This blog was first published on SAP for Banking, 26th August 2015 and is Part Two or a two-part series. Part One was published on 12th August.

Will Alipay and Wechat get Amazon and Google into banking?

No-one can ignore the developments taking place in China’s banking system, as their two largest internet players launched banks this year. In Part One of this two-part series, we looked at the developments in China of simple payment systems through messaging apps like QQ and WeChat along with launch of internet only banks WeBank and MYBank from Tencent and Alibaba. What does this mean for the global banking system, and will we see Google, Amazon and Facebook following similar paths?

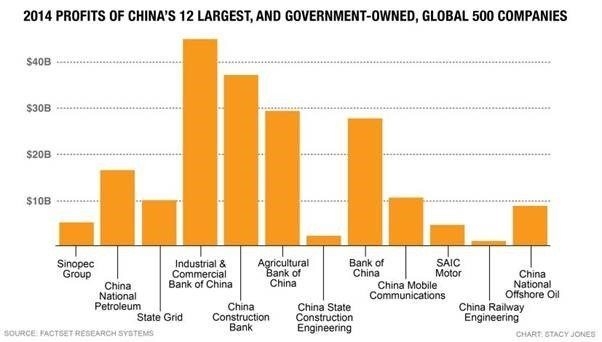

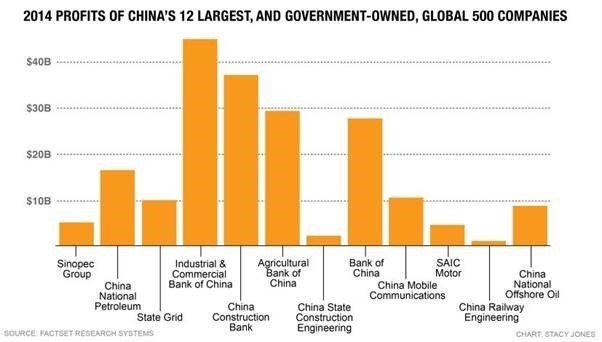

The answer is that we will see some emulation of the experiences in China in Europe and America, but it will be very different. Firstly, China’s story is of a newer economy building itself into a powerhouse, but most of China’s large companies are state-owned. Of China’s 12 largest companies, all of them are state-owned including the largest banks ICBI, the Bank of China, the Agricultural Bank of China and China Construction Bank.

This is very different to European and American banking structures, even with the 2008 banking bailouts, and means that China’s regulators are highly restrictive of what internet banks can do. For example, they’ve ensured that the Chinese banks do not compete in the same space as the state-owned banks by banning branch operations and limiting their operations to credit markets only. However, there are some interesting nuances underlying what has happened in China that our internet giants will learn from, particularly Facebook.

For example, although WeChat was only launched four years ago, it already has over 550 million monthly active users (MAUs). That’s almost three times the MAUs of Japan’s Line, and ten times the MAUs of Korea’s Kakao. In fact, it’s only 150 million MAUs short of Facebook Messenger, the largest messaging system out there. This is where the comparison appears as to what is likely to develop over the next year or two, because the cornerstone of WeChat is payments.

Using the WeChat Wallet, WeChat users can order food deliveries, buy film tickets, play casual games, check in for a flight, send money to friends, access fitness tracker data, get banking statements, pay the water bill, ID music and search for a book at the local library, all via a single, integrated app. It’s very similar to a vision I had some time ago that the ideal app would allow me to order taxis, coffee, music and accommodation without having to enter my bank details in Uber, Starbucks, iTunes and Airbnb’s apps as separate services. That’s what WeChat’s Wallet achieves, and enables the user to easily order services in any app that sits on the WeChat platform. It’s more elegant than AliPay, as that service is geared towards Alibaba’s commerce platforms. In fact, Alibaba have failed to compete with WeChat as their messaging service, Laiwang, failed and has been shut down.

Now the beauty of the WeChat Wallet is that it’s the Trojan Horse to quickly get a user’s payment credentials registered, and then use that payments capability to unlock a range of new monetization opportunities for the entire ecosystem. This is noted by Connie Chan when she blogged about WeChat on the Andreessen Horowitz site recently. In the blog, Connie points to how Facebook Messenger could copy the lead of the WeChat Wallet in Europe and America, and notes that it is no coincidence that the man who runs Facebook Messenger is the former CEO of PayPal, David Marcus:

“To get a sense of this in the U.S.: Just imagine how many more transactions would occur on Facebook’s platform if more users linked their credit cards to Messenger, how much faster Pinterest’s buy-it button would take off, how much faster Snapchat users would move from sending cash to buying goods, and how many more Twitter users would pursue options to buy products. In this sense, WeChat gives us a window into the potential evolution of Western social networks and buying behaviors if they, too, succeed in convincing users to embrace payments on their platforms.”

What Ms. Chan has picked up upon is the clearly evolving model of not just Facebook Messenger but also Apple Pay, Twitter and others. The battle is for the Wallet, and the way to win the Wallet war is to create a single, elegantly integrated app that has a payments wallet at its core. If you become the standard core wallet, then you rule the mobile, social world. That’s what China’s WeChat has achieved, and it will be intriguing to see what happens as Facebook, Twitter and other mobile social systems deploy their ‘buy it now’ buttons.

Just watch China if you want to see what will happen.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...