A lot of folks are asking me whether I’m really saying that banks need to start all over again? Is that really feasible, Chris? How can you recommend that we tear down the house and rebuild it?

Well, there’s a lot of reasons I can say this, and believe it.

First, we started building systems in the 1960s based on automating transactions in the back office on a mainframe. The transactions were the debit and credit accounting ledgers, and the information derived from branch-based operations.

In the 1970s, we implemented 3270 green screens in branches to feed those mainframes with data for the transaction ledgers. This was a cost-cutting, administrative and efficiency play. It worked.

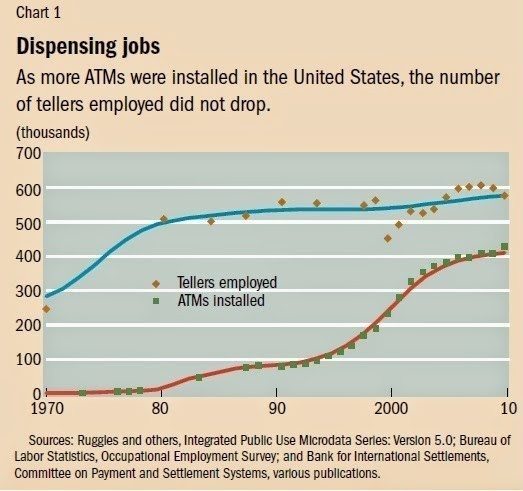

In the 1980s, we introduced ATMs to the network. The ATM was designed to get rid of tellers (it didn’t btw ...

... and have become the main electronic outreach point for most banks in a physical sense.

In the 1990s, the next major electronic movement was to remote customer support through the telephone call centre. Already, by this time, banks had multiple legacy systems created through M&A, expansion of offers and disparate IT strategies. Most banks had multiple head office systems on multiple providers platforms, because they built their deposit account administration on IBM, for example, but then introduced insurance, mortgages, cards and other product lines from other specialists from Unisys to Fujitsu to Amdahl. This is why most call centre customer service representatives were already struggling by 1999, having to use multiple windows on their desktop screens to answer a simple customer call, as they had to access multiple systems across multiple platforms to get a comprehensive customer view.

The result was that the central head office based focus was securely cemented in play by 2000, thanks to the previous quarter-century developments of systems, and much of this focus was upon transaction processing for internal branch and call centre support.

Then things changed. Things changed fundamentally. The focus of support moved from internal to external.

It was at this point, we started talking about multichannel support, as we had to make what was previously only visible internally, external. We had to give customers online banking, and so we had to rethink the internal machine. Most banks didn’t. They just took the internal machine, and stuck a front-end internet bank access to it through a username and password. That is why most banks’ internet banking looks just like a bank statement, because that’s just what it is. An online access to the bank statement.

We got away with offering an online access to a bank statement for a decade, but then the smartphone appeared with apps and real-time, and the emperor’s clothes became visible. Most banks tried to move their head office focused internal systems from big screens onto small screens, and it just didn’t work. It didn’t work because it’s not real-time, it’s batch. It didn’t work because it’s focused upon internal cost cutting, not customer experience. It didn’t work because it supported staffers, not users. It didn’t work for so many reasons, that almost every bank started looking at what to do and the answer was: buy something so it looks better.

So the banks went out and bought Meniga, partnered with Moven, invested in IND, procured Yodlee and so on and so forth. That is all that investment in the customer experience in the front office that was highlighted in my blog last week.

The trouble is the back end is still that half a century year old layer of mess that needs sorting out. In fact, banks are cemented in legacy mess, which is why they talk about channels. We only talk about channels because each was a layer on our entry point, and our entry point was that transaction systems for debit and credit recording in the head office mainframe dating back to the 1960s.

Branch was layered on the mainframe; ATM another layer; call centre the next one; internet banking the last one; and mobile the latest. Each layer, we call a channel and now we talk about omnichannel integration.

What complete tripe.

There is no such thing as channel, as I’ve said so often. The reason there is no such thing as channel is that a channel is just a layer on a legacy. It is legacy upon legacy. So when I hear banks talking about omnichannel or digital channel, I know that they are just adding legacy to legacy. And it will not work. It will not work because the legacy is based upon a physical infrastructure view or, as I present this, a structure built in the last century for the physical distribution of paper in a localised network. We now need to rebuild this for the digital distribution of data in a globalised network and the problem is that you cannot rebuild this from the front-end. You have to start rebuilding this from the core.

In other words, we have to look at that half-century old structure we’ve built for head office transaction recording and rethink it for 21st century structure of augmented non-stop real-time access.

We have to do this for both the user and their user experience, but also to ensure we can monitor in real-time. Real-time monitoring will give us knowledge of opportunities (cross-sell, increase share of wallet, loyalty offers, etc.) and threats (cyberattack, unusual activity, accessibility issues, etc.).

This is why I keep blogging about digital core, because I truly believe that no bank can evolve their legacy systems to support a 24*7 real-time world. Those systems just weren’t built that way. That is why, when I hear the use of the word channel, I feel revulsion. I feel revulsion because it immediately says that you are thinking in an analogue, 20th century view. You are in the mind-set of adding whatever it is you are adding as an extra layer on your legacy. It will never work and is my first alarm for the failure of any digital project in a bank.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...