shift is now starting to show signs of Hong Kong potentially becoming more attractive.

That’s why HSBC’s CEO Michael Geoghegan has moved there, and why it is likely that several banks will locate their key offices there, or similarly attractive locations, in the future too.

For the countries that are trying to therefore stick their finger in the leaking dyke of the banking markets, such as the UK and USA, it leaves them pretty much defenceless as they are left with ailing banks whilst the strong ones move, with all of their economic supporters and wealth, to countries that are more supportive of their large-scale activities.

Asian financial markets will show their muscle

The result of all of the above will be the long expected start of an Asian financial market boom.

For a start, Shanghai is expected to eclipse London as the world’s second largest financial centre before the end of the decade; and Asian banks have proven their mettle in the global markets by being some of the strongest financial brands in the world today.

Today, the world’s 12 most valuable banks by market capitalisation are, in order: the Industrial and Commercial Bank of China; China Construction Bank; HSBC; JP Morgan; Bank of China; Bank of America; Banco Santander; Wells Fargo; Citigroup; BNP Paribas; Goldman Sachs; and Commonwealth Bank of Australia.

There are five American banks, three Chinese, one British, one Spanish, one French and one Australian.

Five years ago, the world’s biggest banks by market capitalisation were: Citibank; Bank of America; HSBC; JP Morgan Chase; Wells Fargo; Royal Bank of Scotland; UBS; Barclays; Wachovia; BNP Paribas; Bank of Tokyo Mitsubishi UFJ; and US Bancorp.

Six were American; three were British; one was Swiss; one was Japanese; and one was French.

The axis has changed, the markets are different and the market players to watch are not the one’s we used to watch. In fact, I would be as bold as to expect and predict that ICBC will buy one major American or European bank this year.

Now there’s a real prediction.

But it’s not that radical. Since 2006, Industrial and Commercial Bank of China has struck deals with banks in Thailand, Indonesia, Macao, South Africa and Canada and, according to Goldman Sachs research, Asian banking sectors are stronger than their global peers with average tier one capital adequacy 9.5 points higher or more than their counterparts in Spain, Germany and Italy.

So yes, ICBC and the other Chinese banks should be on the march this year, acquiring and partnering with banks in Europe and America to build a global presence.

American and European banks that faltered will stabilise

Whilst Asian banks seek expansion, most American and European will seek peace. Throughout 2009, the banks suffered the worst sort of anger and hate ...

... anger and hate that will continue, particularly towards those that really were leeching off the taxpayer (you know who you are) ...

... but memories are short.

People will forget.

TARP funds will be paid back.

In fact, the banks that have a real issue are those with governmental ownership such as Citigroup in the USA; ING and Fortis in the Netherlands; KBC in Belgium; Commerzbank and WestLB in Germany; and Lloyds Banking Group and the Royal Bank of Scotland in the UK.

These banks fall between the devil and deep blue sea, in that they cannot be as competitive as they need to be due to government controls, restrictions and interference; and yet they cannot be returned to private ownership until they are fit to compete. Whilst under government control and influence, getting fit for free market competition is always going to be a challenge.

Nevertheless, the good news for these banks will be that at least 2010 will see the markets become more manageable and predictable for them. As a result, these banks will also stabilise with the government stakes in these banks are likely to be returned within the next two years as they are floated back into private ownership.

So there you have the lay of the land from my own perspective as to what is most likely to occur in banking this year:

- Certainty in the economy returns

- Banking markets return to normality

- Too big to fail restructures the industry

- Too big to succeed becomes a problem

- The world’s biggest banks will stop politicians over-regulating

- Asian financial markets will show their muscle

- American and European banks that faltered will stabilise

Tomorrow, I’ll talk a little more about predictions for 2010. This time from a technology perspective.

* Amazingly, Citibank’s website only shows the company’s history up until 2007. This shows them expanding through acquisitions such as: Akbank (Turkey, est. 1948); Bisys Group (U.S.); Quilter (U.K.); Grupo Cuscatlan; Nikko Cordial (Japan); ABN Amro Mortgage Group; Egg Banking plc (U.K., est. 1998); Bank of Overseas Chinese (Taiwan); Old Lane Partners LP (est. 2006); Automated Trading Desk (U.S.); and Grupo Financiero Uno (Nicaragua). A far cry from their reductive approach ever since.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...