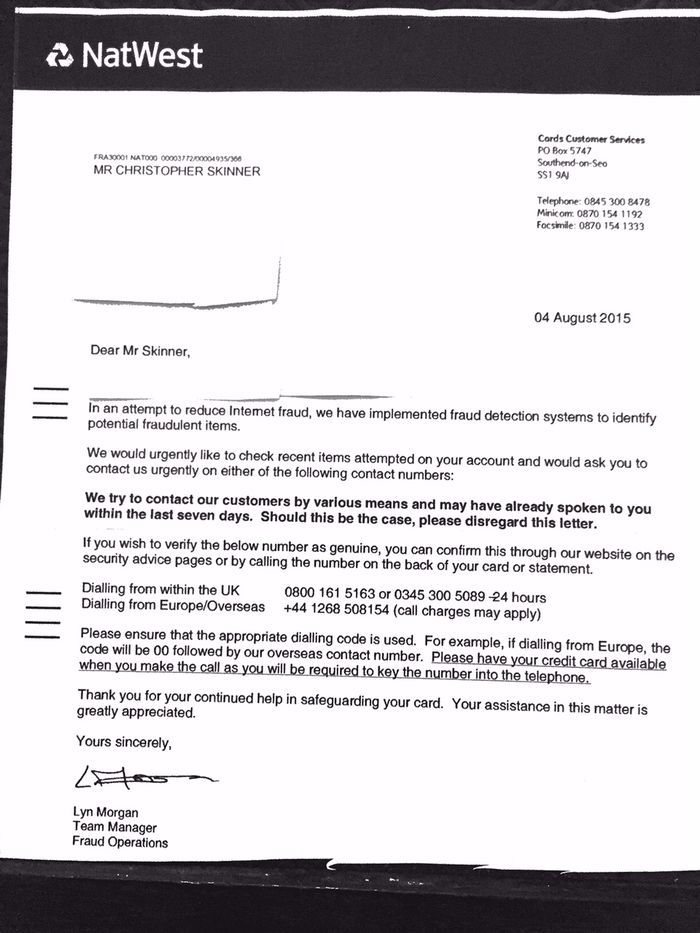

I just got a letter from my bank (NatWest).

The fraud team wanted to ask me some questions. I wondered why they had sent a letter, which takes a week to arrive, when they urgently needed to talk with me?

Anyway, as you can see, they want me to call them about my account and so I called.

To begin with, I was irritated as they give two numbers and then have a long message saying if you didn’t call the 0800 number you should, as it’s cheaper than calling the 0345 number … unless you’re using a mobile telephone, in which case you should call the 0345 number and not the 0800 number.

You get the idea.

Then they ask me to enter my card number (why do I have to do that when I’m using my mobile and you could auto recognise it’s me?), which I duly enter.

I then get a voice – a voice, not a human, but someone reading a script who might as well be a robot – who says that she can’t talk to me until I answer some security questions.

I’m used to it, so fire away.

“Please confirm your full name”, she say.

“Chris Skinner”, I reply.

“No, your full name please”, she insists.

“OK, it’s Christopher Bertrand Chesapeake Skinner, if you insist”.

“Not according to our records it’s not, sir”, she declares.

“OK, it’s Christopher Michael Skinner”. There? Satisfied?

She is.

“Can you tell me where your bank branch is?” she then asks.

“It’s over there”, I say.

“I can’t see where you’re pointing sir, we’re on the telephone. Can you name it’s location?” She persists.

“OK, it’s in Eastcheap, London”, I reply.

“Very good, thank you. Can you tell me the expiry date on the card please?” She continues.

“Yes, it’s July 2016”, I’m being a good boy now.

“And can you tell me how you usually pay for the balance on the card sir?” She’s starting to irritate now.

“Yes, by direct debit monthly”, I grit my teeth.

“And can you tell me two transactions on your account in the last week please?” She’s a voice that does not go off script.

“Look, you‘ve sent me a letter implying my card is being used fraudulently, and now you’re giving me the Spanish Inquisition*!!! I don’t’ remember using my card, so just talk to me about this fraudulent transaction you have written to ME asking ME to call YOU to talk about,” I burst.

“I can’t talk to you until you finish answering our security questions”, the voice replies.

“Well, this is ridiculous”, I answer.

“Can you tell me a transaction in the last week”, she presses onwards.

“OK, I used it to buy train tickets”, I answer.

“Where, when and for how much”, the robot continues.

“About £25 at St Pancras station this morning”.

“OK. Thank you. And can you name another?” the machine demands.

“No”, I say.

“I cannot talk to you until you do”, says the machine.

“Well, YOU wrote to ME asking ME to call YOU to talk about a transaction that YOU think is fraudulent. Do I really have to take a Mensa test in memory retention before you’ll talk to me?” I fume.

“Yes”, says the machine.

“ALRIGHT. I used it to buy cinema tickets on Sunday.” I yell.

“That’s an online transaction sir, and is not acceptable”, says the robot. “You must remember a Chip & PIN transaction for me to be able to talk to you”.

“Gnnnnnnnnninnnnnnggggg….” I gnarl my teeth and squeeze the phone tight. “OK. I paid for a meal at Loch Fyne on Sunday”, I suddenly remember.

“And for how much”, the robot pervades.

“About £55”, I spit.

“Thank you sir. You have now successfully answered our security questions and the transaction we wanted to ask you about was for £190 to the Adelphi Theatre on 4th August. Was that you”, the machine asks.

“Yes it was you computer says no useless piece of telephone voice mail”, I scream.

“Oh, and that was the transaction we rejected so you may want to try again then”, says the robot.

At this point, I jump out of the window and land in a heap, as I’d forgotten we were on the thirty-third floor of the Shard. I’ll write more next week once discharged from hospital.

P.S. this blog was updated from Chris Skinner’s brainwaves whilst lying on the operating table at St Thomas’s Hospital, London

P.P.S. * no-one expects the Spanish Inquisition!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...