Social media? Give it to marketing

I just attended the EFMA Marketing Summit in Barcelona, and used my usual slide that talks about social: “you need to be social, because that’s where the customer is”. I have said that a lot for the past 18 months or so, and the point I make is that social media is NOT a marketing thing. It is a customer thing.

Most banks get this wrong. They think social is a gimmick and that it’s just for outreach to show that you exist and customers should like your page or follow your tweets.

Rubbish.

Social is where the relationship is.

In these days where all banks are seeing the relationship move to devices, the relationship is through the device in the social network.

It’s a fundamental cultural difference between banks that get digital and those that don’t. For example, the banks I talk about the most – mBank, Fidor, ICICI, Deniz, Akbank, UBank, USAA, Wells Fargo and a few more (only a few) – really understand customer engagement through digital platforms (note: I do not say channels and social media is not a channel – another debate).

These banks invest dedicated time and teams to customer outreach through the social network and believe that (a) it is a marketing investment but, more importantly, (b) it is a service investment. These banks are investing in customer engagement by joining the conversation and being part of the conversation. They want to immerse themselves in the network and be a part of it.

The bank that illustrates this better than most is Fidor in Germany, who lower their loan rates and increase their savings rates based upon Facebook Likes. They know that being liked doesn’t cut the mustard, but being liked does get you 338 new friends (the average Facebook user has 338 friends according to Pew Research). Once you’ve got 338 new friends, you can start talking with them – not to them – and get into a dialogue that makes you more and more relevant and, by doing so, more and more trusted.

They know that being liked doesn’t cut the mustard, but being liked does get you 338 new friends (the average Facebook user has 338 friends according to Pew Research). Once you’ve got 338 new friends, you can start talking with them – not to them – and get into a dialogue that makes you more and more relevant and, by doing so, more and more trusted.

It is why Fidor’s average cost to onboard a customer is $20, compared with $1,500 for the average US bank. The $1,500 is the cost to push products through channels at customers that don’t trust you. $20 is the cost to gain relationships through conversations with communities that do trust you.

It is very different thinking, and is why I say that social media is not a marketing thing, but a cultural thing. Does your bank CEO use Facebook? Does he or she even know what it is? And even if they are using it, can they envisage how it could be used to reignite the trust in the bank?

ICICI Bank has a dedicated staff conversing in Facebook for Facebook-based Customer Service. The staff are there 24*7 for anyone to chat with and, more importantly, to reach out to those who need to talk (the whingers, the worriers, the wassocks), and it works. ICICI Bank turned around a massive net negative view of the bank to a polar opposite net positive view within just 15 months of immersing themselves in Facebook-based Customer Service.

So I was disappointed that, just before I was ramming this point home once again, EFMA summarised their latest research findings to discover that banks:

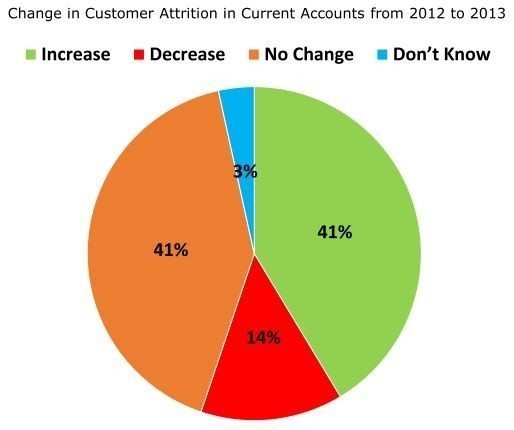

(a) worry about customer attrition as one of their top priorities …

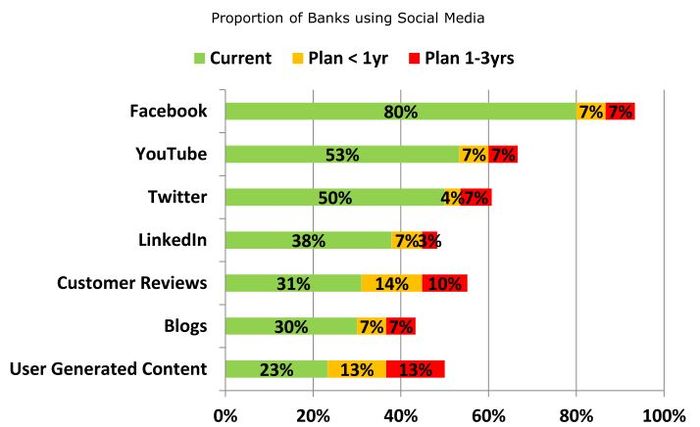

… (b) are starting to use social media as a platform for dialogue, particularly Facebook (oh, why won’t they blog???) …

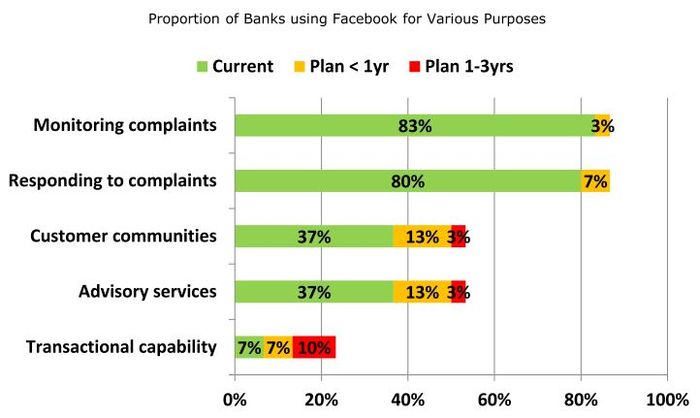

… but (c) are mainly using social media for monitoring pissed-off customer complaints …

Something’s gotta change.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...