I spent some of the recent holiday in Florence, visiting many of the amazing Renaissance buildings, whilst reading a great historical novel about the rise and fall of the Medici bankers in the 15th century.

The book is called Medici Money written by Tim Parks, and traces the fame and fortune of five generations of Medici from the original founder of the bank Giovanni di Bicci de Medici (1360-1429) to his great-great-grandson Piero (1472-1503) who ruined the bank when he fled Florence in fear of the French, who invaded in 1494.

The banks rise was based upon dealing with the challenge of usury. Making interest on loans was considered a mortal sin by the Church, and would result in a sentence to burn in hell should the perpetrator be caught in such acts.

As a result, people found ways around it.

For example, the Medici fortune was made by using foreign exchange trade and arbitrage.

The way it worked is that the Medici’s would collect money, or tax if you prefer to think of it that way, being paid to the Holy Roman Empire under the new Catholic regime of Rome. Bear in mind, this is the century that recognised the powers of the Pope, and citizens across Europe paid weekly tithes to purge their sins. If they did not, they would go to hell.

This flow of monies from London, Paris, Madrid and more to Rome needed organisation, and the Medici bank emerged as the leading organisation to manage this monetary flow. The bank was registered in 1397 by Giovanni di Bicci, born a poor man and becoming one of the richest in Europe by the time of his death in 1429.

This is because he ascended into a position of innovation in finance that could be leveraged, so long as the banker walked the fine line between being a usurer and an enabler of monetary flows.

By the time Giovanni registered the bank, at the end of the 14th century, many of the key products of finance had been invented by the Italian banks, giving them a virtual monopoly on European finance. It was during this time that the system of paying tithes to Rome came into force, and so the Italians used double-entry bookkeeping, bills of exchange, letters of credit and deposit accounts to manage it all.

These were all invented before Giovanni’s bank took over and, to put in context, the Medici bank appeared just a few decades after a terrible plague wiped out two-thirds of the population of Florence including Giovanni’s father – the population was reduced from 95,000 in 1338 to just 40,000 in 1427 – and left the way clear for a new force in town.

As the Medici bank began operations, Giovanni rapidly realised that (a) money could be made through exchange rate arbitrage and (b) money could be made by using cash for trade.

Remember that this was a time that Religion and Commerce were working both together and at opposites. On the one hand, the Church needed the bankers to collect their donations. On the other, the Church condemned any act of usury and would send the sinners to hell.

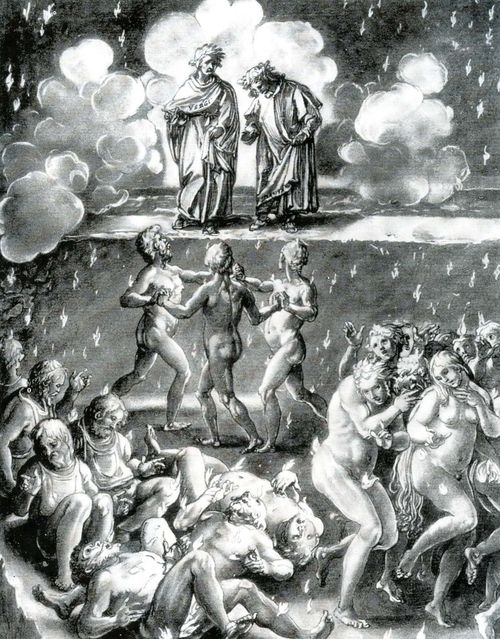

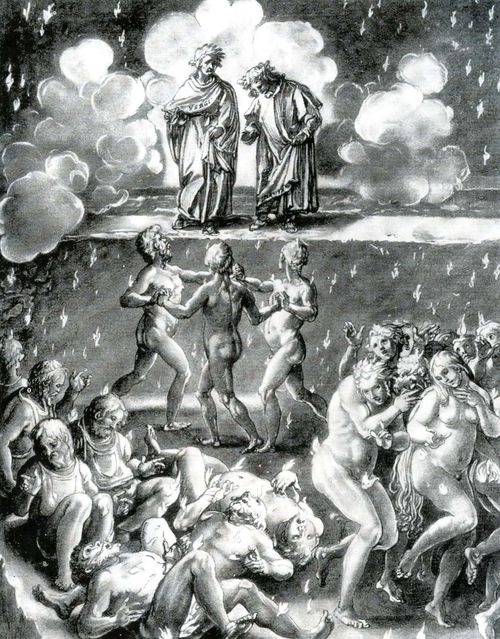

Just look at Dante’s Inferno if you want to see how usury was considered at the time.

In Dante’s Hell, usurers share a ditch with the sodomites and blasphemers at the seventh circle. They sit perfectly still, as they did at their accounting tables, with only their hand moving rapidly as though counting coins or writing bills that have no currency beyond the grave. Their faces are disfigured with grief bursting form their eyes that are ruined by their registers.

Source: Illustrating Dante's Sodomites

As can be seen, this sin warranted eternal damnation at the time.

So how did Giovanni get around it?

By collusion with the Church, as usury is all a matter of interpretation.

There are some priests who are fundamentalist and denounce this as a sin that warrants eternal damnation; then there are other priests who study the law carefully to find loopholes in it that allows some leeway for commercial operation.

It is the latter that Giovanni di Bicci hooked up with, and the Medici bank flourished through two methods of commerce: foreign exchange and discretionary deposits.

The bank took the tithes, or donations if you prefer, from London, Paris and Madrid and brought them to Rome. In doing so, the bank would often make some speculative investments in the hope of making a profit. So the bank would take £100 in London and buy wool. The wool would be taken to Italy and traded into local currency. The difference in exchange would often result in a minimal 20 percent profit, and so the bank made money.

By way of example, in Parks’ book, of 67 exchanges recorded in the bank’s offices, only one resulted in a loss while the remaining 66 made gains between 7.7% and 28.8%

Equally, discretionary deposits allowed the bank to grow its book of business. A discretionary deposit is a deposit where the name of the deposit holder is kept secret, and the holder’s return on the money he deposits is at the discretion of the bank. There is no contract and any return on the deposit is a gift.

The deposits often came from Churchmen as it was illegal to transfer the Church’s wealth, including any salaries paid, into the private sector. As a result, many senior religious leaders used the Medici’s to manage their assets. For example, Cardinal Hermann Dwerg, a close friend of Pope Martin V, is said to have lived in a “a spirit of evangelical poverty”, while keeping 4,000 florins in a discretionary deposit account with the Medici’s – 35 florins would have paid a year’s rent on a small townhouse with a garden at the time – and accepting their annual gifts.

In fact, most of the power that the Medici’s gained was given to them by the Church, although this was also not clear-cut.

At the time, there was still serious upheaval and change in the Holy Roman Empire, with eleven different Popes during the fifteenth century and sometimes more than one Pope in office at the same time.

This meant that backing the right Pope was key.

For example, when Giovanni di Bicci became banker to the Pope, there were three Popes vying for control over the Vatican. The Medici bank backed Pope Giovanni XXIII but he lost the vote of the Holy Counsel and ended up being imprisoned.

After his release, he was staying with Cosimo de Medici, Giovanni di Bicci’s son, when he died, which actually became a key moment in cementing the Medici's as bankers to the clergy.

More tomorrow …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...