We hosted Errol Damelin, Chief Executive and Founder of

Wonga as our keynote guest at the London Financial Services Club last week, to

end our season of meetings for the 2012-2013 season (2013-2014 season about to

be announced).

Errol is someone I met when Wonga first started its journey towards

becoming a core big brand in Britain.

Back then, he talked to me a lot about their investment in

data and technology and this is still the core fo what makes them different to

the pack of firms out there today.

I would write more about his interview with me, but thought

I would edit Robert Peston’s blog of last week where he discusses the virtues of Wonga and pretty much covers all

the salient points:

In many ways

Wonga is an impressive, even admirable business.

It is funded exclusively with equity capital, with £100 million

genuinely at risk of being lost if things go wrong.

So, unlike a bank, it has no depositors or creditors who can

pull their money out in a panic and bankrupt it.

If all lenders

were financed in this way, we wouldn’t have had the banking crisis of 2007-2008.

Also its technology, unlike our banks, is world class.

Wonga has written algorithms that determine whether you

deserve to be given a loan in seconds, from looking at details about you and

your behaviour, such as what email service provider you use and whether you

have bothered to look at the company’s terms and conditions.

The proof of the robustness of this automated credit

assessment is that it rejects 60% of

applicants, and has a default rate of just 7.5% on its wholly unsecured

personal loans, which seems remarkably low since Wonga is by definition

lending to those who have exhausted their ability to get money from

conventional sources.

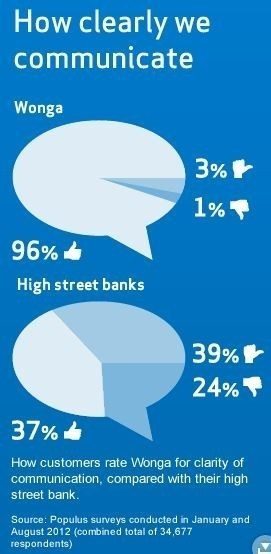

Nor is it possible to say that what it charges is hard to

understand.

The interest rate is 1% a day, with a £5.50 transmission

charge, for loans of up to £1,000. Its’ typical loan is £200 for 15 days.

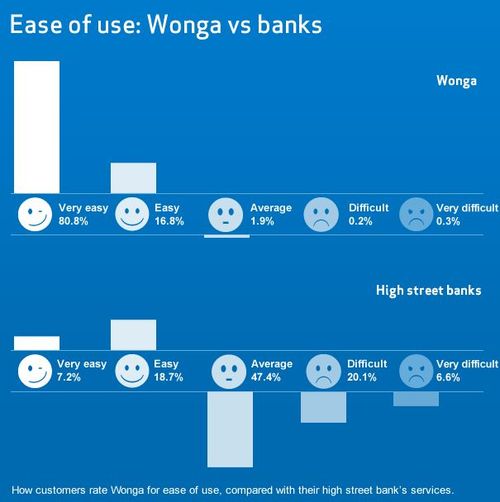

And if you go to its home page or mobile app, it is

staggeringly easy to see within seconds how much it will cost you to borrow

what you want for the time period that suits you.

If only bank

charges were so transparent.

Interestingly, the idea of interest rate caps is also a misnoma.

For example, if I said to you “lend me £20”, and you said “OK, but if I do that then will you buy me a pint next week when you pay me back?”, does that sound reasonable?

Of course it does but, if the pint costs £3 then you paid me almost 1,000% APR on that loan.

This is because, as Wonga makes clear, you are taking a short-term or emergency loan, not an annual or longer loan.

So it's not the interest rates that are the problem but the process, and any criticism of Wonga would not be that it is a risky,

or poorly managed business.

Arguably, given the way it is now expanding overseas and into

small business loans, it is impressively entrepreneurial.

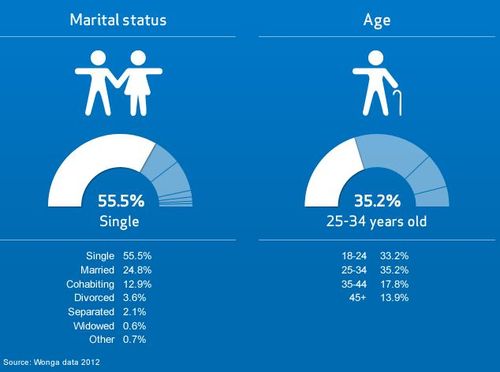

The case against

Wonga would be that there is something wrong with an economy that creates such

huge demand for its very expensive money.

Its’ simple 1% per day interest rate equates to an annual

percentage rate of interest a touch shy of 6000%. This is very, very, good

business for Wonga and its venture capital backers, and a manifestation of the

powerlessness of those who borrow from it.

If you hate Wonga, you are probably railing against a world

in which millions of people find themselves desperate for money in the course

of a year, and have nowhere to turn but a business charging an eye-wateringly

high rate of interest.

Now there are so-called payday lenders (Wonga, by the way,

insists it is a short-term lender, not a classic payday lenders) which are more

rapacious and less transparent than Wonga.

And maybe the investigation into their practices by the

Competition Commission, which has been announced today, will rein them in to an

extent.

But if you hope that investigation, or indeed regulation and

supervision by the newly created Financial Conduct Authority, will somehow

eliminate the market for Wonga, or indeed destroy it as a business, well you

may be guilty of an admirable but unrealistic naiveté.

I think that pretty much coves what Errol said in our

meeting, but I will add a bit more as they have a fascinating stats and facts

document on the Wonga website. Here are few key ones.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...