I recently hosted a meeting of financial market players to

talk about how to rebuild trust in banking.

It was an interesting evening, with most of the attendees

accepting that trust in banks was at an al-time low.

But how low is an all-time low?

Well, it’s pretty low

according to Edelman. Edelman are the

global press relations company who publish an annual trust index. The index measures the general trust in

government, media and business across 26 countries through interviews with over

31,000 people.

It’s pretty comprehensive.

And yes, according to the survey, trust in banking is at an

all-time low.

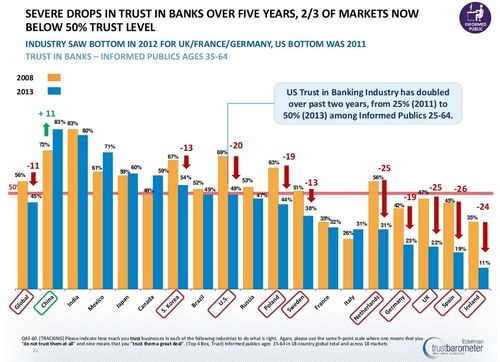

Most developed markets have placed trust in banks below 50%,

which is a sign of being untrustworthy, with the Irish, Spanish, Brits and

Dutch having the least trust and biggest drop in opinion of their banks whilst

the Chinese and Indians have the most trust.

This does not mean that Chinese and Indian banks are more trustworthy

than Irish and Spanish banks generally.

For me, it is a sign of how the media reports the banks activities combined

with the actual actions of the banks.

For example, some think that China is about to hit a financial derailment of a similar nature to the

subprime crisis, whilst bad debt threatens to bring down the Indian economy

according to the billionaire Uday Kotak,

whose family owns almost half of the

Indian bank KMB.

Nevertheless, trust in banks overall is high in India and

China and low in Western economies.

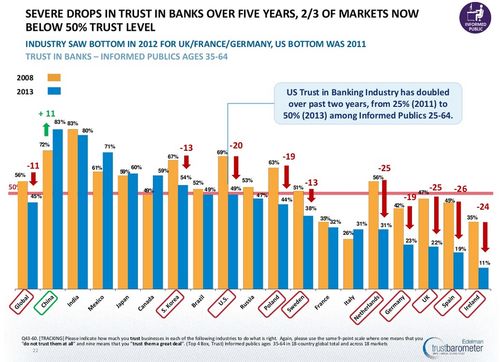

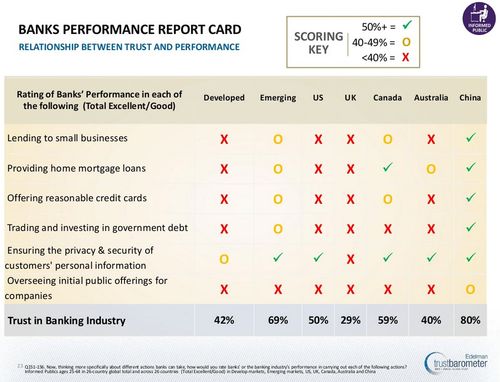

Delving down a layer below, it gets interesting as this lack

of trust is across all aspects of bank services: offering credit cards, providing

home loans, lending to small businesses, trading and investing in government debt

and launching new business.

As can also be seen, the UK has

the lowest trust of all, with British citizens not even trusting that their

bank will keep their information secure.

Interesting, as in another

survey just released, the British trust their banks far more than their

governments to protect them from financial losses.

ACI Worldwide, the payments

firm, also released a survey last week, and find that 80% of British citizens think

that government and law enforcement agencies only do an average or below

average job of fighting card or account fraud, whilst 90% say they have

confidence in their financial institution to protect them from card fraud.

So trust is a multi-coloured spectrum

of issues, with trust in banks as an industry being far less trustworthy than

trust in our own bank to look after our own financial assets.

These are two different things

and are the reason why, even with all this trashing of the banking system and

the industry’s reputation, most people have still not switched or changed their

bank.

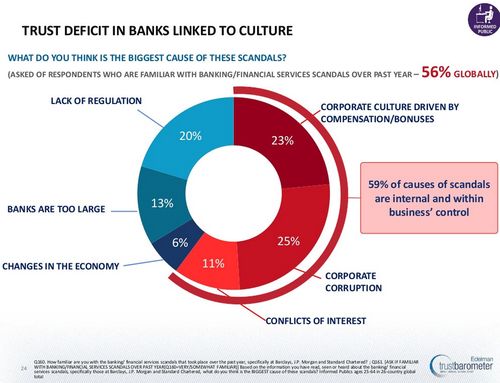

This is well illustrated when

the Edelman survey charts the reasons why banks have lost trust.

It is a case of corporate culture and corruption being rotten, rather than the systems and processes the bank operates to manage our finances.

You may or may not agree with that assessment, but here's the whole survey for those who want to read more:

Along with the opening executive summar:

Hardly a month passed in 2012 without another financial

services organization in crisis management. Whether allegations of mortgage

fraud at Deutsche Bank or money laundering at HSBC, Libor manipulation at Citi

and Barclays (to name just two, both of which lost their CEOs over it) or rogue

traders at UBS, scandals drove news coverage. In turn, among informed publics

surveyed, 56 percent of whom say that over the past year they have been aware

of banking or financial services scandals, the industry’s reputation suffered.

In fact, the Trust Barometer shows globally a dip in trust

in banks from 56 percent in 2008 to 45 percent today (figure 7). Of the 18

countries for which the Barometer has data back to 2008, over that time trust

in banks dipped in nine, eight of which are developed countries. Over the past

two years, trust in banking in the U.S. has doubled from its lowest point at 25

percent in 2011 to 50 percent

Much of the

trust people place

in the banking

and financial services industry

rests on two attributes: perceived

performance and perceived behaviour. In

both, banks have fared poorly.

Performance

Of the top six areas in which banks operate – lending to

small business, providing home mortgage loans, offering cred- it cards, trading

and investing in government debt, ensuring privacy of personal information and

overseeing IPOs – in five of them, fewer than 40 percent of informed publics in

developed countries rate them doing well, while the lone holdout, ensuring privacy of pe sonal information,

still remains below 50 percent. In emerging countries, privacy is the only area

in which trust is more than 50 percent.

Canada and China rate banks as doing well in more than one

of these six areas – two in Canada, where overall trust in banks is 59 percent,

and five in China, where trust in banks is 80 percent. In the UK, where over-

all trust in banks is 29 percent, all

six areas fall below 40 percent trust.

Behaviour

Among informed publics, the many banking scandals of 2012

have caused a significant trust deficit linked to culture, corruption and

conflicts of interest (figure 8). Specifically, among those who are familiar

with banking/financial services scandals over the past year, 25 percent of

people felt corporate corruption was the biggest cause of scandal while 23

percent blamed corporate culture driven by compensation and 11 percent blamed

conflict of interests. Cumulatively, these account for 59 percent. People also

point to lack of regulation (20 per- cent), banks being seen as too large (13

percent) and changes in the economy (6 percent).

As performance becomes a less important factor in earning

trust (see page 9), the importance of how business behaves is growing. Only one

in five respondents feel business leaders will make ethical and moral decisions

and only 18 percent expect business leaders to tell the truth. Clearly

important, these behavioural aspects represent a growing concern for people who

see these behaviours as fully within the control of business.

So the question becomes: to recapture and expand trust, do

leaders in banking and financial services have what it takes (and are they

willing to modify their behaviour) to overcome a damaged industry reputation?

Moreover, will business leaders (outside financial services) and governmental

leaders, all of whom the Barometer suggests are tarred with the same brush,

listen and learn?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...