OK, this is the final part I am going to write up about

Fixing the Banks (a session that is being repeated at the Financial Services

Club on 14th May). The final part of the discussion focused

upon the customer.

It was opened by Dominic of Unite and completed by James

Daley of the Which? Consumer organisation.

The opening salvo began with a thrust at the sales culture

of banks.

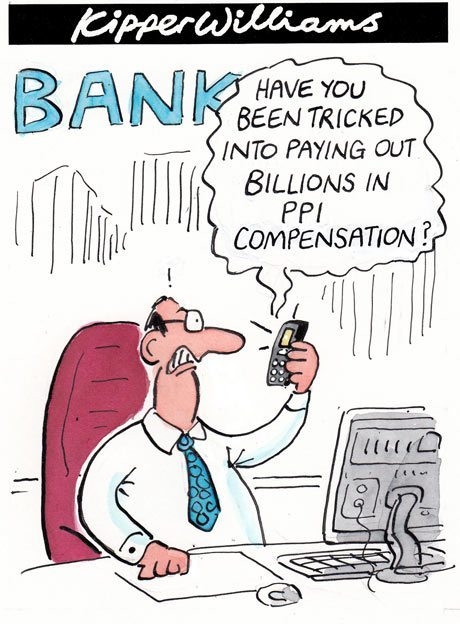

Banks moved from being trusted advisors on finance to retail

credit pushers during the last few decades and, in so doing, created a

pervasive and poisonous culture of mis-selling.

Endowment mis-selling, pensions mis-selling, payment

protection mis-selling, swaps mis-selling.

The list goes on …

… and it is endemic and invasive within the culture of the industry.

It costs the industry billions to sort out the mistakes, but

then you wonder what the sales profits were that created the billions of fines

in the first place.

And it is all down to an industry being able to sell

products to naïve customers who don’t understand what they’re buying because

they don’t understand finance.

This is as true today, even after all these scandals, as it

was yesterday, if not more so.

Go into any bank and you find whiteboards showing what was

sold by whom the last few days and weeks.

It used to be that you would get incentives and bonuses for

that but, since the Financial Services Authority review, there’s been a big change.

Now, you don’t get an incentive or bonus for selling mortgages,

credit cards and loans.

No.

According to Dominic, it’s now part of your performance

management review.

In other words, you sell these products or you get sacked,

as your basic level of job is measured on a minimum number of sales per month.

Hmmmmmmmmmmm.

So is the customer really at the heart of the bank?

No, not really. They

are there to be financially raped.

Dominic and James both believe that this culture of

measuring and managing staff and mis-selling and stealing from the customer’s

share of wallet is a core issue in the banking system today.

It is caused by three basic issues:

1)

The structure of the industry, and the fact that

there is little new or effective competition;

2)

The culture of the industry, which rewards the

wrong behaviours even today after all of the problems of the past decade; and

3)

The regulation of the industry, which has been insufficient

and poor.

What is needed is more focus upon the bank’s code of conduct

and certification of staff, and a rethinking of how staff are rewarded. By way of example, HSBC has removed all remuneration

of staff based upon bonuses for sales, apart from at Board level.

James finished off his presentation by calling for action.

The action is for Big Change in Banking, with Which? calling for three Big Changes in

Banking:

1)

Bankers should put customers first, not sales

2)

Bankers must meet professional standards and

comply with a code of conduct

3)

Bankers must be punished for mis-selling and bad

practice.

Find out more over at the Which? website.

I must admit that last bit left me feeling a bit angry.

After all, if you go into a Tesco and want to do some shopping,

should Tesco grab you at the door, ask what you are buying and, if they know it’s

a better deal at Sainsbury or Morrison’s, ask you to leave and go there

instead?

If you go into a chemist and say I’ve got a clod, should the

chemist check you out with a factfind before offering you medicines?

I know that most people compare banks with doctors, and say

they shouldn’t push you with all sorts of medicines but should first find out

what’s wrong with you.

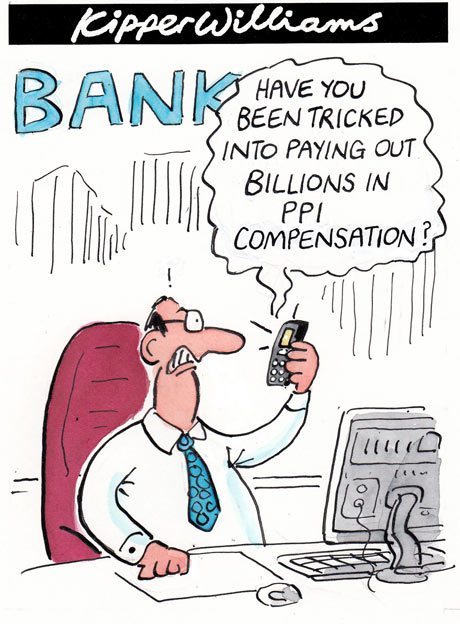

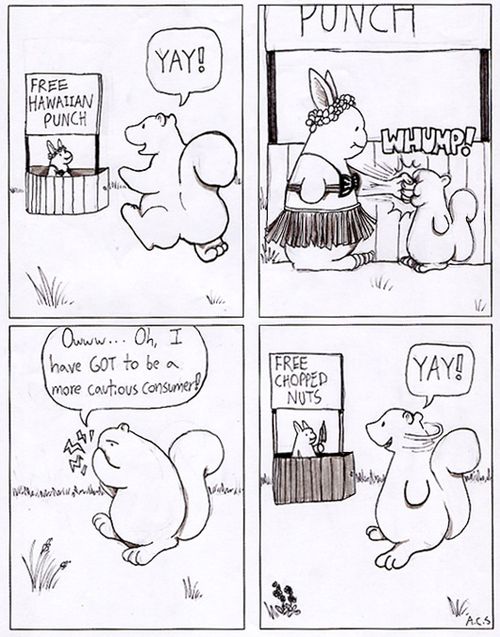

We have this view of the seller is the problem and the buyer

is just there as a gullible idiot waiting to be fleeced.

Maybe so, but banks are sales firms. They are not doctors, but chemists.

And customers are there to be fleeced, which is why it would

do them good to remember some caveat

emptor – the buyer beware.

And yes, I know there is fine line here between the company and

the customer’s interests, but far too often I think we just accept that banks

are always the bad boys when customers are just not engaging their brains when

they buy.

Now that should start an interesting debate.

Anyway, that’s it for now.

As mentioned, we have a repeat evening of this debate at the

Financial Services Club on 14th May with:

- Charles Middleton, Managing Director of Triodos Bank;

- Dominic Hook, National Officer for Finance and Legal with the Unite union; and

- James Daley, Head of Money Content with the Which? Consumer’s Association

If you would like to attend, click here.

This was part five in a five part series:

- Fixing Our Banks: Part One

- Fixing Our Banks: Part Two - the Bank View

- Fixing Our Banks: Part Three - the Shareholder's View

- Fixing Our Banks: Part Four - the Employee's View

- Fixing Our Banks: Part Five - the Customer's View

Picture sources: The Guardian, The Bunny System

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...