2012 is here and we all hope it’s better than 2011. Sure, some of you may have had a very good last year, but most thought it pretty dire with job losses, austerity measures, civil uprisings, protests, a second financial crisis in the Eurozone and more being the name of the day.

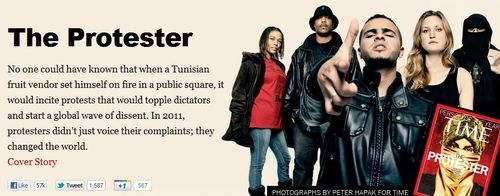

Time Magazine named their Person of the Year as a collective Protestor, rather than an individual …

And the Times named Mohamed Bouazizi - the young market trader who set fire to himself outside the government offices in Tunisia as a martyrdom act that fuelled the Arab Spring - as their Person of the Year.

Is this a time when societies worldwide change their world or will media, finance and government, continue to control and direct?

Probably a mixture of both.

Thanks to this internet age, the individual can change things and change things fast – the Arab Spring, Occupy Wall Street, Anonymous and Wikileaks prove this – but those in power will still direct, as far as they can.

The question may be who is in power, as demonstrated by the Eurozone issues of 2011.

Where are we going in 2012, is therefore a key question.

To put this question in context, I said three years ago that the next resurgence in the economy would be in 2014, after plateauing in 2012.

I still believe that.

This year is going to be a tough one, as things haven’t finished yet, but things are stabilising.

Europe’s going to a have a mild recession, America is going to revive and Asia is going to wonder where it’s going.

So here are the four key things that reflect the economic times of 2012:

- Asia’s light continues to shine, but not quite as bright

- American equities is the place to invest

- There will be a major European bank failure

- A country will leave the Eurozone

Asia’s light continues to shine, but not quite as bright

Asia, particularly China, continues to astound.

From Urban Times, 2010

Ten years ago, China had more mobile phone users than America, and last year it manufacturer more and registered more patents. In 2014, its retailers will sell more too and the day that China becomes bigger than America is getting ever nearer.

In 2003 – when Jim O’Neill coined the term the BRICs for Brazil, Russia, India and China – he estimated that China’s economy would overtake America’s by 2041. Last year, that estimate had moved fourteen years nearer, to 2027, thanks to the economic crisis. As the crisis has continued, the estimate is now that 2018 will be the year China gets to be bigger than the USA, according to Emma Duncan in the Times.

Nevertheless, with the American and European market demands contracting, China is not sailing a static sea. For example, Reuters Breaking Views blog states that China’s growth may dip under the magical 9% this year – even falling under 8% – as multiple challenges hit: falling house prices, a slump in property investment, and slowing exports. Add to this that salaries surged 40% last year – admittedly to just $160 per month – and we can see that global growth and stability will not be plain sailing at all in 2012.

Source: PhilSTAR / Bloomberg

So where should you invest?

American equities is the place to invest

In a bout of good news for Barack Obama, in the year where he fights for his political future against Mitt Romney, the US looks to be a safe bet for investments in 2012.

Terry Ewing, head of US equities at Ignis Asset Management, believes the US can continue to surge, as its economy has differentiating growth characteristics that will underpin both earnings growth and the stock market.

Mr. Euwing has expectations of 2% GDP growth, compared with the 'inevitable European recession' this year. By way of history, US industrial production rose by 8% between 1993 to 1995 whereas Europe's shrank by 5% and he believes a similar divergence could well happen again.

He lives with good company, with Jim O’Neill of Goldman Sachs saying that American equities could rise by as much as 20% this year, and Paul Frank agrees. John Paulson promotes buying US stocks over US government bonds, whilst James Paulsen sees this year as the ‘gear year’.

Source: PhilSTAR / Bloomberg

With all those “Pauls” behind it, something’s gotta be right and so yes, invest in America is the message in 2012.

Unfortunately, that means don’t in Europe.

There will be a major European bank failure

In July 2011, the European Banking Authority (EBA) issued its summary of how fragile the European bank system was after stress tests on 90 European banks. Eight failed that test – nine if you include the German Helaba Bank that dodged it – and a further 16 were in the danger zone.

However, the tests did not include a sovereign debt default, such as the issues we now see in Greece.

And with the ECB lending €500 billion it should stabilise the system, except that the ECB is receiving a similar amount back in overnight deposits and European banks still have to face almost €2 trillion of toxic assets on their balance sheets.

Add on to this that European banks also face a major capital shortfall – at least €115 billion and more like €350 billion – and we are bound to see more European banks failing this year.

I said a third of European banks would fail two years ago. It won’t be that many, due to the €440 billion European Financial Stability Facility, but there will still be some major failures with Commerzbank already in the frame.

It should be noted that this is not unique to Europe however, as 92 banks failed in the USA in 2011. It’s slightly down on 2010 (157 failed) and 2009 (140) but it’s still high and will continue as an analysis by The Wall Street Journal suggests that failures are down because troubled banks aren't failing as quickly.

A country will leave the Eurozone

Due to fragility in the European banking system continuing, along with a lack of confidence in Europe’s leadership, one or more countries will be forced to leave the euro.

There’s already been lots of speculation that a Eurozone member will need to breakout of the euro. Greece is the usual one cited, but Italy and others are also regularly debated. There has been lots of simulation and planning for such an event and so, when it does, it won’t cause any major ripple in the markets at all.

It will be a disaster for the country concerned of course, but the idea of continuing the Eurozone where a third of the members – Portugal, Italy, Greece, Ireland, Spain and more – are being propped up by Germany, and to a lesser extent France, is just not workable long-term.

And I’m not the only one saying this.

The Wall Street Journal is charting its demise, whilst the Guardian is talking about it every day, as are many people in the countries affected themselves, such as Greece and Ireland.

The UK Treasury is planning for it to fail; as are most bank analysts, banks and companies.

In fact, the only ones saying it won’t happen are the ECB, obviously, and Wolfgang Schäuble, the German Finance Minister.

But what does it mean if it happens?

Well, it ain’t good, but it doesn't mean the end of the Eurozone. Just that Europe has to rethink a lot of the Maastricht Treaty, and come up with a new Economic & Monetary Union approach.

Peter Sands, CEO of Standard Chartered, puts it succinctly:

“I think the probability of countries leaving the Eurozone has increased because we have had several successive plans announced to solve the problem of the Eurozone which simply haven't convinced the market.

“Nobody should underestimate what a big deal that would be, because it would be very difficult to manage the contagion risk, even if it was only Greece. The disruption from that would really be quite significant.

“That will have ramifications all over the world . . . because the simple maths is that the Eurozone is a very large part of the global economy and if it is going slower, then economic trade will be slower around the world.”

So there’s a short guide to the 2012 economic outlook:

- Asia’s light continues to shine, but not quite as bright

- American equities is the place to invest

- There will be a major European bank failure

- A country will leave the Eurozone

This is one of three 2012 outlook pieces:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...