A short blog today, but a challenging one.

I was talking about Movenbank with a colleague and mentioned that it was going to be the world’s first paperless, cardless bank.

They looked at me quizzically.

Paperless?

Cardless?

What do you mean?

I said “no cash, no card, just mobile contactless”.

They thought I was off the planet, but that’s the promise on the homepage of Movenbank.

Here’s what the bank says on their website:

What does no plastic mean?

It won’t be very long before the plastic card you are carrying around in your wallet becomes a collector’s item – ok well a useless piece of junk might be more apt. We believe the future of payments and banking is in the mobile phone and mobile wallet. It’s faster, it’s way more secure, and above all it provides us the ability to interact with our customers when they spend. When was the last time you were able to see your current balance or rate on your plastic card?

Movenbank is designed to be used everyday, wherever you are, but you won’t pull out cash or plastic from your wallet – you’ll be using your phone. Your mobile phone is at the core of the way Movenbank works. Some may feel threatened by that possibility – at Movenbank we call it inevitable. But there’s one other key to our focus on no plastic – it has to be about making banking easier and better.

How will I pay without plastic?

Contactless payment technology has been in use around the world for more than a decade. In some parts of the world, such as the United States, the adoption of this has been slower. However, with Google rolling out their Google Wallet, with PayPal, Starbucks, Square, Visa, Mastercard, American Express, ISIS and many others now rushing to launch mobile payments capability, the infrastructure is rapidly being deployed.

Within a couple of years, contactless payments will all be pretty much standard. Already you can use a contactless card or your mobile phone to pay at places like Best Buy, Walmart, CVS, GAP, McDonalds, Walgreens, KFC, Starbucks, 7-Eleven, National Car Rental, AMC Movie Theatres, taxis in New York City and San Francisco, Nordstrom, and hundreds of thousands more locations. Movenbank works just the same as your existing debit or credit card, it’s just that you don’t need to swipe anything, you just touch your phone to the point-of-sale and the transaction is initiated.

No Paper? Ever?

That’s our aim. You’ll get your statement and receipts online, and these will provide you with much more information than you currently get from your bank, and it will all be easier to understand. That way you’ll be able to manage your finances even better.

When it comes to new services or products from Movenbank, we’ll be doing everything we can online or through the mobile. On occasions we’re presented with regulations when we might need to ask you some specific questions, or deal with a specific problem you’re facing that might require some written form of communication. However, we think that we’ll be saving lots of trees and at the same time working much simpler and easier. Most of the time when a bank asks you to fill out a form, it’s not because they need your signature on the paper – it’s just the way they’ve worked for the last 40 years and they can’t be bothered to change it.

So the deal is that the bank exists as a mobile app supporting contactless payments.

Contactless payments does not mean purely NFC or RFID as Square offers a contactless method with no chip involved, just an app, but it is a radical vision.

Nevertheless, you then see figures from Forrester that support Movenbank’s logic.

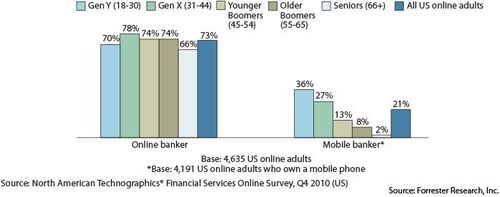

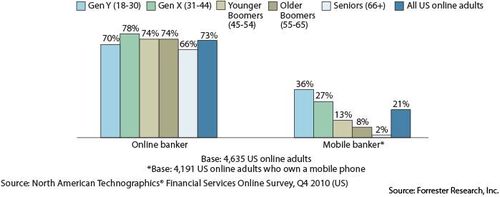

In the US today, Consumer Technographics® data shows that mobile usage is still far from mature in many industries. Take the financial industry as an example: 21% of US online adults with a mobile phone do any form of mobile banking versus 73% of US online adults who do online banking. When looking at the different generations, we see that younger generations, who are more likely to be early smartphone adopters, dominate in mobile banking.

In other words, the youth of today who are the mainstream consumer of tomorrow, are totally into the idea of mobile finance.

That’s the target group that Movenbank is going after and the idea of cards and cash being passé is therefore a reality.

Or is it?

What do you think?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...