Jamie Dimon’s letter to JPMorgan Chase’s shareholders was released over the weekend.

It’s a great 36-page read and, although I don’t normally do this, I thought it worth reprinting some of the key aspects here as it provides a fascinating insight into a global bank’s operations.

This takes the form of four posts.

This first one provides an insight into JPM's operations.

The second is a few comments related to banker's bonuses and TARP.

The third is a key section of the letter that outlines Jamie Dimon's views on regulatory reform.

The fourth is a few summary notes from key industry observers’ views about his comments.

First, here’s a review of JPM’s business ...

“For JPMorgan Chase, these past two years have been part of a challenging, yet defining, decade. We began it as three separate companies: Bank One, Chase and J.P. Morgan, with each facing serious strategic and competitive challenges ... on March 16, 2008, we announced our acquisition of Bear Stearns at the request of the U.S. government; on September 25, 2008, 10 days after the collapse of Lehman Brothers, we bought Washington Mutual ...

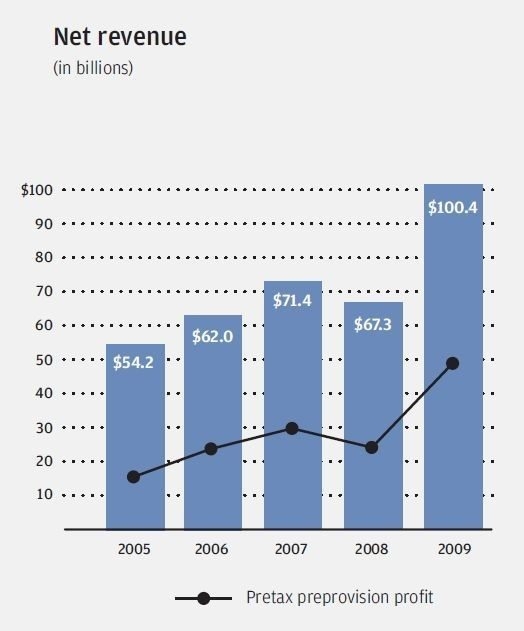

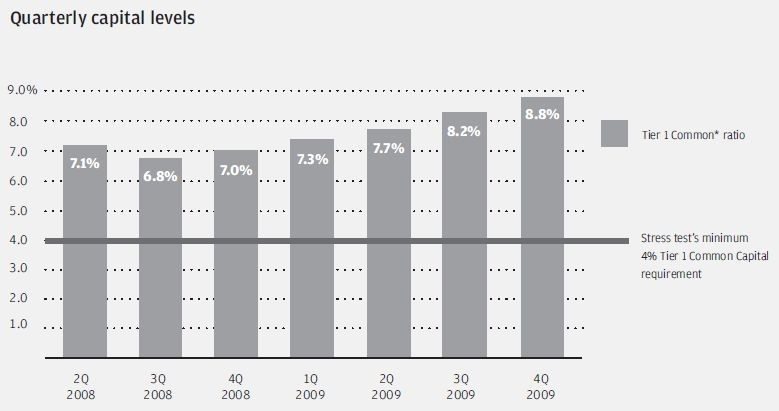

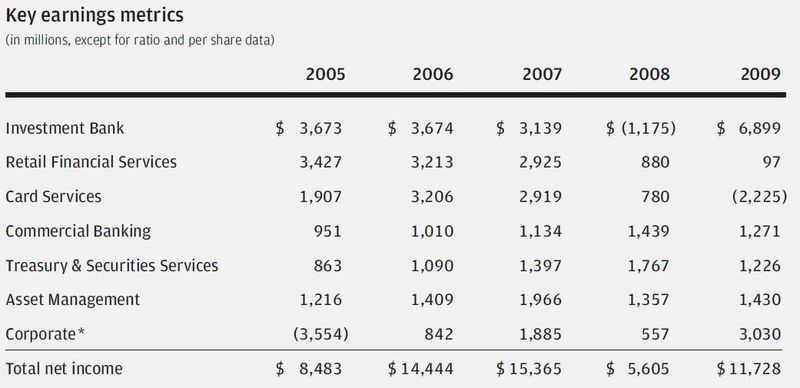

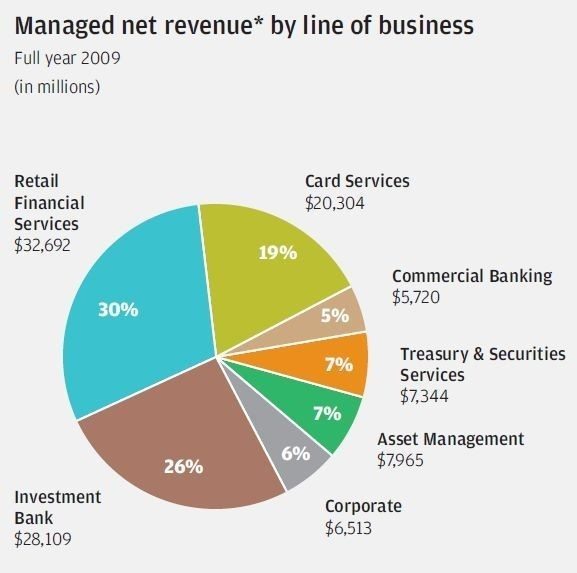

“Our revenue this year was a record $100 billion, up from $67 billion in

2008. The large increase was due primarily to the inclusion for the

full year of Washington Mutual (WaMu) and the dramatic turnaround in

revenue in our Investment Bank. Profits were $12 billion, up from $6

billion in the prior year but down from $15 billion in the year before

that. While these results represent a large improvement over 2008, they

still are an inadequate return on capital – a return on tangible equity

of only 10%. Relative to our competition, our company fared extremely

well. We did not suffer a loss in any single quarter over the two-year

crisis (we may have been one of the few major global financial firms to

achieve this). In absolute financial terms, however, our results were

mediocre ...

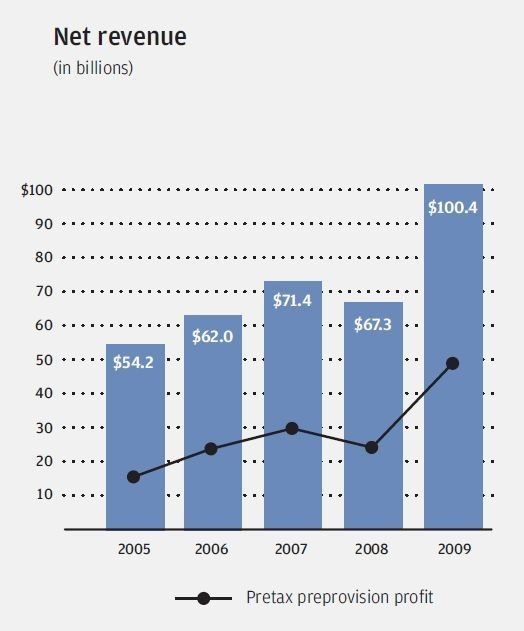

“As we entered the most tumultuous financial markets since the Great

Depression, we experienced the opposite of a run on the bank as

deposits flowed in (in a two-month period, $150 billion flowed in – we

barely knew what to do with it). At JPMorgan Chase, our deposits always

exceeded our loans; deposits always have been considered one of the

safest sources of funding for a bank. The average bank has loans that

are generally greater than 110% of its deposits. For JPMorgan Chase,

loans were approximately 75% of deposits. In fact, our excess deposits

greatly reduced the need to finance ourselves in riskier wholesale

markets. In the long-term wholesale unsecured markets, we borrowed on

average $270 billion. Only $40 billion was borrowed unsecured in the

shortterm credit markets – an extraordinarily low amount for a company

of our size ...

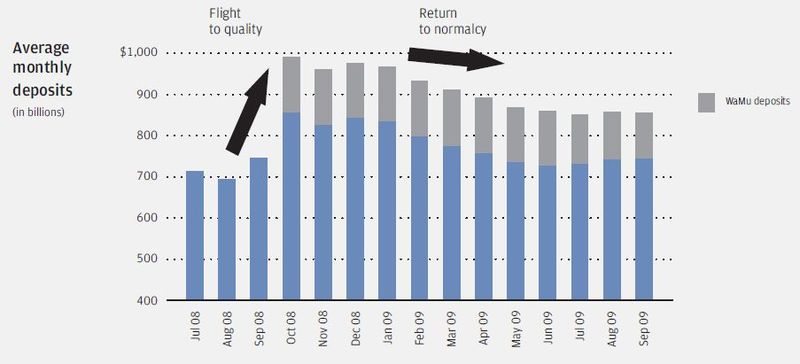

“We maintained an extremely strong Tier 1 Common ratio, which stood at 8.8% at year-end. We also increased our loan loss reserves over the course of the year from $23.2 billion to $31.6 billion, an extremely strong 5.5% of total loans outstanding ... our total technology and operations and corporate overhead costs would be more than $9 billion higher today if they were running at the same cost per dollar of revenue as in 2005 ...

“We have 220,000 employees around the world ... 19,000 programmers,

application developers and information technology employees who

tirelessly keep our 80 data centers, 55,000 servers, 225,000 desktops

and global network up and running – and who were a major part of

completing the Bear Stearns and WaMu conversions in record time. 80,000

employees fulfilling operations functions globally and thousands of

customer service colleagues. In 2009, they responded to more than 245

million phone calls ... 13,000 people in Legal & Compliance, Risk,

Audit, Human Resources and Finance ...

“The Investment Bank (IB) delivered record performance across the board: net income of $6.9 billion on revenue of $28.1 billion. These results were led by best-ever Global Markets revenue of $22 billion and record investment banking fees of $7.2 billion. The IB generated a return on equity of 21% on $33 billion of allocated capital, our best result in five years ... trading is perhaps the least understood area of our investment banking activities. We have 6,500 professionals on approximately 120 trading desks in 25 trading centers around the world; these professionals include more than 800 research analysts who educate investors on nearly 4,000 companies and provide insight on 40 developed and emerging markets ... we execute approximately 2 million trades and buy and sell close to $2.5 trillion of cash and securities each day. On an average day, we own, for our account, approximately $440 billion in securities ... at the end of 2009, we announced that our U.K. joint venture with Cazenove Group Limited would become a wholly owned part of J.P. Morgan. Our initial investment in Cazenove in 2005 was extremely successful – among other things, it increased our U.K. investment banking market share (as measured by total fees) from 5% to 13% ...

“Retail Banking, which includes Consumer and Business Banking, earned $3.9 billion, primarily by serving customers through bank branches in 23 states. Consumer Lending lost $3.8 billion because of continued high charge-offs in the home lending business ... our 61,000 people in 5,154 Chase branches in 23 states served more than 30 million U.S. consumers and small businesses ... retail operations teams processed 700 million teller transactions, 3.5 billion debit card purchases, 100 million ATM deposits, close to 6 billion checks and more than 1.3 billion statements ... we added 4.2 million mobile banking customers and another 5.2 million new online banking customers ... loan origination in 2009 was down 58%, as customer demand decreased significantly and our underwriting standards became more disciplined.

“Card Services lost $2.2 billion (compared with last year’s profit of $780 million) ... our 23,000 Card Services employees around the world provide financial flexibility and convenience to customers who, in 2009, used Chase credit cards to meet more than $328 billion of their spending needs. With more than 145 million cards in circulation held by approximately 50 million customers with $163.4 billion in loan outstandings ... in 2009, in addition to the terrible environment, the U.S. credit card business faced fairly dramatic changes because of a new law enacted by Congress in May. The new law restricts issuers’ ability to change rates and prohibits certain practices that were not considered consumer-friendly. These changes alone are expected to reduce our after-tax income by approximately $500 million to $750 million ... we reduced limits on credit lines, and we canceled credit cards for customers who had not done business with us over an extended period. In fact, the industry as a whole reduced limits from a peak of $4.7 trillion to $3.3 trillion ...

“Commercial Banking reported net income of $1.3 billion with an ROE of 16% ... highlights included a 20% boost in revenue to $5.7 billion; a 25% improvement in operating margin to $3.5 billion; double-digit increases in both average liability balances, up 10%, and average loan balances, up 30%; and a 20% jump in gross investment banking revenue to $1.2 billion – a full 25% above plan ... the average length of a Commercial Banking client relationship with us is more than 18 years ...

“Treasury & Securities Services reported net income of $1.2 billion with an ROE of 25% ... vs. $1.8 billion in the prior year. The business delivered net revenue of $7.3 billion, down 10% from the previous year. We describe TSS as our “Warren Buffett-style” business because it grows with our clients and with inflation; delivers excellent margins and high returns on capital; and is hard for would-be competitors to replicate because of its global scale, long-term client relationships and complex technology ... more than 6,000 TSS bankers serve more than 40,000 clients from all of our other lines of business in 60 locations around the world. TSS provides clients with critical products and services, including global custody in more than 90 global markets, holding nearly $15 trillion in assets; corporate cash management, moving an astounding $10 trillion a day of cash transactions around the world for clients; corporate card services, providing 27 million cards to more than 5,000 corporate clients and government agencies ...

“Asset Management reported net income of $1.4 billion with an ROE of 20% ... the Corporate sector reported net income of $3.7 billion ...

Part Two: Jamie's views on banker's

bonuses and TARP.

Part Three: Jamie's views on regulatory reform.

Part Four: Industry

observers’ views about Jamie.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...