Jamie Dimon’s letter to JPMorgan Chase’s shareholders included some interesting comments related to banker's bonuses and TARP:

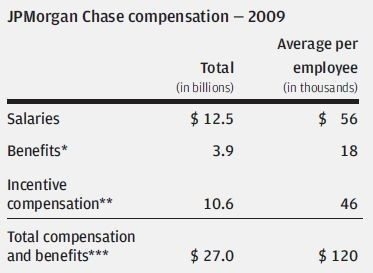

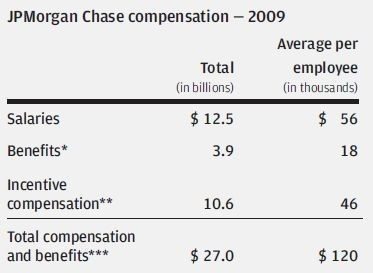

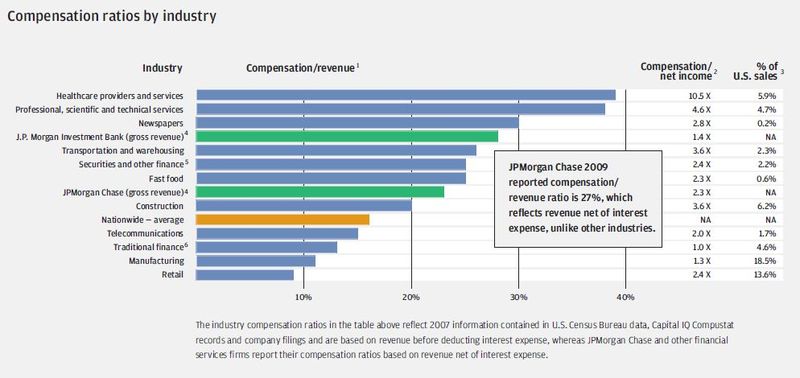

“Many commentators, in an attempt to measure fairness and reasonableness of a company’s compensation payouts, have looked at total compensation as a percentage of revenue. On this basis, JPMorgan Chase’s total compensation (salaries, benefits and bonuses) was 27% for 2009; this number averaged 33% over the previous several years. For our Investment Bank alone – the part of the company receiving the most scrutiny – compensation was 33% of revenue, down from an average of 44% over the last five years. The chart on the next page compares these same percentages with a wide mix of businesses (double click to see large version):

“For the average U.S. business, total compensation as a percentage of

revenue is approximately 16%. In general, at businesses that are

people-intensive and not capital- or intellectual property-intensive,

such as professional services companies, a high percentage of the

company’s revenue is paid out to the employees. Law firms, for example

(which are not included in the following table), pay out more than 80%

of their revenue to their employees. In highly capital-intensive

companies, like telecommunications or certain manufacturing companies,

payout ratios are considerably lower ...

“We know there are people in this industry who have been extraordinarily well-paid – and, in some cases, overpaid. Some of these people have benefited from profits that turned out to be ephemeral or were the result of excessive leverage in the system. Some benefited from extreme competition for their specific talents, often from hedge funds and other such businesses. While no firm can claim it gets compensation right every time, we at JPMorgan Chase do think we have generally been disciplined when it comes to our decisions ...

There's a long section on the use of $25 billion in TARP funding that JPMC felt compelled to accept ...

“We did not anticipate the anger or backlash the acceptance of TARP capital would evoke from the public, politicians and the media – but, even with hindsight, I think we would have had to accept TARP capital because doing so was in the best interest of the country. I do wish it would have been possible to distinguish between the healthy and unhealthy banks in a way that didn’t damage the success of the program – so as not to create a situation where the public was left with the impression that all banks were bailed out. Last, I do regret having used the FDIC guarantee because we didn’t need it, and it just added to the argument that all banks had been bailed out and fueled the anger directed toward banks ...

“Surviving banks have paid for the cost to the FDIC of the approximately 200 bank failures since the beginning of 2008. Of those failures, the largest one, WaMu (with assets exceeding $260 billion), has cost the FDIC nothing. That is because JPMorgan Chase bought WaMu. All of the other banks that have failed were far smaller (the next largest failure was IndyMac, with $32 billion). All of these failures combined have cost the FDIC an estimated $55 billion ...

Part One: An overview of JPMorgan Chase's Operations.

Part Three: Jamie's views on regulatory reform.

Part Four: Industry

observers’ views about Jamie.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...