Earlier this week Adrian Coles, Director-General of the Building Societies Association, gave a fascinating presentation to the Financial Services Club Scotland on the state of the UK's Building Societies sector.

The presentation didn't actually say too much about Building Societies but was more of a reflection of where we are with the mortgage and savings markets in the UK, and a sad story he told.

Rather than writing down Adrian's presentation in full, it's probably easier to share a few hand-picked slides which tell the tale.

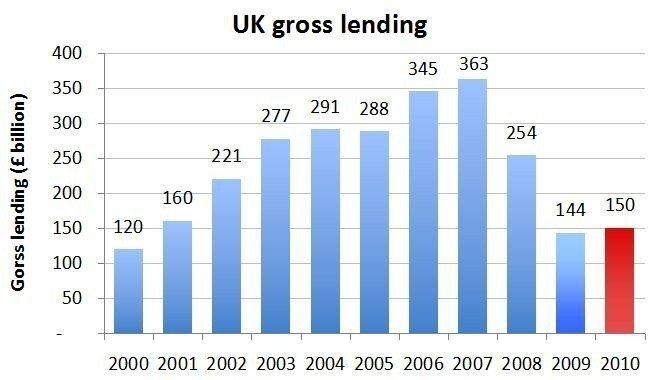

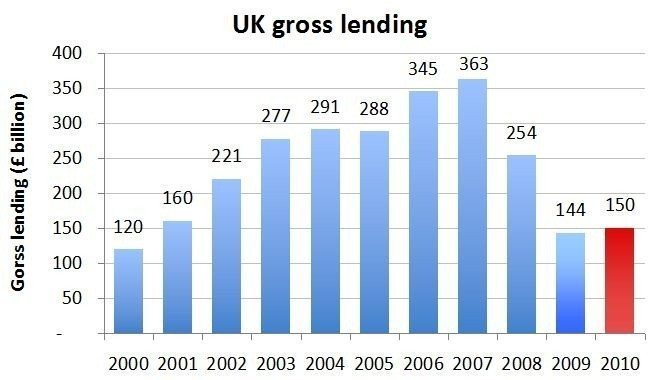

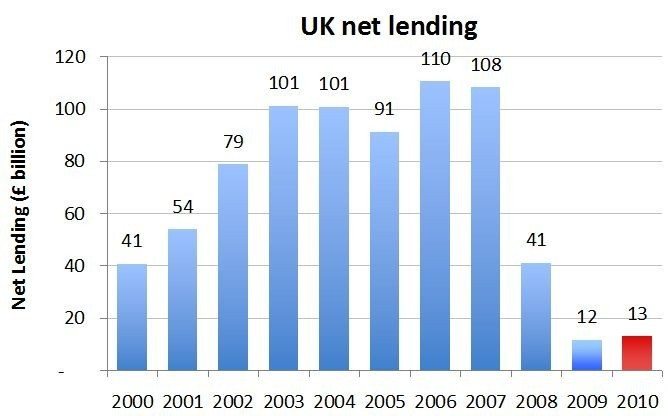

First, here's the gross and net UK lending figures for the past decade:

EEK!! Net Lending is the lowest it's ever been.

No wonder house sales are so tepid ...

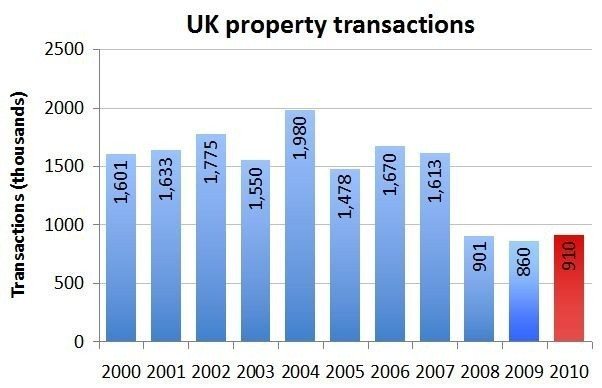

But what was really worrying is that Adrian had picked on two of the Bank of England's Financial Stability Report Charts to illustrate that the situation isn't going to get any better.

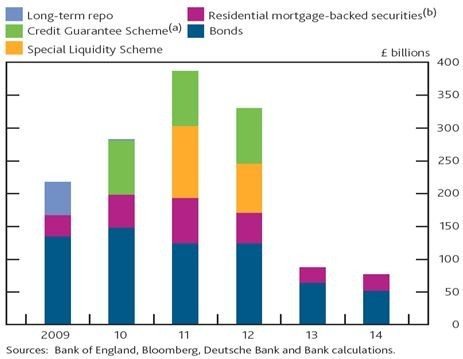

The first is the maturing funds of UK banks' wholesale liabilities, by instrument and year of maturation:

This was in the June 2009 chart section of the Bank of England's report, and shows the ballooning debt maturity mountain peaking in 2011. In other words, banks' stringent lending conditions will probably remain in place until that debt bubble bursts.

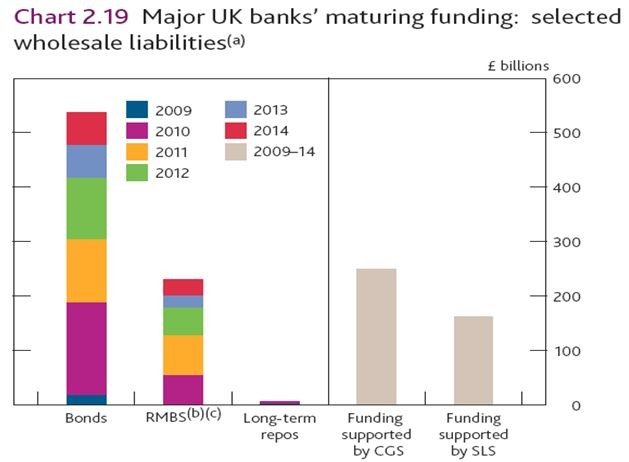

Interestingly, this chart was dropped in the December 2009 Financial Stability Report, but is just as well illustrated by Chart 2.19:

[CGS and SLS are the Credit Guarantee Scheme and Special Liquidity Scheme introduced by the current government as our equivalent of TARP]

The figures speak for themselves.

UK banks need to cover £1 trillion of maturing debt over the next four years, including the re-securitisation of £250 billion worth of Residential Mortgage-Backed Securities ... don't expect another house price boom in Britain for a while.

Note: Adrian's presentation is available in full to all Financial Services Club members

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...