So how are we going to make money in this brand new bank?

This is the toughest question as it’s quite easy to make money in finance by focusing upon rate churn. Just offer lower interest rates on loans and credit cards and higher interest rates on savings and investments.

This is the approach that many have taken in the past, and it works.

Take the approach of Citi for example. I always remember one of their strategies saying that to enter a new country they would always start with credit cards. Credit cards is easy as it gets business on board that makes good money at low risk if you do it right (don’t mention doing it wrong). But it’s purely a rate tart business and inspires zero loyalty or stickiness.

Of course, you can make yourself sticky by focusing on a great customer experience, but even the banks that offer a great experience in the UK are targeting rate churn.

For example, the two banks in Britain that are consistently voted #1 by customers are our internet-only banks: Smile and Cahoot.

Smile's homepage today:

And Cahoot:

You could say that’s just retailing, but then retailers are also trying to get this business.

Tesco Bank's homepage today:

The issue is that you can have great service but if you fall into the trap of competing on interest rates, then you undermine that service.

Sure, you have to get a customer … but the important thing is to keep them and get share of wallet.

This is well understood by some.

For example, if Tesco get you, they’re going to get you for everything.

This was made clear by Terry Leahy at a conference I attended in 2009:

“In our move from retailing products to bank retailing, it amazes me that the current incumbents reward the new customer rather than the existing one. That encourages promiscuity and commoditisation. If you can reward the existing customer more than the new one, by learning more about them, then you can price your products better.”

It’s also an approach that is being taken by Metro Bank:

“Clear and simple: Metro Bank's Isa strips out all 'stupid' bank rules:

“Metro Bank has launched its first Isa aimed at savers who are fed up with confusing bonus rates which disappear after a year. The Instant Access Cash Isa has a rate of 2.35% and is guaranteed to increase in line with the base rate until 2013. Metro says this means customers won't be left feeling cheated after being tempted by an initial high rate, as they would when a bonus rate drops off.”

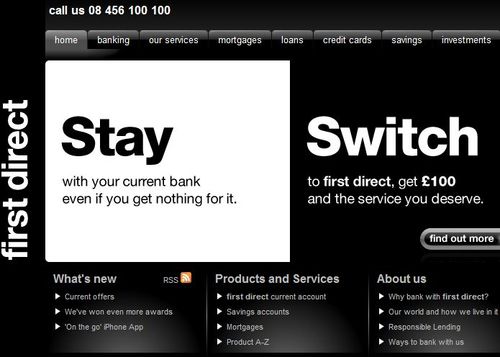

First Direct also gets nearer the mark, with their approach that gives you £100 to join their bank and another £100 if you leave in the first six months.

That sounds risky, but they know their service is so great that customers will stay.

That’s why they offer this guarantee.

So my approach would be to be up-front in fairness, transparent in fees, clear in my offer and differentiation, incentivised to join but making it more beneficial to stay and avoiding the rate tart churn through being a bank that people want to be with (cool).

That will make money, believe me, although it will take time and will not be easy.

None of this is easy, but if you can attract business based upon a culture of being the fair and cool bank that gets the mobile internet, then it will ensure longevity of relationship.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...