We

had our fifth plenary meeting of the Clearing & Settlement Working Group

(CAS-WG) in March.

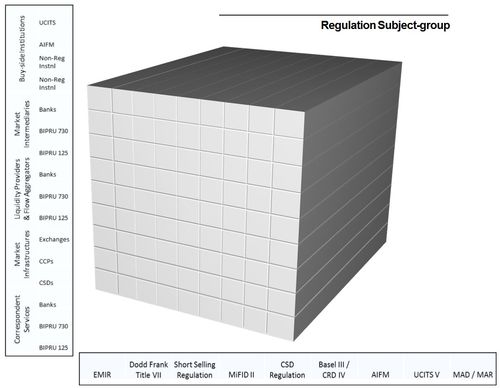

The meeting covered all the latest

issues, news and views, and was kicked off by Greg Caldwell, Chair of the

Regulations Subject Group, who outlined the complexity of European and Global

Regulations through this slide outlining the Rubik’s Cube of Regulations.

Between

EMIR (the European Markets Infrastructure Regulation), Dodd-Frank, MiFID II

(the Markets in Financial Instruments Directive), CRD IV (Capital Requirements Directive),

MAD (Markets Abuse Directive) and more, the regulatory landscape is changing

and complex.

There is an awful lot of overlap and

conflict between directives across regions.

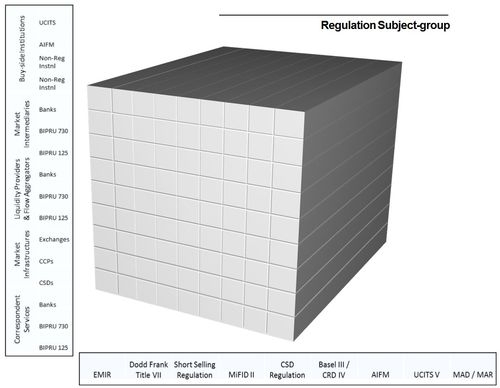

For example, just look at Dodd-Frank

versus EMIR where there are distinct differences and conflicts between

confirmations, client documentation, portfolio reconciliation and compression

requirements as demonstrated by this paper published in November 2012 by

Clifford Chance:

Greg concluded by saying that the primary

value-add of the Regulations Subject Group will be to identify opportunities

for financial institutions to avoid unnecessary costs or, as he terms it, avoid

‘digging up the road more than once’.

This is the focus of a crowdsourcing

initiative to get ideas as to where there are conflicts and overlaps

in regulations. Anyone with a view should send these views to kamila@fsclub.co.uk or greg@gregorycaldwell.com , with one entry to be picked at

random for a free membership to the Financial Services Club.

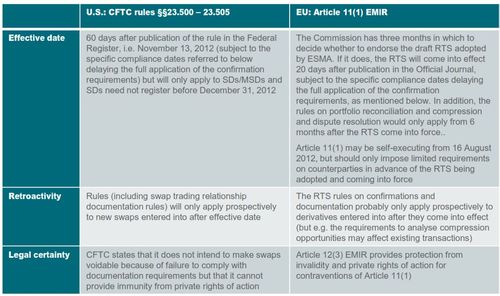

Greg was followed by a fascinating presentation

by Ben Parker, Head of Clearing & Settlement for UBS, on the likely path of

T2S (TARGET2 for Securities) and whether it’s a good or bad thing.

Ben began by talking about when he

first saw the details of T2S, and how the ECB had developed the idea of it

after the success of TARGET as a Real-Time Gross Settlement (RTGS) system for

pan-European high value payments.

T2S

was spawned back in the early 2000’s as an outcome of the Giovannini Committee,

who found that the barriers to a harmonised European trading market was due, in

large part, to the barriers to cross-border settlement due to member state

laws.

In order to overcome this, the ECB

created T2S.

Ten years later, it’s getting nearer

to launch (it’s still not there yet).

A good idea in principle but, in

practice, it has issues in terms of what this means for the unbundling of

products and services in post-trade between custodians, clearing houses and

securities depositories.

Ben then went to talk about the

elephant in the room.

Is T2S worth it?

Are there going to be any benefits?

Is the end state achievable and,

more importantly, worthwhile?

He put this in the context of UBS

who process nine million trades a year (I assume he means in Europe).

The order size of those trades has

come down but the Custodians costs have gone up. T2S should

reduce those costs as they will be able to consolidate custodial services to a smaller

number of providers.

In

fact, today, UBS are unable to outsource much of their post-trade settlement

services due to the complexity of each member states operations. Post-T2S

the hope is that this will be simplified and so settlement outsourcing to a

sleek and small number of custodial providers will become the norm. That

means that T2S will provide increased efficiencies and capabilities. It will

make settlement a commoditised process and reduce risk, with T+2 a major step

forward.

Good quality collateral is another

key challenge and there is a barrier to optimising collateral when long

positions have to held with multiple custodians in multiple venues.

T2S overcomes some of those issues by allowing the consolidation of custodians.

Ben fully expects that, over time, most of the major players will in fact

move towards a self-settlement environment.

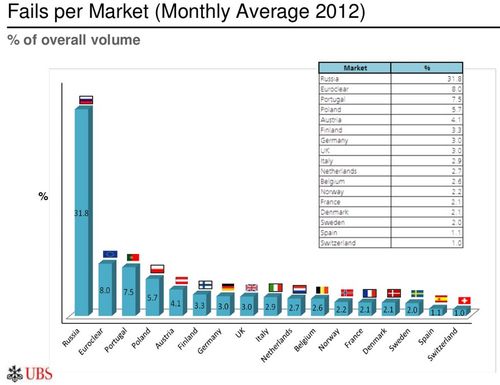

Another issue for Ben is open

trades. Open trades are a nightmare as they could mean that these are failed

trades and therefore open risks. Russia has the most failed trades for

UBS,

closely followed by Portugal.

A

third of the open trades are caused by static data. Therefore,

harmonising and standardising

post-trade settlement towards greater real-time analytics will make markets more

efficient.

Admittedly, there will be a

short-term issue of settlement costs rising for many firms but that should be

offset by the longer term reduced costs provided by the move to self-settlement

and consolidated custodial services. Although this idea of unbundling securities

from asset servicing is nothing new, the idea of getting the benefits of consolidation

and self-service is key.

Then there is the issue of

cost. Many have complained about the cost of T2S, which is estimated to

be north of €1.5 billion by some. But the banks should not have to absorb

that cost as most of this will be taken by the custodians. Sure, the

custodians will pass on that cost to the customer but, as customers consolidate

custodians, they will reduce costs over time so it is worth the cost.

The only other issue is the one of

who’s in and who’s out. After all, 40% of the trading in the UBS operations

are in the UK and the UK is not part of T2S. That is another key issue.

However, all in all, the cost and fragmentation

is not as big an issue as the opportunity to move to self-servicing and consolidation.

So there are challenges but also major benefits for UBS in the move to T2S.

Ben was followed by an update from

our other two subject groups – the Market Infrastructure Subject Group, chaired

by Kathleen Tyson-Quah, and the Technology Standards Subject Group co-chaired

by Virginie O’Shea and Graeme Austin.

Kathleen made clear that their group

is facing a funding challenge. They believe they have hit

upon a fantastic idea to map the trade flows between execution venues, CCPs, CSDs

and markets, but need funding to build the model into reality.

The straw model is already live at http://emiit.info/ and the group is now seeking

investment from interested parties to build this into a realistic system.

It was interesting to note that this

would really help the regulators as well as the providers, as Kathleen was recently

with one bank who produce 23,000 risk management reports globally every

day. The bank recently found that, of those reports, 85% are never

actually reviewed or read.

Do regulators

read the reports they receive? Probably not but, by having a tool that

can

show them trade flows across markets in real-time, they would have the tools to

concentrate the mind.

This is why Kathleen’s group are making

their next step to present the trade flow tool to the Financial Stability Board

and the Prudential Regulatory Authority, to see what appetite the regulator has

for these tools.

The final presentation was from

Virginie O’Shea on Technology Standards.

Virginie

talked about various activities in the Technology Standards Group, with the aim

of clarifying the connectivity and interconnectivity of CCPs, CSDs and ICSDs,

as well as T2S.

Equally,

with co-chair Graeme Austin, Virginie made it clear that the Group is

co-ordinating key dialogues with SWIFT, FIX, ISISTC and AFME to identify areas

of correlation and overlap, and to ensure clarity of focus upon trade and trade

confirmation areas.

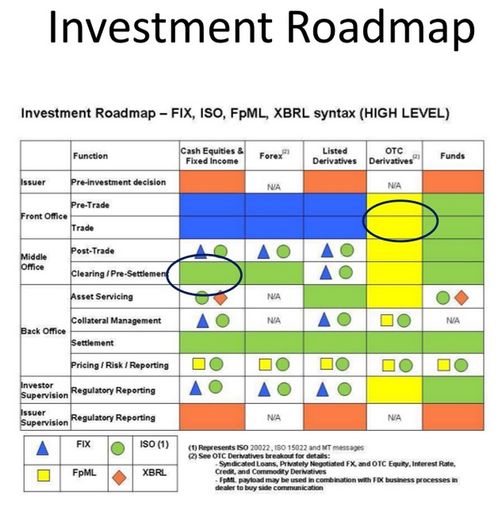

One

of the biggest areas the Group feels it can contribute and develop knowledge

around is the technology standards investment roadmap.

The

Investment Roadmap affirms the commitment of

the various standards organisations – FIX, FpML, SWIFT, XBRL, ISITC and

FISD – to ISO20022.

It

was notable from the work of the Technology Standards Group that some of the

standards bodies are more committed than others, as there is still some work to

be done to achieve ISO20022 conformance in a number of areas.

The

plenary finished with a debate between Martin Watkins of Ernst & Young, Bob

Fuller of Fixnetix and Andrew Simpson, Market Infrastructures Consultant, about

the merits of the European landscape today, in the context of EMIR and other regulations.

It was a fascinating debate and one

that I will write up separately as it merits its own space.

So, watch this space for a view on

where European regulations are going right now (not including Cyprus of

course).

In

the meantime, here are the slides from the session for those who like this sort

of stuff:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...