So the Vickers Report has finally crept out into the wilderness.

All 358 pages of it.

Half of it talks about how to increase the competitiveness of banking and the other half about what to do if a bank fails in another crisis.

The latter has garnered all the news headlines, whist the former has been generally overlooked.

More copy has been written about this report than anything else in banking over the past week or so, with a selection of headlines that makes the mind reel. Here’s just a few:

- Search for new approach to banking has begun - Financial Times

- The complexity of bank reform cannot be underestimated - The Telegraph

- Ring-fencing will dent growth, says forecaster - The Independent

- ICB to admit its reforms will cost banks billions - The Telegraph

- David Cameron in push to dilute ICB ring-fence reforms - The Telegraph

- Oxford Academic Becomes Key for U.K. Banks - Business Week

- 'Shadow banks' move in amid regulatory push - Financial Times

- Grab some bargain banking shares while you can - The Telegraph

- The wrong reforms will break the banks - The Telegraph

- Banks 'at risk from devaluations' - BBC

If you want the truth, you can read the full Vickers report, which I’ve been reading this morning and so far have found nothing too surprising, as most has already been leaked.

Here’s a summary of the key points on ring-fencing:

- Ring-fencing is confirmed, where banks separate domestic retail banking services from global wholesale/investment banking. The commission is vague about whether banking to large companies should be in or outside the ring-fence but it suggests that between one-sixth and a third of the £6 trillion of bank assets should be inside the ring-fence.

- The ICB describes the ring-fence as "high" and said that the ring-fenced part of the bank should have its own board and be legally and operationally separate from the parent bank.

- Ring-fenced banks should have a capital cushion of up to 20% comprising equity of 10%, with an extra amount of other capital such as bonds. The largest ring-fenced banks should have at least 17% of equity and bonds, and a further loss-absorbing buffer of up to 3% if "the supervisor has concerns about their ability to be resolved without cost to the taxpayer".

- Capital could be moved from the ring-fenced bank to the investment bank, as long as the capital ratio of the ring-fenced bank did not fall below the 10% minimum.

And on creating new competition:

- The ICB has backtracked on an idea in its interim report that Lloyds Banking Group be required to sell off more than the 632 branches it currently has on the market to meet EU rules on state aid. It dilutes this, to say that it "recommends that the government seek agreement with Lloyds Banking Group to ensure that the divesture leads to the emergence of a strong challenger bank."

- It should be easier to switch bank accounts and the ICB recommends "the early introduction" of a system that makes it easier to move accounts and that is "free of risk and cost to customers". It rules out number portability — as is used with mobile phones — in favour of this switching service. The amount of interest that customers miss out on by having a current account — known as interest foregone — should also be published on annual statements.

- The industry should be referred for a competition investigation in 2015.

For the most part, I’m disappointed with this report. It’s not that I’m against bank reform, but what is the right sort of bank reform?

What this report appears to do is tread a fine line between bank anger, government need and public input, and comes out on the side of muddle.

It’s already had plenty of flak for this, but let’s pick on a couple of things.

First, account portability. Why hasn’t the ICB included this, as it makes eminent sense as discussed back in December at the ICB meeting I attended.

What the report actually says about this is as follows:

“The Commission recommends the early introduction of a redirection service for personal and SME current accounts (to make account switching easier) which, among other things, transfers accounts within seven working days, provides seamless redirection for more than a year, and is free of risk and cost to customers. This should boost confidence in the ease of switching and enhance the competitive pressure exerted on banks through customer choice. The Commission has considered recommending account number portability. For now, it appears that its costs and incremental benefits are uncertain relative to redirection, but that may change in the future.”

In other words, the cost of using different account numbers between banks allowing portability is too great. For example, if might from RBS to Lloyds with account number 75280025, there may already be someone at Lloyds with that account number. Therefore, to introduce account portability of account numbers, you would probably need to renumber all the bank accounts in Britain with unique ID’s. That’s why it’s been dropped.

But then the report adds more details to this idea (page 218) and shows it is feasible:

“Under account number portability, a customer’s sort code and account number would not change when the customer changed banks, thereby avoiding the need to change any payment or credit instructions. Evidence to the Commission suggested that the effect of account number portability could be achieved through the creation of an ‘alias database’. This proposal is for a new database to be created with a new code for each account that would be assigned to each sort code and account number: a customer would give the direct debit originators (and creditors) they deal with the new code, which would never change; when the customer moved banks, the sort code and account number assigned to the customer’s code would change and nothing else.”

Later on (page 222), it expands on the risks and opportunities of account portability:

“One significant benefit of account number portability (whether done through making existing account numbers effectively portable, or through the creation of an alias database) is that it would remove the cost of switching to direct debit originators, as well as those who make automatic payments into customers’ accounts. However, given the importance of the payments system, it would be critical to ensure that the migration to account number portability did not disrupt the flow of payments or introduce greater operational risks into the payments system.”

In light of a need for bank reform, this would have been a worthwhile aspect to develop now, and it is something left in the report for further evaluation so you never know.

Nevertheless, the big question is whether this would improve competition anyway?

Competition is more about the barriers to entry – governance, licensing, capital, technology etc – and hence, these are more mighty areas … that the report also fails to address.

The report mentions competition 414 times, and yet the main recommendations of the interim report:

- “that the divestiture of Lloyds’ assets and liabilities required for EU state aid approval will have a limited effect on competition unless it is substantially enhanced;

- “that it may be possible to introduce greatly improved means of switching at reasonable cost, and to improve transparency; and

- “that the new Financial Conduct Authority (FCA) should have a clear primary duty to promote effective competition”;

... have all been watered down.

Then we move onto ring-fencing, which purely addresses the aspects of what to do if a bank fails.

"Structural separation should make it easier and less costly to resolve banks that get into trouble. By ‘resolution’ is meant an orderly process to determine which activities of a failing bank are to be continued and how. Depending on the circumstances, different solutions may be appropriate for different activities. For example, some activities might be wound down, some sold to other market participants, and others formed into a ‘bridge bank’ under new management, their shareholders and creditors having been wiped out in whole and/or part. Orderliness involves averting contagion, avoiding taxpayer liability, and ensuring the continuous provision of necessary retail banking services – as distinct from entire banks – for which customers have no ready alternatives. Separation would allow better-targeted policies towards banks in difficulty, and would minimise the need for support from the taxpayer. One of the key benefits of separation is that it would make it easier for the authorities to require creditors of failing retail banks, failing wholesale/investment banks, or both, if necessary, to bear losses, instead of the taxpayer."

Living wills and all that aside, the proposal to leave banks as integrated universal operators – good for Barclays – by purely creating a delineation between their domestic commercial and retail banking operations versus their global links is a duck out.

Why?

Because it does not address the issue of why banks fail, but just what to do when they fail. This is a positive thing according to some and yes, sure, it's a good thing to know what to do when a bank fails ... but why not try to deal with the core of failure as, even if we know what to do, a bank failure in its investment arm will still destroy value in its overall operations.

Northern Rock illustrates this well where, as a pure retail bank, it failed due to securitising its loans and mortgages in the wholesale markets. Surely these aspects of potential liquidity failure should have been in the report, and how a bank builds an illiquid position that leads to failure, rather than just what to do post the event.

And no, I'm not forgetting that through a ring-fence recommendation increased capitalisation of both the retail and investment operations will help, but an illiquid position is still on the cards and that is surely a point that should have been the core of the reforms, not the post-failure fall out?

Equally as Sir John Vickers has been saying in today's press calls: “the too big to fail problem must not be recast as a too delicate to reform problem”, but is he reforming or just adding insult to injury?

As the action of ring fencing is a unilateral action not being followed by any other major nation right now, it may be the latter.

Renowned former Federal Reserve Chairman Paul Volcker gets to the heart of the matter when he says that he “completely doesn’t understand the British approach, where they can leave all these questions unanswered. They said they wanted a retail bank in the same holding company as everything else. I don’t know what ‘everything else’ means. Is that not a bank too? It’s just a wholesale bank. Who makes the payment system work – the retail bank or the wholesale bank … the philosophy is you are a group of banks that serve the consumers, the retail customer, and that hold their deposits with the central bank and so forth, does not solve the problem with all the other parts of the financial system. I also don’t believe in a firewall or Chinese wall between them, as you need a very high ring fence to stop the deer jumping over.”

Sir John may claim the fence is high, but it cannot be high enough.

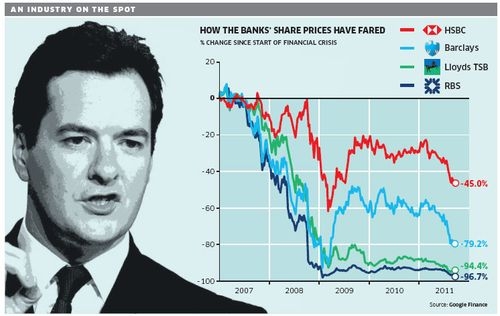

When a Barclays investment bank fails, it will still bring down Barclays Bank as Barclays investment banking operations represents 42% of the bank's total revenues (Royal Bank of Scotland generates a third of all revenues from investment operations; HSBC 27%; and Lloyds Banking Group is unceratin as it has no official investment banking arm).

Meanwhile, the costs are at least £4 billion to implement these reforms and the overall programme has really hammered the value of the UK banking sector in the world's financial markets:

With much of the loss of value this year due to Sir John's committee's actions combined with the Eurozone crisis.

So my key question is that we are living in a world where Basel III, G20 reform, European Union Directives along with American restructuring is creating so much imbalance in the global financial system that adding to such imbalance though unilateral action is questionable.

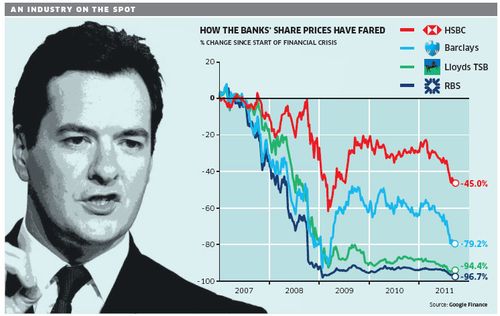

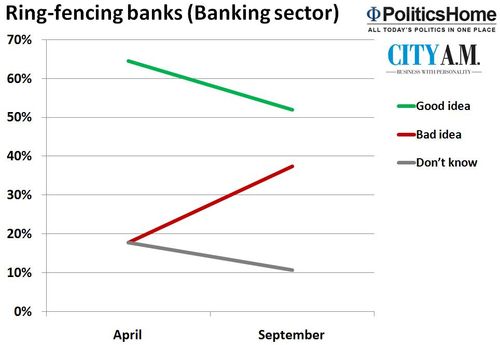

This is corroborated by the views polled by City AM and Politics Home.

“Among just those working in the banking sector, however, support for the idea has collapsed - and while a small majority of bankers still back a ring-fence, net support have fallen from +46% to +15%. This is surely a reflection of recent rumbling in the press on the dangers of such a scheme to the sector.

Those working in the banking sector, however, thought the idea would make no difference in preventing a repeat of 2008, while thinking it would be actively damaging to promoting UK economic recovery, getting banks lending, as well as keeping HQs in the UK.

All in all, the whole area is a cauldron of trouble and messiness that this report has done little to resolve and, if anything, has fuelled more debate about the UK’s sole stance in the face of global regulatory drives.

So what should we do?

We should ensure that we work in harmony with Wall Street on the capital market reforms whilst implementing domestic policies to lower the barriers to entry for new entrants in banking.

The former may be seen as being difficult, but the #1 objective of the UK should be to maintain UK’s attractiveness as a centre for financial services.

That’s the piece that has been most badly damaged by these proposed reforms.

Luckily, it won’t be implemented until 2019 in order to ensure consistency with the developments of Basel III, so delay was inevitable after all.

A few further comments:

Andrew Gray, UK banking leader, PwC, said: “The report from the ICB today sets out a clear statement of the direction it believes should be followed in order to reduce the risks of banking in the UK, increase competition and ensure globally competitive banking based in the UK. The measures recommended will have a far-reaching impact on the way in which banks operate in the UK in future. A key question for government to consider will be the trade-off between improved financial stability and facilitating economic growth. The core proposals revolve around the use of ring fencing of retail banking activities to ensure both the financial stability of the banking sector, but also to ensure the government is not called on to rescue the banking sector in the future. Ring-fencing on its own does not change the risks inherent in banking (except when it comes to resolving failed firms) and the ICB recommends higher capital levels than those proposed by the Basel Committee. The importance of a strong banking sector as an integral part of the UK economy is clearly recognised, as is the need to ensure the UK remains a globally significant centre for financial services. Overall, these proposals, while not unexpected, will represent a significant change to the UK banking landscape. These are detailed proposals which will take time to digest and, in doing so, more questions will emerge. It is too early to assess the real impact on the UK banks and the wider economy. The real consequences will only become clear once the Government decides what is to be passed into law.”

Michael McKee, Head of Financial Services Regulation at DLA Piper, commenting on the Independent Commission on Banking - Final Report, said: "The ICB Final Report has stuck to the line set out in the Interim Report. Most interesting is the detail of how the ring fence will operate. It will focus on deposits of individuals and small businesses - but this is likely to catch a lot of private banking business too. The ring fence looks like it will be quite a "hard" ring fence - a retail bank will have to deal at arms length with other parts of the group and apply large exposure rules. Moreover the ICB sticks to its guns about a minimum level of 10% capital for retail banks and also wants a lower leverage limit than international proposals. Overall, therefore, the ICB has withstood political pressure from the Liberals but has taken a tough line on the content of its ring fence."

Edward Sankey, Chairman of the Institute of Operational Risk (IOR), said: “We are concerned that the Vickers Commission are proposing economic solutions to what they believe are economic problems. However the IOR believes that the root causes of the financial crisis were failures in people, processes and systems, which are the targets of operational risk management. The proposals will not on their own do anything much to reduce the possibility that failures by people, processes and systems will not again threaten banks and their clients. Time and again we have seen that more sophisticated regulation and restriction leads to more sophisticated efforts to find ways through them, or even plain evasion. We have a great opportunity to make lasting reforms that will not only help to ensure a sustainable and profitable UK banking sector, but also strengthen UK economic growth. Unfortunately the Vickers Commission is focusing on the wrong solutions – solutions that will do little to correct the failures in people, processes and systems that preceded the crisis.”

Andrew Wingfield from SJ Berwin’s Financial Institutions Group commented: “The ICB’s proposals totally focus on retail protection and would impose a cost ahead of any bank failure. The costs of restructuring and higher equity capital levels will place returns under further pressure and the ICB’s proposal will likely be a Herculean task given that people and IT systems are intertwined within banks. The key recommendation (in our view) is around a clear message to UK banks to ring-fence their operations with the tone of the political debate already showing signs of an irreversible process and the Government committing to immediate steps towards implementation. Over the next few weeks, it will be interesting to see whether support for the recommendations wanes as the party conference season approaches. However, the message is softened by a long final implementation deadline of 2019, which is intended to synchronise the timeline with the implementation of new international standards under Basel III. In our view, all Banking reform measures adopted by the UK authorities need to be carefully analysed in order to ensure that the full consequences on the economy and the recovery of banks’ ability to support customers is understood.”

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...