Over the past week, I’ve spent time conferencing in the Spanish cities of Barcelona and Santander. In the case of the latter, my family thought I was going to a conference in the bank’s vaults, and I had to get a map out to show them that there actually is a city called Santander.

Now Spain has had a right old drubbing lately. Breathed in the same breath as Greece, Spain is viewed as being on the brink of failure and could bring down the Eurozone all on their own, although Portugal, Italy and Ireland may also have a say in this.

Their only saving grace is that they actually have a football team who played in this World Cup, unlike France, England and Italy.

Mind you, the Germans are also playing some pretty neat football with Sebastian Schoepp giving Spain a good kicking in the German newspaper, Sueddeutsche Zeitung.

The tone of his article may be summarised as follows:

Spain was a country full of donkey trails and decaying villages but now has the fourth largest Eurozone economy, behind Germany, France and Italy. But its economy is all built on sand, as it was all developed using the unsustainable property boom, where Spanish businesses sold sunshine to Brits, Germans and Scandinavians. The sad fact is that Spaniards have been living beyond their means and now need to pay the bill. Its banks sit on mountains of bad loans and foreign speculators will sell Spain short just as Sir Francis Drake did to their galleons three centuries ago (is this guy not English?).

OK, Spain is a bit of a sick dog of Europe, but is it really that bad?

In some respects, yes.

At the banking conferences I attended, a common theme is that Spanish banks over-expanded and now need to retrench. For example, there is a move to close down at least a quarter and maybe a third of all Spanish bank branches.

How come so many, I ask?

The answer is given to me that so many branches were opened to support and fuel the property boom that these branches are now desolate, unwanted, unnecessary and unforgiven.

Banks are on the back foot ... but not all banks.

I recently blogged about how Spanish banks are thriving in social media. But these are the big banks and community banks. Savings banks, regional banks and mid-sized banks are all closing, merging and consolidating.

Apparently, Zapatero’s government has been actively pushing for banks to merge rather than close, although regional and local governments across Spain also have a say in this.

Meanwhile, the economy sinks further with unemployment at 20%.

This makes Spain's economic mess one of the worst in the Eurozone.

In reality, that figure is underestimating anyhow, as these figures vary by city, town and village, with the average rate reportedly running at 25% unemployed rising to almost half the population in some areas.

Add onto this over developed property markets that cannot shift property, and this will continue to be an issue for the longer term.

The Spanish construction issues are also made worse by the fact that, like Dubai, a lot of the developments involved migrant workers from Eastern Europe, South America and Africa.

Money movement corridors for remittances are therefore well developed in Spain, but these have been impacted too.

First, many migrant workers have gone home as there is no new construction taking place.

Second, volumes and values of remittances have gone through the floor.

Third, there are too many money transfer agents.

On this third point, that's for a reason.

According to the remittances conference I attended last week, there are around 25,000 money transfer agents in Spain which is almost the same number as America, and these figures need to come down to around 10,000.

But then someone else tells me that Spain doesn’t have 25,000 agents. It’s just 10,000 but with 2.5 exclusivity licences each.

What?

Well, most money transfer operators want their agents to be exclusive.

This may be a problem but not for Spanish agents who have been getting around such rules for years. For example, papa signs an exclusivity agreement with Western Union, mama signs one with Moneygram and bambino signs one with Travelex.

This is going to change as the Payment Services Directive (PSD) says that money transfer firms cannot have exclusivity licences.

Well, says my Spanish remittances friend, the PSD is irrelevant here in Spain as we use derogation rules to get around anything that might cause an issue or impact our domestic markets.

Ah well, that’s Spain for you.

And this is why the German journalist was so vitriolic, as he’s not only worried that Spain will be another Greece but that, with their lackadaisical attitudes towards rules and regulations will be much worse.

This could be much more of a drag on the German economy and the Eurozone as a result.

To make matters worse, the FT reports today that the European Central Bank (Frankfurt!) has just put the hee-bee gee-bees up the Spanish Banks sails by refusing to extend their loans:

Spanish banks have been lobbying the European Central Bank to act to

ease the systemic fallout from the expiry of a €442bn ($542bn) funding

programme this week, accusing the central bank of “absurd” behaviour in

not renewing the scheme. On Thursday, the clock runs out on the

ECB financing programme – the largest amount ever lent in a single

liquidity operation by the central bank – under the terms of the

one-year special liquidity facility launched last summer.

Oh dear?

Will this push Spain to the brink and, therefore, the Eurozone?

Is there any optimism here?

Maybe.

Spain does have problems, but many of the conference attendees told me that they think they are getting over the worst of it.

The exodus of migrant workers has halted, and volumes and values of money transfer are now stable.

The property disaster may come to an end. OK, it’s unlikely that Brits, Germans and Scandinavians are going to come back to Spain with remortgages for second homes, but retirees and holidaymakers still want sunshine.

And, for all of its foibles and practices, Spanish folks are nice people to get along with. Sure, some folks might want to kick ‘em up the rear-end but that doesn’t mean kicking them when they’re down if we're serious about a European Union for the future.

And finally, for all of Spain’s economic issues, it’s still not a bad place to be.

However none of the optimisms above fix the loan mountain that Spanish banks sit on.

In summation, don’t expect Spain – or Portugal, Ireland, Italy and Greece – to get their act together fast or to sort out their issues without further hostility and acrimony between Europe's nations.

The EU will have its biggest test for the next decade to see if it’s getting its act together. In fact, as Gideon Rachman said in the Financial Times last week, Europe is having a midlife crisis and some folks emerge from a crisis with a new sense of purpose whilst others just get divorced.

Unless Europe continues to behave in a united fashion, where Germany and France keep banging the drum of the Eurovision, then we may well go back to a disenfranchised and disenchanted Eurozone.

A broken one.

And I guess that it is the net:net of my Spanish reality.

For the European Union to continue, it really just boils down to whether Germany and France can keep it together.

Oh dear ... think I’ll go down the pub to watch Spain and Portugal battle things out in the World Cup finals.

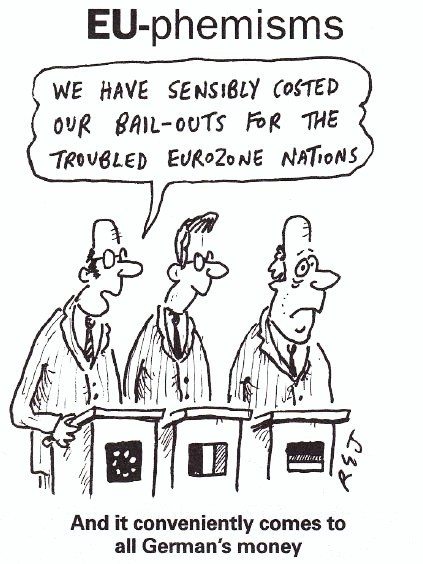

Sources: Private Eye for the cartoon and Fabio joke, and The Week for the links to articles

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...