We talk about Big Data and information leverage a lot. Banks are underutilising the data they have about customers and should be far more holistic in approach.

It’s a theme on the blog regularly, and is challenged by various issues: the appetite of the bank to invest in data leverage; the silo-structure of the bank that allows information to fall between the silos; the lack of an enterprise view, or need for one; the ailing architectures of legacies that are hard to integrate into the new infrastructures; the global nature of a bank, and lack of single platforms; and more.

Today’s news about Google being in the firing line of regulators is actually a great example of what banks should be doing.

Google has just changed their privacy permissions so that they have one policy across all of their websites.

What an outburst of headlines that has caused, with the Europeans (actually it's the French) and Japanese immediately claiming this violates data privacy laws.

What’s going on?

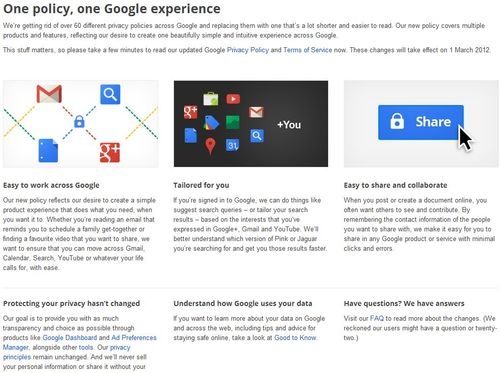

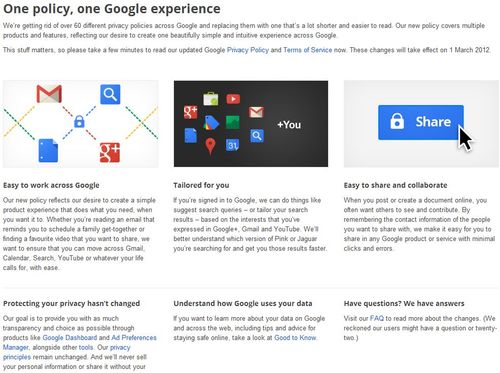

In January, Google said it was going to simplify its approach to privacy by consolidating its 60 or more privacy policies across various websites from YouTube to Gmail to Maps to Google searches and more, into one.

The new privacy agreements came into force today, and allow Google to take a single view of the searcher, or targeted individual if you prefer, that will help advertisers target you more effectively.

You can find out more by watching this CNN report:

*

The change of policy has created an outcry, but that is purely because it now means that Google Wallet can promote offers to you based upon the episode of The Inbetweeners you watched on YouTube last night or the search you just made for a restaurant address near Piccadilly.

So what?

This is exactly what information leverage of Big Data is all about.

If the customer agrees to have their data leveraged, then the information provider must and should leverage it.

The critique in Google’s case is that the new privacy rules are not spelled out clearly in plain English.

The policy is explained here and is pretty clear if you ask me …

... it's also well flagged on all of their websites so you can't miss it ...

... but maybe I’m biased as I believe that Google’s example is the one that banks must follow.

Tell customers you are going to leverage their data to give them better service.

Explain in simple illustrations (ideally using HTML5 as Flash is dead!) how the changes will impact the customer.

Then implement the new policy and create information leverage, not leakage.

And as for Google’s policy, if you don’t want your information tracked and used, then you have to get smarter and protect yourself from data leakage.

Don’t be evil.

And don’t be IKEA (IKEA 'illegally spied on its shoppers and staff').

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...