I tweeted yesterday that bank branches are still important as, for many, digital only is too nerve wracking when it comes to money. I knew it would get some pushback, and it did, but here’s the logic and how this started.

We’ve just seen JPMorgan hold their investor day, where they announced three things that grabbed the digital fintech headlines from the announcement (forget the financials).

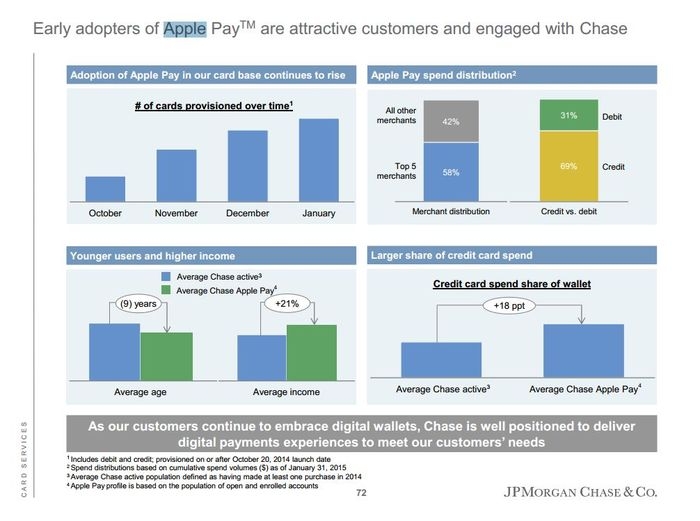

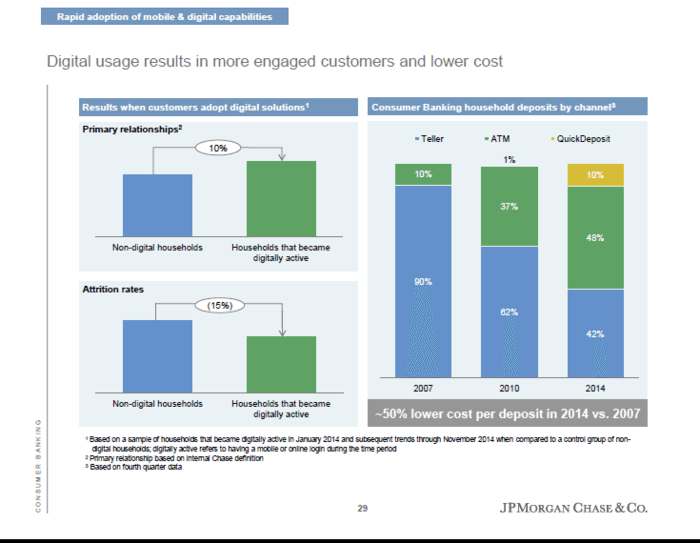

First, Apple Pay has been activated by over a million cardholders since its launch in the US in October:

- Card activation is on a steady increase since October, with 1 million cards activated since Apple Pay’s launch;

- 69 percent of the cards registered to Apple Pay are credit cards;

- 58 percent of the activity is concentrated in the top 5 merchants (Chase does not list the merchants); and

- The users, not surprisingly, are younger and more affluent- which, tracks, of course, to the profile of the iOS user more generally.

The second thing announced is a closure of branches as customers move to digital:

J.P. Morgan Chase & Co. plans to cut roughly 300 branches by the end of 2016 … J.P. Morgan’s anticipated branch cuts amount to roughly 5% of its overall footprint. It’s a shift from 2012 and 2013 when the bank added 106 and 28 net branches respectively. In 2014, J.P. Morgan cut 28 banks from its footprint. Between 2013 and 2014, the bank cut roughly 6,500 or 11% of its branch employees.

This led some to immediately say: “oh, digital replaces physical and all bank branches will disappear soon”. Wrong.

The third thing noted came from Javelin’s analysis of the investor call:

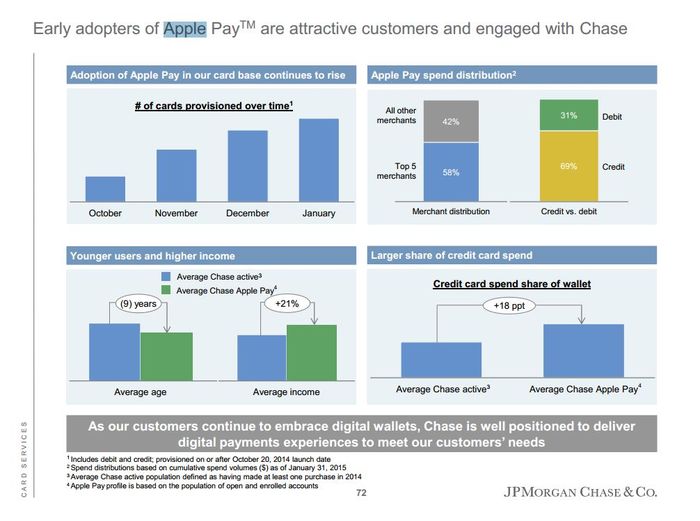

Many of the headlines in the wake of J.P. Morgan’s investor day fixate on the news that the banking giant plans to close hundreds of bank branches. On the face of it, that is factual. But this is akin to focusing on layoffs without accounting for hiring in other parts of a company that can drive future growth and employment. The reality is Chase’s news is an example of getting leaner, not lopping … to be sure, Chase does forecast reducing its 5,602 branches, but only by about 300 over the next two years … citing year-over-year numbers, Chase reported hefty increases in mobile app users (20%), mobile QuickDeposit transactions (25%), mobile QuickPay transactions (80%), mobile bill payments (30%), and ATM deposits (10%). And here’s an important milestone for Chase’s branches and ATMs: 2014 marked the first year its customers made more deposits through digital channels than at teller windows (ATMs 48%, mobile deposit 10%, and tellers 42%) … Chase concludes that digital usage leads to more engaged, more satisfied consumers who are less likely to switch banks. They do more transactions, and they conduct them in cost-effective, self-service digital channels. And when they do head to a branch, there will still be plenty of them – with an increasing focus on face-to-face interactions that matter both to the customer and Chase’s bottom line.

This led to a thought in my head that linked this to TSB’s announcement that they had achieved significant numbers of account switchers. TSB is a near 700-strong branch based UK bank spun out of Lloyds under European competition rules that forced the IPO of the new/old bank. They made it clear that they’re getting good customer acquisition – half a million new accounts in 2014 – but that this is because they have the right mix of customer access, particularly including branch.

In the release of their first year results, they also released this report: Why branches matter in a digital age.

In the introduction, former CEO of digital bank Virgin Money (before they bought Northern Rock’s branches) Paul Pester, makes clear why branches matter:

Some argue that because technology and innovation is revolutionising the way in which customers interact with their bank and money that’s the only way to compete, and that emerging digital-only providers – be they from the banking industry or elsewhere – will make branches redundant. The steady flow of bank branch closures by the major established banks over recent years has given that theory an air of credibility.

TSB thinks differently.

TSB believes the future of banking lies in branches and technology – enabling customers to bank where they want, how they want and when they want. Yes, customers are adopting mobile and digital banking at a pace we’ve never seen before. But the importance of having a branch in a convenient location is as important as ever for consumers.

The report also points to research that substantiates this point:

Although online banking is growing, branches remain important to customers. New data from ComRes shows that 69% of people believe that it is important to have bank branch close to where they live.

Branches also remain TSB’s most used service channel with 72% of customers who use any channel using a branch in the past three months and, 36% solely using branches to access their accounts. This is reflected in research from professional services firm Deloitte, which has found that nearly three quarters (72%) of consumers will still usually go to their high-street or shopping centre branch to access financial services.

Analysis by the consultancy firm Accenture, moreover, even suggests that branch usage is growing, with a sharp rise recorded since 2012. Their research has also shown that more than half of bank customers (52%) now use their branch at least once a month.

Metro Bank makes the same point. In my recent interview with Craig Donaldson, CEO, he makes clear why branches matter:

People such as Brett King are saying that the cost overhead of [branches] are too high and adds unnecessary cost to the customer. Equally customers don’t want stores, especially millennial customers who don’t feel they need to see any one face to face and get advice.

I think it is important that the customer is given the choice as to how they wish to interact with the bank, they are the customer! But there are times when people really do want face to face service no matter what … if you look at our account openings, 77% of our customers had their accounts opened in fifteen minutes, from first key stroke to last key stroke, in the first half of last year. That is a full account opening with Know Your Customer and delivery of a personalised card and cheque book. That is fifteen minutes from the first keystroke to the last keystroke. No other bank can do that.

In fact, most banks claim that account openings are most influenced by having access to a local branch. That may change but, today, that is still the case.

Finally, there are some other factors in play. For example, Atom Bank – the UK’s first digital-only bank – make clear that the customers who are most satisfied are those who don’t come into branches … but they are also the most financially confident and competent. If you are confident with money, you want to control it yourself. You don’t want someone talking to you about it and, in this case, the most satisfied customers are those who you never see.

However, most first account openings will be with people who are not confident with money. They are young, have never had a mortgage or deposit account, are probably getting their first salary cheques paid and, in many cases, struggle with debt. For these young market account targets, as well as those nervous with money, the branch plays a critical role.

That’s borne out by research from many banks, Atom Bank included, and these are not the targets for digital only banks. In other words, the targets are people who are account switchers, over 30 and confident with money. For the rest, they want serious banking in serious bank stores.

Some will argue this case, but I always remember Deutsche Bank opening a funky branch in Berlin and telling me that they built it with millennials and seniors in mind. They had two rooms in the branch: one designed for millennials and one designed for seniors. The millennials room was all white plastic (like the iPod at the time) and looked very cool and futuristic. The seniors room was called the Senator Room, and had red leather chairs and oak wood panels. It was a serious room.

When the new bank branch opened, the youth all rushed into the Senator Room to have serious discussions about serious matters; whilst the seniors all went to the iPod Room to recapture their youth and feel funky.

Fact of the matter is that we can opine for everything digital, but there is still a strong role for physical and always will be.

Postscript: for a different view of the world, checkout Brett King's blog about the FDIC Report Brick-and-Mortar Banking Remains Prevalent in an Increasingly Virtual World

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...