I was jut updating a presentation about

mobile payments.

The presentation was from May 2011 and

talked extensively about Google Wallet, Square and M-PESA.

One year on and the presentation still

talks about the same things but I am shocked and amazed about how much things

have changed in just eighteen months.

For example, the focus of the presentation

was mainly on M-PESA, NFC contactless mobile payments and the impact of Google

Wallet.

Eighteen months later, and the focus is

firmly upon Square and the rise of mobile payments in other territories like

India.

Now I’ve written lots about Square, so I’m

not going there – although I love the fact that it was originally going to be called

Squirrel – but the Indian story is a newer one

that I’ve only just garnered, so it’s worth repeating here.

Now we all know that India is a massive

market with over a billion consumers.

Like China, it could be the largest market

for new forms of banking and is already showing signs of doing things

differently.

This is in part due to the Reserve Bank of

India (RBI) managing a strategic rollout of mobile payments to encourage

financial inclusion.

According to the EIU report I referred to

yesterday:

- A third of the Indian

population are completely unbanked; - 55% of the population has a

deposit account; - 10% have life insurance;

- 90% use cash to pay for their

daily needs; - Money orders and cheques

dominate fund transfers; and - Only a tenth of India’s 630,000

villages have a bank branch.

Over the past two years, RBI has granted 17

wallet licenses to mobile carriers.

There are restrictions with the wallets, e.g. you cannot get cash out

unless the carrier has partnered with a bank, but that has not stopped the developments transforming the country almost

overnight.

And it is not just the actions of the RBI

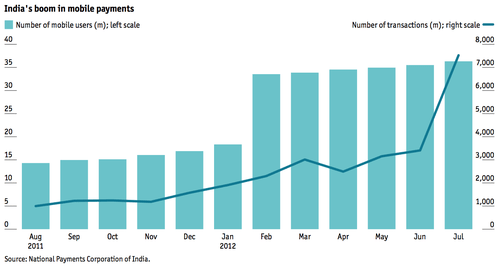

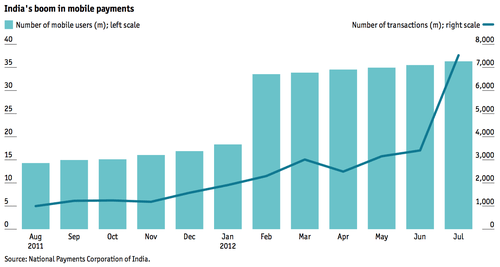

but also the encouragement of the National Payments Corporation of India (NPCI). NPCI is India’s ACH. Owned by the banks, PCI has been running an

interbank mobile payment systems since November 2010 and, by June 2012, 36

million people had registered for the service.

The results have been phenomenal

- There were 3.34 million mobile

banking transactions in June 2012 worth Rs 3067 million (US$55 million), more

than double from a year earlier - There was a 143% year on year

growth in volume and 211% YoY growth in value of transactions.

Source: the Economist Intelligence Unit

Even more noteworthy was the announcement of

NPCI to expand the mobile payments service to retail payments last week, as this could ignite a flame of change.

Initially the NPCI services was purely for

P2P payments,. Now that mobile merchant payments are allowed it should

dramatically increase commerce as, today, there are just 600,000 point of sale

terminals in India shared amongst ten million merchants.

So, this announcement by the NPCI is like

offering Square for India, but in a country where ten million merchants and a

billion people have been unable to transact effectively before.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...