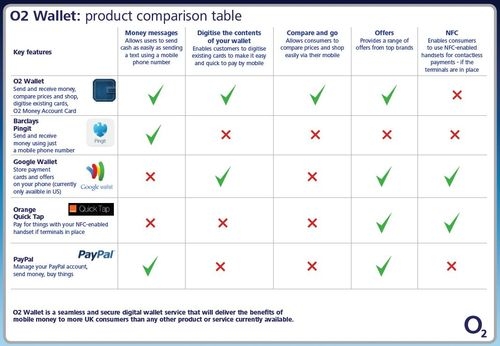

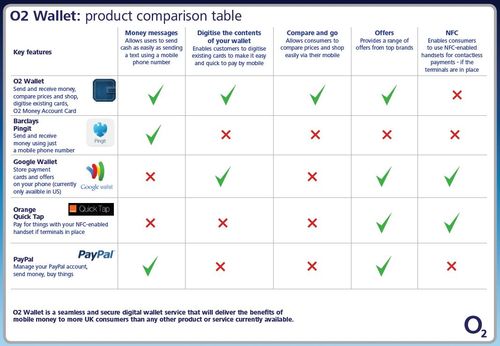

I don’t normally cover press releases, but this one is a goodie as it’s announcing a new mobile wallet and, thanks to this chart (doubleclick chart to enlarge):

Let the wallet wars begin.

Here’s what the press release says:

O2 today announced the launch of O2 Wallet - a seamless and secure digital wallet service that will deliver the benefits of mobile money to more UK consumers than any other product or service currently available.

Here's the video:

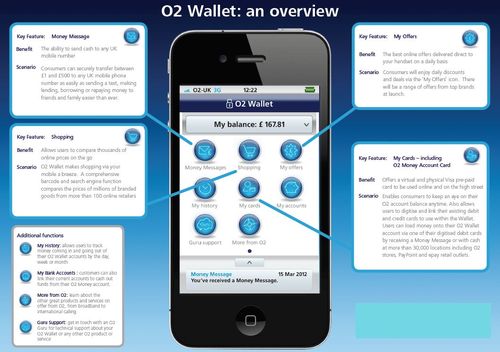

O2 Wallet is the new way to send and receive money, compare prices and shop via your mobile; and you can use it whether you’re with O2 or not - meaning anyone can take advantage of its numerous features.

O2 Wallet uniquely combines the following functions:

- Money Message – O2 Wallet enables consumers to securely transfer money to any UK mobile phone number as easily as sending a text. Money Messages allow consumers to make daily transfers of between £1 and £500; and will make lending, borrowing or repaying money to friends and family easier than ever.

- Shopping via your mobile – O2 Wallet makes shopping via your mobile a breeze. A comprehensive barcode and search engine function compares the prices of millions of branded goods from more than 100 online retailers. In addition, consumers will enjoy unique daily discounts and deals via the ‘My Offers’ icon. At launch these will include discounts and money off offers from retailers such as Debenhams, Comet, Sainsbury’s Direct, and Tesco Direct

- Your phone as your wallet – O2 Wallet enables consumers to digitise their existing debit and credit cards making it quick and easy to pay for things via their mobile. Customers can load money into their O2 Wallet account via one of their debit cards, by receiving a Money Message or with cash at more than 30,000 locations including O2 stores, PayPoint and epay retail outlets. O2 Wallet’s ‘transaction history’ helps consumers keep on top of their expenditure with texts alerts when the account balance changes; a 30 day payment history on the app; and a 12 month history online. In time, O2 Wallet will evolve to incorporate near field communications (NFC) technology and enable contactless payments direct from your handset.

- O2 Money Account Card – O2 Wallet offers both a physical and a virtual O2 Money Account Card. Both are based on a Visa prepaid account making them ideal for customers wanting to manage their finances as they can only spend what they put in. The ‘virtual’ O2 Money Visa Account Card is perfect for online shopping. Consumers can also apply for the physical O2 Money Visa Account Card to pay for things on the high street or withdraw cash from ATMs. This is a contactless card allowing tap-and-go payments at more than 100,000 contactless payment points across the UK; it’s fast, easy and convenient.

James Le Brocq, Managing Director at O2 Money, said: “O2 Wallet delivers the benefits of mobile money to more UK consumers than any other product or service currently available. With O2 Wallet, it’s easier to transfer money, track expenditure and pay swiftly and securely, all using your mobile. We believe it will transform the way people manage their finances and spend money.”

Additional functionality will soon enable consumers to use O2 Wallet to top-up mobile airtime, buy train tickets and make mobile contactless payments via NFC technology.

James continues, “We recognise that security is absolutely key. O2 Wallet has been trialled internally for months and has undergone extensive ‘stress-testing’ with security experts. In additional to PINs and passwords, all personal details and financial data are held on remote central servers rather than on the mobile device itself. This, we believe, is the safest and most secure way to deliver mobile payment services.”

Sandra Alzetta, Senior Vice President of Mobile at Visa Europe, adds: “We welcome the launch of O2 Wallet and are delighted to be enabling the m-commerce experience with a Visa prepaid card. The new service creates an easy and efficient online payment experience for mobile device users, supporting the continued growth of m-commerce in the UK, as well as encouraging contactless payments among those users who choose to take a physical card. This announcement is another step towards an integrated future where the way we pay reflects the full potential of these new technologies.”

O2 Wallet is compatible with the majority of smartphones as well as iPads. Even those without a smartphone can use various features of O2 Wallet – for example Money Messages – providing they have web browsing capability on their handsets.

O2 Wallet has been developed by a team of 250 experts from a variety of specialist fields including financial payments and e and m-commerce. In addition, O2 has worked with a number of specialist partners including global e-payments company Wave Crest; global banking and payment technology provider FIS; digital banking solutions provider Intelligent Environments; G&D for its contactless payment cards; IDT Financial Services Limited which is providing an interim e-money licence and BIN sponsorship whilst O2's own e-money licence is approved; Cogenta for its product search and promotion capabilities and Visa Europe for the payment brand and contactless payment technology.

The launch of O2 Wallet will come as good news to the millions of consumers who already use their mobile to manage their money and shop on the go. The proportion of people using mobile banking increased from 9.7% in 2010 to 20.4% in 2011*; whilst shopping on mobile devices is set to increase by 53% in the next 12 months hitting £4.5bn** and making Brits the biggest mobile shoppers in Europe.

*TNS Mobile Life, 2011

** Kelkoo & Centre for Retail Research

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...