I was asked to join a panel discussion on social media during

a recent conference.

A social media masterclass, as it was called.

Interesting.

Sure, I’ve been blogging and tweeting and facebooking for as

long as I can remember, but does that make me a master of social media?

I don’t know, but here’s what I said so you decide.

I remember my first exposures to social media goes way back to

2006.

I had been using forms of social media before this date, but this was when I ran a future of banking course for one of the big global banks and

Facebook had just hit my radar. Suddenly, there was this opportunity to do something creative as a technology user, not just to receive and interact online.

Today we, as do many,

use Facebook and other media easily as tools to share and create content as both a business and social network but, back then, no-one used it for much at

all.

Facebook had just emerged out of university campuses and banks

could not see why it was relevant at all.

But this point about social was hammered home to me early, thanks

to presenting at a conference where the CEO of McKinsey admitted that they had

never heard of YouTube until Google spent $1.65 billion acquiring it in 2006.

In other words, major pattern and behaviour shifts were occurring

in how people consumed media and entertainment and, if McKinsey could miss such things, we all could.

Now my radar focused firmly onto the outcomes of these developments.

The next big occasion when social hit my radar was in 2007.

I was lucky enough to host Wells Fargo at the Financial Services Club and Tim Collins, SVP of Experiential Marketing

was asked by the UK banking audience why they blogged?

Tim’s answer was simple: “if you’re not part of the social

world of conversation amongst your customers, then they will talk about you

negatively and you have no voice to respond.

If you engage in the online conversation, then it becomes far more

civilised, interactive and interesting.”

There were lots of things discussed.

For example, the UK bank said they tried an internal blog

for three months but got so much negativity they shut it down.

Tim responded by saying that Wells Fargo had the same thing

from customers at first but, by having a team monitor their social media 24 by

7, they always responded to any negativity straight away with a response

explaining why it happened that way.

Customers were far more polite and calm when they saw their

rude postings garnered a civil reply; hence it led to being engaged in a

conversation. Through conversation, the

bank learned a lot more about what frustrated customers. The result is better products and services.

However, it is quite clear that the bank cannot engage in

such activity half-heartedly, as you need to be responsive and therefore have

people dedicated to social media interaction.

Like a call centre, it’s a response team to online questions

and issues.

He also said that now other customers often reply to rude

postings, and that their best service agents are their own advocates.

I hear this from many other banks now too.

Finally, Tim talked about the reasons why they first got

into social media and it was in part related to one customer who had created a

website called wellsfargosucks.com.

Unfortunately, that website came up as the first result in

any Google search.

Therefore, in order to ensure the right image of the bank

was presented, the bank sees social media as a key method of moving the right

message to the top of the search results rather than leaving it to negativity

from media or anti-bank activists.

Three years after these events, we saw the Arab Spring,

Molly Katchpole publicly shame Bank of America,

Wikileaks and Anonymous compromising everything from the US Department of Defence

to their Head of Cybersecurity.

These are all momentous changes in society, communication

and how we relate to each other, how we consume, how we are entertained and how

we lobby governments, regulators and media.

The Occupy movement would not exist without social media,

and this movement is now a key influence on the Bank system, as regulators like

the Bank of England pick up and use their influences to shape their regulations.

We also see many new financial service operations using social media leverage from capital markets (etoro, stocktwits, etc) to

corporate banking (funding circle, kickstarter, Market Invoice, Platform Black,

the Receivables Exchange, etc)} to retail banking (zopa, moven, simple, Bitcoin,

etc).

This is an unstoppable movement and it is shocking that most

banks and bankers do not even use Facebook and Twitter (which are just

platforms,

not social media itself).

I carried on to talk about various examples of best

practices, including AMEX and CBA, USAA and First Direct, but you need to come

to my presentations to find out more about these.

Regardless, the point being made is that any organisation that

ignores the fabric of society – bear in mind over a billion people use Facebook

,and it’s already old (youngsters are already moving to alternatives like Vine)

– is missing a trick.

In fact, more importantly, they would be missing the point:

the world is changing and we need to too.

What amazed me in 2006, and still does today, is that most banks miss the point as to why these deveopments are important because they are firewalled out.

The workers spend all day working and do not see why social media is relevant because they cannot use it at work and are too tired to spend time at home on a social network when there are other things to do, like being a dad, mum, husband or wife.

I am sure many banks are changing their policies towards

social media and no longer firewalling everyone out … but there are still far

too many that are not and these are the ones that are starting to smell a

little bit of nostalgic old worlds.

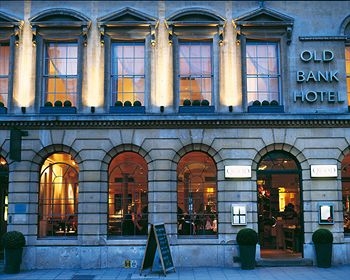

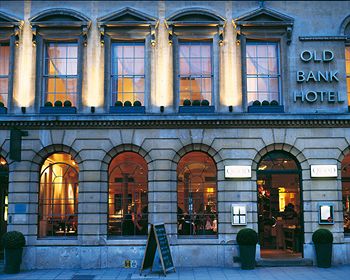

Traditional, heritage, Grade II listed banking.

The Old Bank Hotel, Oxford - what usually happens to a Grade II Listed Bank

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...