There’s been quite a lot of coverage recently of the British Bankers Association’s (BBA) report about bank branch closures in the UK.

Based upon the stats, UK banks are closing three branches a week. That still leaves over 9,000 branches out there, but they are shrinking.

The reasons are many – cost efficiency, movement away from remote locations, operational overheads, etc – but the clear trend is away from branch and towards automation.

That being said, there are still branches out there and, as folks who read this blog regularly will know, a debate about their value always ends up saying that banks will need branches, just not so many.

But the reason for posting this is two-fold.

One is to repeat the BBA’s stats.

The big names – Santander, Barclays, HBOS, Northern Rock, Royal Bank of Scotland and NatWest – had 9,496 high-street outlets between them in 2009 but 187 closed last year, cutting the total to 9,309.

HSBC closed the most, with 58 of its 1,369 branches disappearing last year; the trend has continued this year bringing this down by a further 79 to 1,290 branches today.

Part of the reason for this is that there are 44 million internet banking users registered in the UK, according to the BBA’s stats. As more and more people are engaged in self-serving online, less and less use branches and hence they are not needed.

That does not quite stack up with the Office for National Statistics (ONS) figures however, which show that around one in four households still does not have internet access:

"In 2010, 30.1 million adults in the UK (60 per cent) accessed the Internet every day or almost every day. This is nearly double the estimate in 2006 of 16.5 million. The number of adults who had never accessed the Internet in 2010 decreased to 9.2 million, from 10.2 million in 2009. There were 38.3 million adults who were Internet users."

Even worse are the demographics, which imply it’s the young and wealthy that the banks now reach whilst ignoring the old and infirm.

For example, among the over-65s, just one in three use internet banking compared with two thirds of those aged 25 to 44.

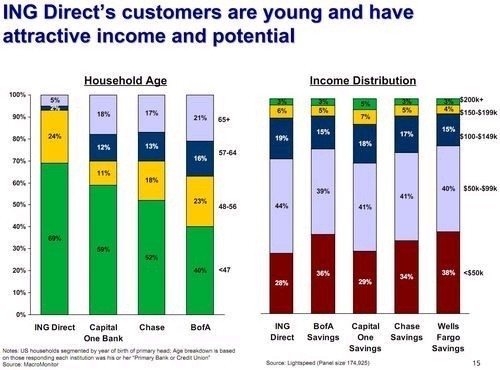

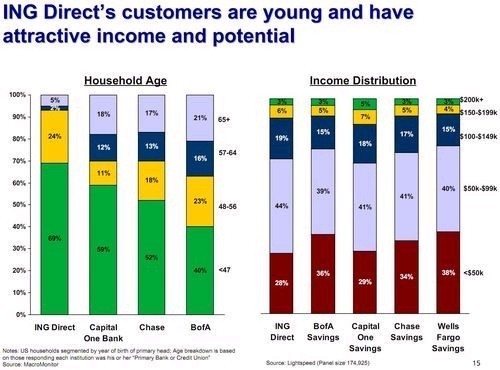

This stacks up with my recent analysis of the ING Direct acquisition by Capital One, which shows that ING Direct’s demographics are skewed heavily to the young and wealthy, whilst traditional banks are directed more towards financial inclusion and the elderly.

What this means long-term is that some banks will want the old and wealthy, the young and the poor; whilst other banks will want the young and wealthy, the old and the digital.

These aren’t simple demographics however.

Banks will appeal to different audiences based upon their channel mix, service offer, customer engagement in person and remote. Some will be heavily branch oriented whilst others remotely focused, but they will each find a niche.

The only change will be that there will be far more niche players, rather than the homogeneous branch based grouping we have today.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...