Following on from yesterday’s blog about 10,000 year thinking, how does this relate to or work in finance?

The idea is to fund long-term projects.

The sort of massive projects that no-one knows how to fund.

The sort of project that governments shy away from as politicians only have four-year lives and thinking past the next term in office is hard for them.

The sort of thing like building a Pyramid or a Cathedral, something that is long lasting and changes humanity forever.

Who today would think about building such a thing?

Back in the heady Egyptian and religious fervour days of old, building a huge monolithic testimonial for prayer and worship was the thing to do. But then, back then, you were rewarded with something other than finances.

Today, no-one would build such things.

However, there are other things we could, and probably should build, such as flood protection barriers, and the Long Now guys used the example of two countries to illustrate this. One that thinks and funds Long and the other Short.

The Long thinking is in the Netherlands.

The Dutch Government spent €450 million building the Maeslant barrier to protect the reclaimed land across the Coast of the Netherlands.

Rather relying on a boy to stick his finger in the dyke, the Dutch government decided they would fund such a project because, if catastrophe ever struck and the land was flooded, it would pretty much wipe out the most important parts of Holland.

So if you’re Dutch, a €450 million spend on an event that may never happen makes sense ... because if it did, the cost could be, let’s say, €60 billion.

What could cost €60 billion?

The devastation and disaster caused by a major flood of the Dutch coast.

And this is also the cost of the sinking of the major American coastal city, New Orleans, in 2005.

Hurricane Katrina cost the USA over $80 billion.

That’s €60 billion. If the USA had thought long, they would have spent the $1 billion it would have cost to build the flood defences for the southern coastline, and saved themselves $79 billion.

That’s the thing about Long Finance, it thinks long-term.

It recognises that the investment of millions today will save billions tomorrow.

For each euro or dollar spent today, it recognises it will save 100 times that amount tomorrow.

So long-term finance thinks long and invests long to save when the short now happens.

Stewart Brand, author of the Whole Earth Discipline, then expanded on this commentary further by quoting from the classic book by Robert Heinlein: Time for the Stars.

In the book, released in 1956, Heinlein recounts the work of the Long Range Foundation (LRF), a foundation that thinks the way outlined above:

“The charter goes on with a lot of lawyers' fog but the way the directors have interpreted it has been to spend money only on things that no government and no other corporation would touch . . . To make the LRF directors light up with enthusiasm you had to suggest something that cost a billion or more and probably wouldn't show results for ten generations, if ever . . .”

The key to the LRF is that they only invest in things so expensive and so far out that it wouldn’t be investable for a government. However, by adopting this strategy, they have become the most profitable company in the universe, making shedloads of cash thanks to those investments paying off when the inevitable disasters, catastrophes or just plain bets pay off.

Oh yes, there are long bets too. For example:

“Over a ten-year period commencing on January 1, 2008, and ending on December 31, 2017, the S & P 500 will outperform a portfolio of funds of hedge funds, when performance is measured on a basis net of fees, costs and expenses.” Predictor: Warren Buffett

But that’s an aside.

The bottom line is that Long Finance and Long Banking looks at uninvestable projects, the big ticket items, and takes them on board precisely because they are good for the long-term health and protection of mankind. That’s the nature of the Long Now.

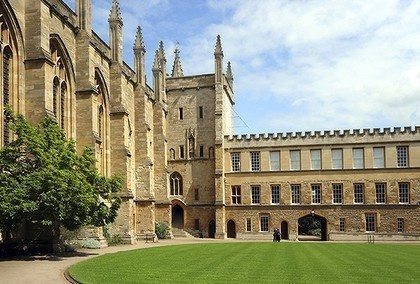

Brian Eno likened it to the story of New College Oxford which, being British, was actually established in 1379 and isn’t new at all.

The College’s Great Hall has this fantastic arched ceiling with oak beams across.

After five hundred years, the beams inevitably were rotting and decaying so badly they needed to be replaced.

So the Dean of the College asked the groundsmen if they knew of anywhere to source some similar beams?

“Oh yes”, the head groundsman said. “Five hundred years ago, when they built the college”, he told the Dean, “the founders planted a forest of oaks of the same wood as the one’s used in the ceiling just over there.”

In other words, they had had the foresight to realise that, at a point in the Long Future, the ceiling beams would need replacing so they planted trees for just such an occasion in the Long Now.

That’s thinking Long, and this is what Long Finance is focusing upon.

I realise all of this sounds a bit tree-hugging or academic, but it's also critically important for those who care about an agenda that focuses upon more the just the right here, right now.

And, just in case you're wondering, yes, the College used the oak trees for their new ceiling and have since planted another small copse of oaks for the next time it may be needed.

A final thought on this tomorrow but, for now, think the Long Now.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...