No, not the state benefits version, but the online version.

I've been blogging a lot lately about cybercrime, identity theft and the do's and dont's of social networking. This was in part due to a seminar that took place this week where we were debating the risks related to social networking and mobile finance.

There is a risk.

The risk is this: as we proliferate devices and provide more and more identity information online that can be accessed and shared by all friends, foreigners and strangers, we are in a position where the world of financial management is potentially compromised. In fact, it's fatally flawed.

Our keys in the past to holding our identity were a card, a PIN and, more recently, a password.

None of these work anymore, as they are too easy to find, compromise and break.

Other keys were our date of birth, mother's maiden name and similar personal information.

That doesn't work anymore either.

So how can we protect ourselves.

With two-factor authentication, one-time password machines, biometrics and more.

Possibly.

But it's getting harder and harder to manage this all the time, and the views of the panellists in our debate were intriguing.

They all felt that the concerns we were airing were irrational.

Yes, there are worries - but we had the same worries about email leakage and internet banking and yet we're all happily using email and online finance today, so what's the big issue?

It's just a case of evolution and, over time, social networking and sharing via mobile devices and more will just become the fabric of how we do things, including mobile banking and payments.

It sounds like it makes sense.

But it doesn't.

The reason it doesn't is that email was controllable.

You can monitor email easily.

It's harder to monitor all the ways we communicate these days from facebook chat to skype chat, and from text messages to tweets.

This point was actually made by one panellist who one minute was saying "it's not an issue", and was then saying how his children had evolved from text messages to using facebook chat.

What he didn't realise is that they do this, not because facebook chat is cheaper and easier but because it's not auditable.

After a facebook conversation, it disappears. Parents can't audit the conversation therefore.

They can with texts, if the kids forget to delete them.

That's the point.

So sure, conversations can be tracked but, by cleverly using personal and company mobiles at work and loading them both with apps that allow quiet communication, you create a real minefield for data leakage.

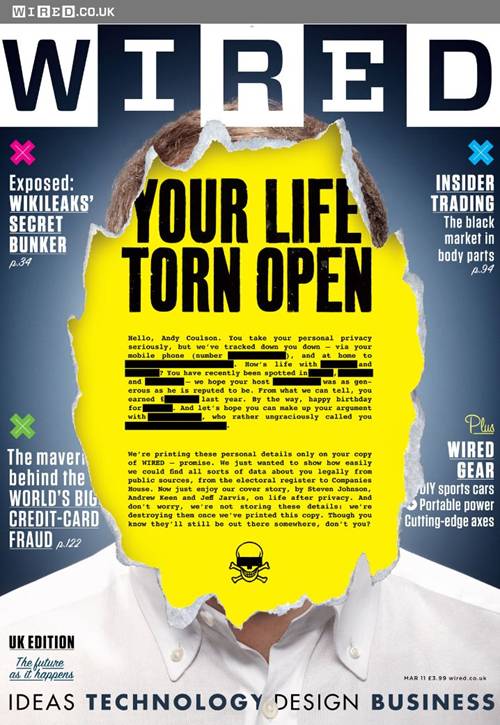

Data leakage is the key issue.

Data leakage used to be controlling emails and chatrooms; then it was policies for laptops, home working and devices that cross-over work and play from mobiles to blackberries; then it was issues related to using USB ports and portable hard drives ...

... now it's the data leakage points exploding by channel - facebook, twitter, skype - and by device - mobile, blackberry, laptop and tablet.

The fact is that data leakage points are out of control.

For example, add all the ways we can communicate then layer on top of that the ubiquity of devices.

We have moved from a few hundred thousand data device leakage points to several billion, and from a few channels of leakage to channels that leverage the strengths, and weaknesses, of each device.

And we have then layered on top of this all the social communication online that allow us to be socially engineered by any criminal fraternity into being socially manipulated to do things that are antisocial.

So there is no social security in our socially networked world and it's not just a controllable evolution, as the panellists proferred.

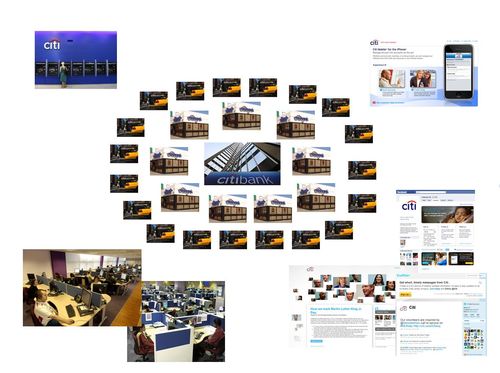

It's a mad explosion of mess that mixes our social with our work, our personal with our professional, our online with our offline. Mix that with the billions of channels and devices and you have a melting pot of data leakage that will mandate a number of new roles within a bank.

The Data Risk Officer.

The Chief Leakage Officer.

The Social Police Officer.

The No Idea How To Stop This Mess Officer.

Oh, and if you don't believe this is a mess, you have to read this story ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...