Various cartoons and images amused me last week.

First was Brookes cartoon in the Times about Greek debt:

And, in the same newspaper, the uneasy ride that Angela Merkel is taking with Nicholas Sarkozy as they try to steer through this disaster and his upcoming elections:

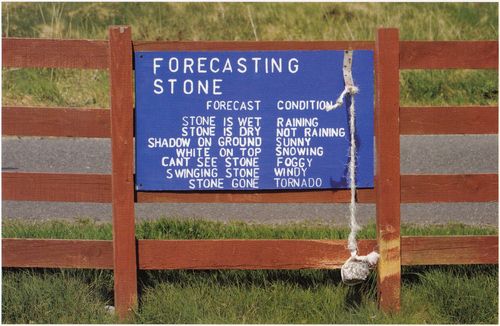

Then I found this gate on my journeys:

And thought it would be perfect for the regulators and banks to use, but with money instead of a stone:

Forecasting condition

Money is wet Times are bad, so lend less

Money is dry No one needs any, so lend more

Shadow on money Gordon Brown is around

White on top Investment guys have been snorting

Can't see money Ponzi scheme in operation

Swinging money Casino capitalism is in operation

Money gone Casino capitalism has failed

But none of these can beat the image of myself as a zombie banker:

Thanks to Al Davison for the artwork.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...