So last week I felt honoured to be invited by the European Central Bank (ECB) to present at their conference on the future of retail payments.

An audience of the great and the good turned up, and I was the last presenter of five panellists at the last session of the last day.

Obviously, this did not auger well as the audience sat smiling politely whilst quietly nodding off.

Equally, the four panellists before me went way over their time schedules of ten minutes so, as I stood up, the conference chair introduced me by saying:

“This is Chris Skinner, we have five minutes left Mr. Skinner. Could you speak quickly?”

This did not auger well.

Having prepared 45 slides for a fast whirl through the future of money, I realised there was no way I would get through the speech and instead went for what I thought was a clearly articulated high level overview.

But the audience didn’t seem to get it.

Apart from the several hundred pairs of clouded eyes, the few hundred pairs of puzzled eyes and the multiple pairs of eye lidded eyes accompanied by sounds of dozing, my message missed its mark.

But I wrote up my notes for posterity and decided to post them here, as I think there was something important to say.

So here’s what I said:

Thank you to the ECB for inviting me to address you today, which is a great honour.

As the last speaker of the panel, you would think that there would be nothing left to say but, for those who know me, I always have something to say.

And the focus of this panel has been upon innovation in retail payments and yet no-one has really defined innovation so let us being with this.

I define innovation as change that is disruptive and mainstream.

What I mean by this is that innovation change the business models of providers in a market space in a fundamental way for the long-term.

That is disruption.

There are many examples of such innovations, some of which can be seen in just the last decade.

For example, Facebook demonstrates innovation. In 2006, no-one discussed Facebook or even knew what it was. The service was confined to around 25 million people mainly on university campuses.

Today, Facebook is the #1 website worldwide with around 675 million dedicated to its usage and spending far more time on there than on Google for example.

In less than two years, Facebook fundamentally changed the face of the internet in that its breakthrough years were 2007 and 2008, as Facebook opened through APIs to the developers’ world and took over the internet.

PayPal did the same with payments with PayPal X.

Launched in summer 2009, the system allowed developers to incorporate PayPal into their applications simply and easily.

Two years later and PayPal expects to burst through the $100 billion of transactions this year, along with revenues of nearing $5 billion. In fact, what amazed me was to see that two percent - $2 billion - of these transactions will be via mobile this year too.

That’s innovation and has delivered growth that has been significant in the last two years, in the face of frenetic competition too.

The innovation of PayPal’s was to open up their platform, whilst the innovators are the developers of apps on that platform.

M-PESA in Kenya is an innovation in P2P payments. Apps on the iPhone are an innovation in commerce. The iPhone itself is an innovation but not a significant one, as its power is already tailing away as Android takes over. But the App on iTunes is a strong source of control and ownership in the commerce stakes.

There are many other examples of innovation out there.

Fast cycle disruptions to traditional business models.

Then we look at the banking industry here in this room and SEPA and I wonder where the innovation occurs in banking.

SEPA has taken over ten years to gestate and has delivered SEPA Credit Transfers and SEPA Direct Debits, SCT and SDD.

SCT and SDD have yet to deliver their promise however, but who said that fundamental changes to business models that become mainstream had to happen fast, ay?

SEPA is an innovation in the payments infrastructure but such innovation in the industry has to happen through a constructive industry evolution towards a common goal.

And so we have innovation in banking that often only occurs through regulation, as regulation forces the industry to work together towards a common goal of compliance.

Meanwhile al the innovations of PayPal, M-PESA and co takes place on the top of the infrastructure.

In other words, we have rapid innovation on top of the infrastructure, a little like the forth on the icing of the cake.

PayPal has replaced nothing for example.

It has just added a layer of convenience to what was inconvenient before.

In other words, innovation takes place slowly at the core (SEPA) and fast at the non-core (PayPal).

But in this new world of rapid cycle change in the non-core, three things are happening.

First, there is no longer a separation of online and offline. There’s just global real-time.

Second, there is a restructuring of the form and function of banking and payments through the development of apps.

Third, the combination of global real-time and apps is creating a much greater recognition that our greatest asset is information.

Let me explain these three points briefly.

First, global real-time is why mobile matters as mobile internet is delivered global 24*7 connectivity.

This is demonstrated by many points but, rather than repeat the points I made in this speech, I would refer you to last Friday’s blog, which shows that the rise of global real-time will enable the mobile operators to become disruptive.

The ability of mobile to start as inconsequential and soon become mainstream as an innovative disruption is amply demonstrated by the rise of PayPal’s mobile channel which is already expected to process $2 billion in transactions this year, and is seeing a doubling year on year.

And the mobile operators will begin with peripheral change and gradually concentrate into core change through experiential innovation.

That is a key.

Second, finance is being restructured in form and function through the increasing use of apps.

Apps deliver a deconstruction and reconstruction of finance, thanks to taking pieces of what was an end-to-end process and breaking it down into simple form.

A balance check no longer requires logging on to look at a complete service from bill payments to credit card transactions. You just see the balance.

Apps can now be delivered for everything from budgeting to alerts, and can be extended from simple consumer tools to complex treasury tools.

The way in which such apps demonstrate a reconstruction of thinking is best demonstrated by Zynga.

Zynga is a gaming firm on Facebook that deliver entertainment such as Farmville and Cityville.

Whilst Farmville took three months to grow to 60 million users in 2009, which was phenomenal in itself, this year Cityville grew from nowhere to 100 million users in just six weeks.

Now the key to this gaming world is that it is driving the emergence of micropayments and microcredits.

People are exchanging virtual nothings for cash.

If just five percent of Zynga’s users spend $5 a month on Cityville, that’s $25 million a month or $300 million a year on one game.

And that’s $300 million spending on virtual nothings.

Now add all the other games out there, and you soon see why a $10 billion on virtual currency in 2011 in Facebook makes it attractive for Facebook and Zynga to launch their own virtual monies.

And these virtual monies are disruptive as they innovative the form and function of exchange.

In the same way that Angry Birds is doing on the iPhone, Android and iPad, Zynga is changing the world of money in Facebook.

This brings me to my third point.

If you have a market today where billions of real dollars are being exchanged for virtual dollars, then the virtual world becomes as important as the real world for commerce and, in some cases, more so.

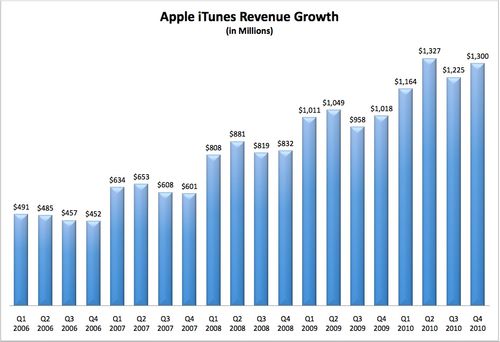

For example, how important is iTunes?

With 200 million active credit card accountholders and revenues in excess of $5 billion a year, I would claim that the virtual exchange of iTunes is Apple’s crowning glory.

The reason is that the Mac, iPhone and iPad are all replaceable.

Android has taken over from iPhone as the primary smartphone system in the USA and it wouldn’t surprise me if the same will be true shortly for the iPad.

But Apple make their stickiness from iTunes.

iTunes is driving the sales of iPad, iPhone and more, as it is iTunes that offers the stuff folks want - games, apps, movies, books ... - and it is the store where real money is exchanged for virtual goods – digital downloads – that is really driving the revenue.

And this iTunes game is the same game as Amazon plays online.

It’s all about information warfare, another subject I’ve spent a long time blogging about.

So the core point for me here is that we have to recognise today that banking and payments is being deconstituted into apps that are delivered in global real-time as virtual forms of exchange of data.

As a result, we live in the information warfare world http://thefinanser.co.uk/fsclub/2011/04/why-banks-should-worry-about-google-apple-facebook-?cid=6a01053620481c970b0147e3c0a023970b of Amazon, Google, Apple and company.

This is the world of finance today and if you don’t see that, then you’re missing a trick.

Innovation is occurring on the froth of the cake and the forth is owned by PayPal today.

It may or may not be tomorrow as other innovators innovate.

But the critical innovations are taking place around three hemispheres.

First, we live in a world of global real-time connectivity.

Second, this world is being reconstructed in form and function thanks to apps.

And third, this results in every business that is digitally enabled – of which banking and payments most definitely is – being locked in information warfare.

Thank you.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...