I just got a copy of the Payments Council’s UK Payments

Markets 2013 Report, and it makes fascinating reading about a developed economy’s

changing payments habits.

Here are the headlines:

- Consumer

card use will rise by 75% from nearly 10 billion payments in 2012 to

nearly 17 billion in 2022, driven primarily by increased debit card use

and acceptance.

- The

number of cash payments will fall from 21 billion in 2012 to around 14

billion in 2022, as people increasingly use alternatives such as cards and

automated payments.

- Consumer

cheque transactions are projected to continue to decline – from 477

million cheques in 2012 to around 186 million in 2022.

- Direct

Debit use by consumers will grow by 20% to around 3.7 billion payments in

2022 – driven by increased uptake of new regular commitments and a growth

in the size of the adult population.

- Mobile

payments and internet banking will help drive up consumer use of one-off

payments from their accounts from 356 million payments in 2012 to around

1.5 billion in 2022.

- Population

growth and economic growth will mean consumer payments are worth over £2

trillion in 2022, up from £1.3 trillion in 2013.

In 2012:

- The value of CHAPS payments grew more than 12%

to £71,717 billion and total payment values, excluding CHAPS, were £6,500

billion.

- 44 million adults used cash machines and more

than three-quarters of them did so at least once a month.

- 32.5 million people use remote banking and 10

million mobile banking.

- Cheque volumes have reduced by 80% since their

peak in 1990.

- Cash accounted for 59% of the total volume and 20%

of the total value of consumer payments.

- Debit card payment volumes grew almost 5% to 7.7

billion.

- Underlying growth in Faster Payments Service

volumes was more than 20% and volumes of one-off payments exceeded 400 million

for the first time.

Based upon these stats, the Payments Council forecast that:

- The volume of one-off payments through the

Faster Payments Service will exceed cheque volumes for the first time in 2014.

- The volume of non-cash payments will exceed that

of cash payments in 2015.

- Debit card payment volumes will exceed 10

billion in 2017.

- Cash machine withdrawals will account for 90% of

the volume of cash acquired from personal accounts in 2018.

- Direct Debit volumes will exceed four billion in

2020.

- Excluding CHAPS, total payment values will be

almost £10,000 billion in 2022.

The report is sprinkled with lots of other interesting stats

and facts and yes, you guessed it, my favourite are those that talk about mobile

internet banking.

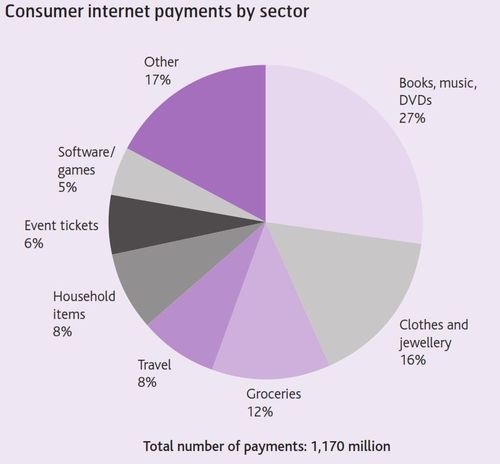

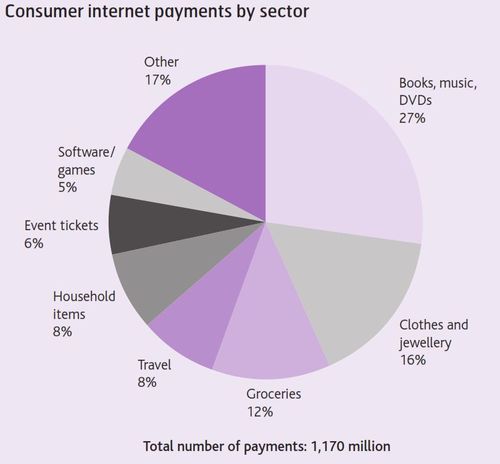

For example, what do we buy on the internet? Mainly stuff from the likes of Amazon (hence

the reason why HMV, Blockbuster, Jessops, Comet et al all went bust!):

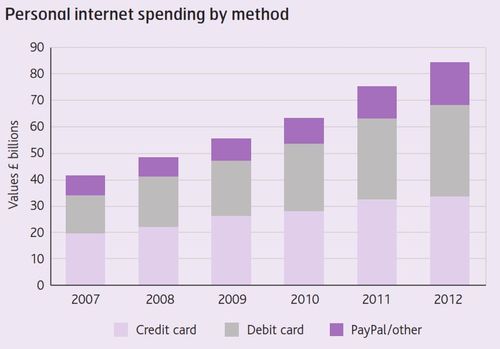

And we pay for this stuff with cards, although PayPal’s chunk of the online payments market seems to be growing:

Having said that, I’m disappointed with the forecasts that

the Payments Council makes for these services.

As mentioned in the main headlines, mobile payments and

internet banking will help drive up consumer payments from 356 million in 2012

to 1.5 billion in 2022. That’s a

four-fold increase and that’s low-balling it if you ask me.

For example, if small businesses get Square or PayPal style

services, then cheque and cash will decline far more rapidly. Add in the internet of things where everyone’s

watches, key rings, jewellery and cars will be making mobile payments and that figure of 1.5 billion looks more like 3

billion to me.

But then I am biased.

The report itself is available for £1,500 from the Payments

Council.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...