I’m continually impressed and amazed by the speed of change in the technology of the investment markets.

For example, last year was all talk about low latency and lit versus dark pools. This year, it’s all about private cloud-based services based upon colocation and proximity services. Next year, it will be all about real-time liquidity and settlement. Equally, the change from old to new trading venues is quite surprising. I was chatting with one of the MTFs yesterday for example. An MTF is a Multilateral Trading Facility, a new class of exchange introduced by MiFID, the Markets in Financial Instruments Directive. The conversation reminded me that only two years ago, everyone was saying that liquidity doesn’t move and there would be no threat to traditional exchanges from these new trading venues.

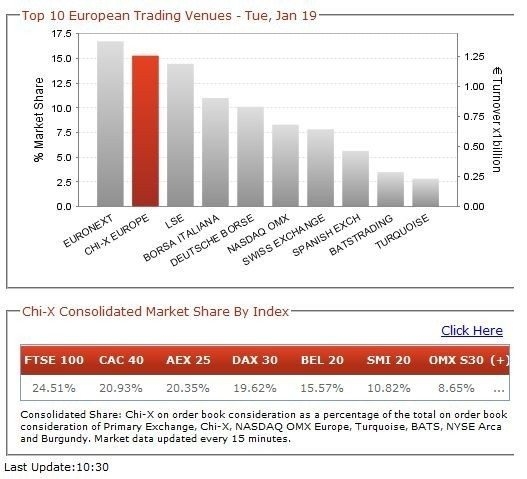

Two years later, Chi-X has more trading and market share than the London Stock Exchange (LSE); BATS is in the Top Ten ...

Source: Chi-X, 19th January 2010, 10:30 GMT

... LSE has acquired Turquoise and completely changed strategy and direction; Euronext has launched a major dark pool; Deutsche Bourse is heavily expanding in ultra low latency connections, targeting latencies under 3.3 milliseconds for Frankfurt-Amsterdam, under 4.5 milliseconds for Frankfurt-Paris, under 40 milliseconds for Frankfurt-New York, and under 49 milliseconds for Frankfurt-Chicago ...

... and so it goes on.

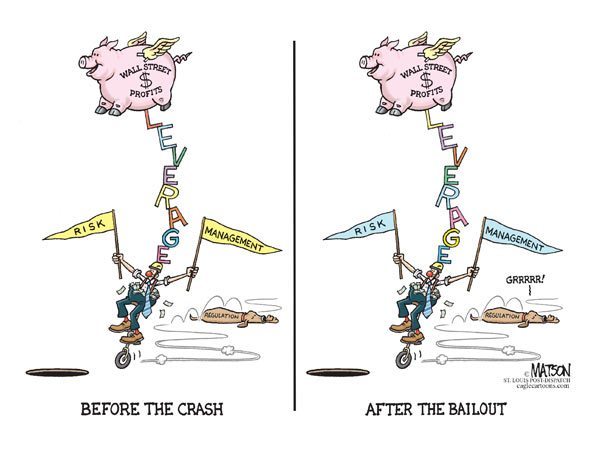

Just two years ago, many exchanges thought that seconds were fine. Today it’s milliseconds. Tomorrow it’s microseconds. And then what?Is it to achieve the ever elusive cross-asset class trading system? The one where a paired equities trade can be combined with an FX hedge across a global arbitrage? Nah, we’ve already got that.Is it to innovate new instruments, even when the last set of instruments – Structured Investment Vehicles, Credit Default Swaps and Collateralised Debt Orders – screwed up the world’s economies? Nah, we’ve already got that too.Is it to bring on board new exchanges and focus on emerging markets?Nah, we’ve already got emerging markets, cross-asset class structure exchange products.So what is the next wave of major change in trading systems and markets, and how will governments manage to derisk the next wave of innovation?Well, if the move does become one where real-time execution is combined with real-time settlement and real-time risk management, as I’ve stated before, then the challenge for broker-dealers will be to bring added value to clients through arbitraging across venues and instruments.But hey, that’s what they do now isn’t it?Of course.It’s what broker-dealers and market-markers have done for all time and will be what they do for the future. You see, the challenge is to keep up with the innovations of a Goldman Sachs and it is the reason why Goldmans made $100 million profits for every day of trading last year.Now there’s a fine border line between making markets and moving markets, and that’s the line Goldman walk.It will be interesting to see how Goldman and company make markets in the future, between the Obama tax and the new regulatory regime.But the key will be to continue to innovate with technology ... and they are and will be.That is why we are moving towards an almost seamless order flow through execution through settlement system, thanks to smart order routing combined with execution management systems.That’s one of this year’s big buzzes in trading tech, especially as Asia has followed Europe and America’s approach with Japan clearing the way for new Alternative Trading Systems and venues.So perhaps the big buzz will really be about arbitraging across venues and instruments using global smart order routing, combined with real-time execution and settlement in microseconds.

Hmmm ... sounds risky to me.

Will governments be up to the job of regulating all of these new innovations?

Source: RJMatson, St Louis Post Despatch

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...