I continue to be stunned by how Facebook and other social media allow me to see things in other people’s lives that should not be seen.

For example, all of my friend’s friends photographs.

This is a feature of Facebook I particularly dislike, and I’m not sure people are even aware of it, although the furore over Facebook’s privacy settings has been well documented.

The feature I’m referring to is the ability to see anyone’s private photographs purely because you are linked to them via someone else.

For example, here’s someone I don’t know:

His name is Mark, and he’s a friend of a friend.

He’s very private and doesn’t share information with me, as is his right.

But here’s Mark at Jeff’s wedding.

I don’t know Jeff either, but this is him and his gorgeous new wife.

Now I could have used many other photos from friends to show how to abuse the system, but will stop there as I already feel I've abused my friends enough by posting these private pictures.

The point is that they are not private though, and not many folks realise that Facebook’s privacy settings change all the time, allowing those you don't want to see you to see you.

Even CEO of Facebook Mark Zuckerburg realised how much of an issue this could become when private photos on his Facebook profile were acccessed, such as this one of him and his girlfriend relaxing:

But then, he doesn’t think privacy works or matters anymore, even though his customers' don't agree.

For example, the Mark I don’t know I could just as easily find through LinkedIn or other social media.

And that’s the point: to be found.

But here’s where it gets nasty because, by being so easily accessible, anyone can be found and potentially compromised.

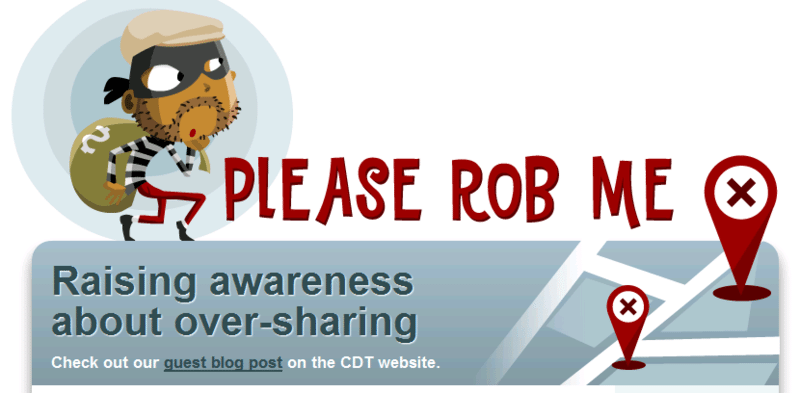

For example, some enterprising Dutch folks created pleaserobme.com a wee while ago:

The site was designed to pick up all location updates on twitter, foursquare and other social networking sites to show when you were not at home.

What better time to rob you?

Equally, I used to illustrate how nasty this could become by talking about a bank employee whose family details were found on Facebook, and the information was used to blackmail her. I stopped telling the story when one bank told me that had happened in reality, mine was fictional, and the criminals had killed her son to get access to the bank. That’s where it gets nasty.

Is there any point to this blog entry?

Yes.

Bearing in mind that our reckless social world of networking is going to mean that customers will willingly give away name, address, telephone number, birth date, mother’s maiden name, friends, location, habits and more, banks must:

- Find some other way to authenticate than personal information

- Educate customers on the dangers of divulging such information and show them how to protect themselves

- Make clear that where information is made available by a customer through social media that, if this information is used to access their account, then they are liable for any losses

You may say it’s the job of the government or the customer to be aware of this.

Well they’re not. Nor are the banks.

For example, I regularly cite First Direct as the best bank in Britain who ‘get’ social media.

So I go onto their website and look at the security section, which explains how to keep yourself protected.

Like most banks, they tell you about viruses and firewalls – as in protecting your computer – but nothing about social media and networking – as in protecting your identity.

This is a major oversight in all banks, and it must change and change fast.

After all, over 500 million are using Facebook alone!

p.s. in case you wondered why I picked on First Direct, it is because they are voted Britain’s best bank in regular polls of UK consumers. In addition, their CEO, Matt Colebrook, will be our guest of honour as speaker at the FSClub London on Monday night. More details here, if you want to come along.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...