Talking about job losses in the City reminded me of a comment a colleague made: "if we had delivered on all the headcount savings our bank has been promised from technology change, we would not have any staff in this bank anymore".

Interesting and, during our conversation, I followed up with: "we never get the savings because we just add more layers of technology into the bank's operation, rather than replacing anything".

This is a double-edged issue: technology should save money but it doesn't, or at least it doesn't in banking.

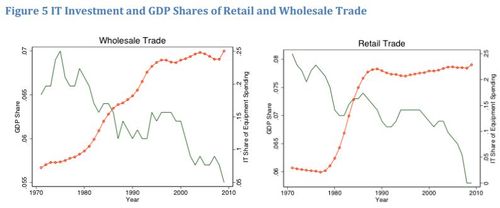

It does in other industries.

In retail, manufacturing and more we have seen massive savings from technology, so what’s amiss with banking?

Well, it's not just down to the addition of services without the removal of legacy, but also related to how banks are managed and structured.

Andy Haldane hit upon this issue when he spoke at the Financial Services Club two years ago.

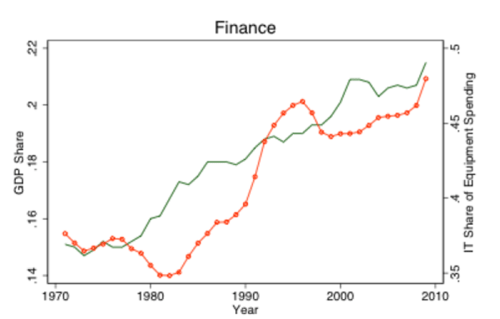

Andy showed research from American academic, Thomas Philippon of New York University, which shows that the markets are inefficient and that the unit costs for finance have risen over the past century.

![]()

That’s strange considering all these investments in IT should be bringing costs down, as it demonstrably has in retail and manufacturing.

But I also don't think it's as simple as banks taking profits into the bonus pool and therefore being unable to show the savings.

It's more to do with the complexity of operations, the structure of service and the remuneration and rewards.

Banks now have to support physical direct and digital remote contact across human interactions (branch and call centre) as well as those that are self-service (ATM, internet and mobile).

That's layers of cost.

And as for the headcount savings, building upon last week's blog, here's just a few insights.

In Europe, from the European Banking Federation Report 2009:

"Banks in the EU-27 employ 3.1 million people"

Four years later, in 2013:

"Banks in the EU-27 employ 2.5 million people"

600,000 people have been laid off, mainly in branches (much more on this story here).

"As a result of bank closures, some 5500 branches were closed (in 2012). The countries concerned are mainly Germany, Spain and Italy, where 1600, 2000 and 1000 branches closed, respectively. In tune with that, the number of staff employed in the banking sector fell by over 51,000 or 1.7%, not least on the account of Spain (over 11.7 thousand), Italy (over 6,800), France (5,400), Germany (4,700), Poland (4,300) and Romania (4,000)."

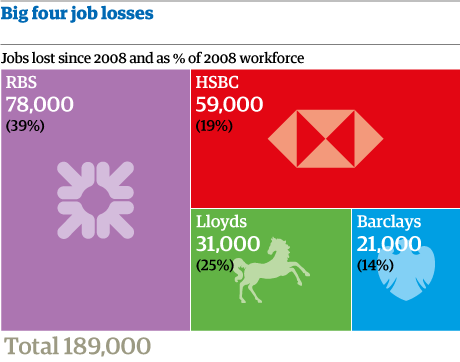

The main four UK bank figures are particularly stark with 189,000 jobs cut worldwide in the last five years.

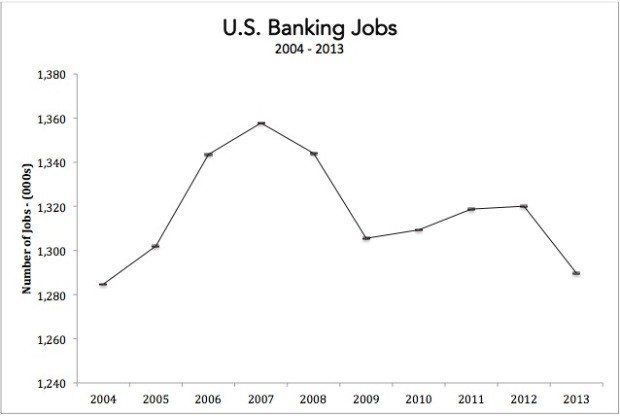

And the USA doesn't fare much better.

Source: Sagacity and the Bureau of Labor Statistics: Commercial Banking Employment

You still want a job in banking?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...