On Tuesday the Competition and Markets Authority (CMA), a UK Government Agency, told British banks that they must digitalise or suffer penalties. In a report entitled Making banks work harder for you, they have ordered the UK banks to digitalise within two years or face regulatory fines.

The key headlines include, under what the CMA calls its “Open Banking programme”, that banks must share their customer data with third-party app providers. This is embodied in the PSD2 European Directive, even though we are leaving Europe, but it’s the first move I’ve seen that is saying this must happen under domestic regulatory review.

In terms of APIs and opening data to third parties, customers have to give their consent before this happens and the aim is that it will enable consumers to see which bank is cheapest, given their particular pattern of borrowing.

The second headline is that all banks will be required to introduce a Maximum Monthly Charge (MMC) to limit the costs of an unarranged overdraft. The MMC will include debit interest - typically charged at up to 20% a year - and unpaid item fees. At the moment most banks cap overdraft fees, but then add on interest payments. The CMA said this would make different bank accounts easier to compare, and cut through the complexities of overdraft charges.

Third, the CMA has ordered new measures to encourage more people to switch their accounts to other providers. Although easier account switching was introduced in 2013, it has not reslted in any big change. Only 3% of personal customers move their accounts each year and recent figures show the number of people switching actually going down. As a result, there will be:

- a new regulator to oversee the Current Account Switching Service (CASS).

- a longer period during which transactions will be redirected from the old account to the new - currently set at three years.

- a “long-term” promotional campaign to encourage more switching.

The news was greeted with some jeers from consumer groups that it hasn’t gone far enough. Alex Neill, director of policy and campaigns at UK consumer group Which?, said: “It is disappointing that the monthly charge cap is not actually a cap and banks will be allowed to continue to charge exorbitant fees for so-called unauthorised overdrafts, rather than protect those customers that have been identified as among the most vulnerable.”

Andrew Tyrie MP, chairman of the Treasury Select Committee, said: “The CMA is relying on the rolling out of new technology to do the heavy lifting on competition. But many customers will not have the tools or skills to do this. Customers are also - understandably - wary of the data-sharing required for this to be effective.”

Diane Coyle , Professor of Economics at the University of Manchester, told the BBC: “There's a lot of reliance being placed on more information, but consumers will need to give all of their transaction information to third-part providers, and there's the trust question ... do you really want another party to be able to see all the transactions that you make in your bank account and be able to tell other potential competitors about that?”

The British Bankers’ Association defended the industry and how it operates however, with their CEO Anthony Browne stating that:

“Banks compete to attract and retain customers every day. They are also focused on giving their customers the best outcome for the services they provide. The CMA’s final recommendations will further help consumers with a package of measures which give individuals and businesses greater power to pick the products that are best for their needs.

“Customers and businesses have already found digital banking hugely convenient and have taken advantage of mobile technology that is allowing us to bank round the clock. We are pleased the CMA has reflected that in its recommendations. However, we recognise more work needs to be done to create a level playing field by supporting new banks wanting to set up business, as well as helping to grow established banks.”

Hmmm … more needs to be done. Perhaps the most intriguing analysis of the CMA’s report came from Financial Services Club member John Gilbert, and he has allowed me to share his research note here. Enjoy …

Open Banking the new order: High street banks to become robo-advisers as Application Programme Interface set to create shadowy banking world?

The Competition and Markets Authority (CMA) package of measures in its Retail Banking final report makes worrying reading to all who fear the ever-rising tide of big-data entities, increasingly driven by artificial intelligence.

This is a report that the spooks will love given its focus on technology re-defining current account banking with the aim of getting consumers to consent to all their financial information being up for grabs after 2018 to facilitate greater competition.

Application Programme Interface (API) will become a new term of banking endearment for the authorities, providing vast amounts of personal financial data as it transforms retail banking. The CMA states: “This is the same technology that tells a Uber driver who and where you are, or which lets you sign in to other / online accounts using Facebook”

There is no mention of who will provide and implement the API but it would seem very likely to be the US tech giants with the information stored offshore in the cloud. It would seem not so much Open Banking but Shadowy Banking.

Indeed the path the CMA has driven down would seem to upend and reverse a lot of the work of the FCA (and previously the FSA). The report states: “Open banking will mean reliable, personalised financial advice, precisely tailored to your particular circumstances…but to get tailored advice banks need to know how you use your current account”

Using ‘personalised financial advice’ in the context of retail financial services comes with regulation. Banks certainly will be required to work harder for their customers .Does the CMA suggest that retail banks should become more holistic in what they offer; both as main financial services provider (MFSP) and main financial services adviser (MFSA)? Currently this is very unlikely.

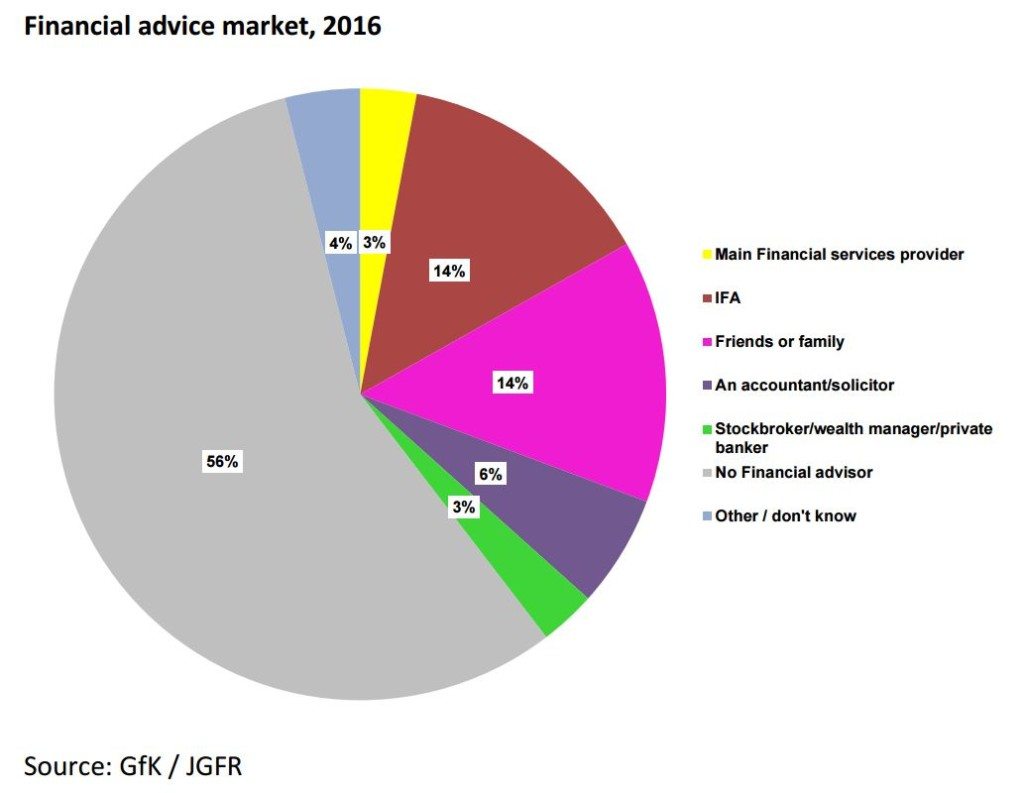

Only 3% of adults regarded their MFSP (aka their main bank) as their main financial services adviser, down from 9% in 2014. The majority of people (56%) do not have a financial services adviser as such highlighting the advice gap. One beneficiary of the move to using the banks for personalised financial advice may be the IFAs who could have a role in current account selection. Another may be a link-up between banks and robo-adviser providers. Research by GfK for JGFR in March found 12% of consumers liking the idea of having an online robo-adviser.

With no mention of bank relationship staff or branches, which provide many customers with a key reason for loyalty / retention, retail banking is being driven down the commoditised price-driven ‘fintech’ route in the interests of competition. Is this what consumers really want? JGFR/GfK research in March found 72% wanted their main bank to be a high street bank with branches.

While mobile apps are transforming engagement in financial services, community banking is still very much in vogue, with many high street banks helping in their local communities. No mention was made of this CSR role in the CMA report. Overall around 9 out of 10 adults have a designated main financial services provider (MFSP), a similar proportion of which are the top 10 banking brands.

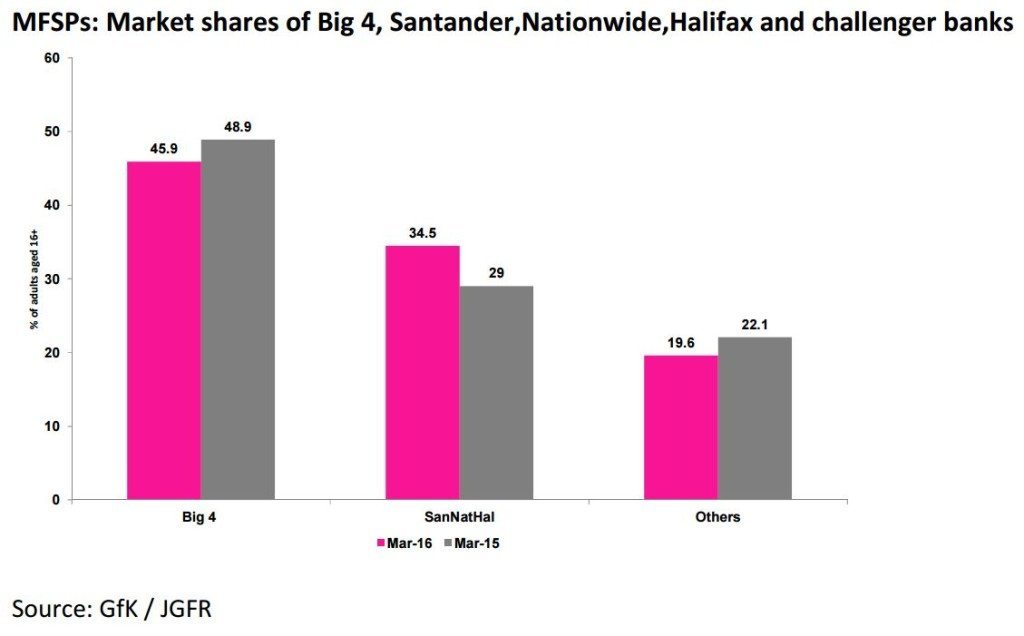

The Q2 JGFR Banking Barometer highlighted the resurgence of the former and current building societies (Santander (ex-Abbey), Halifax and Nationwide) whose share of the main financial services provider market grew from 29% to 34.5 % between March 2015 and 2016, with reductions in the share of the Big 4 bank brands (Barclays, Lloyds Bank, NatWest and HSBC) and among challenger bank brands.

A large branch network will help to generate vital retail bank deposits, something that is very tough for new stand-alone challenger brands to generate consistently. Omni-channel is more the future.

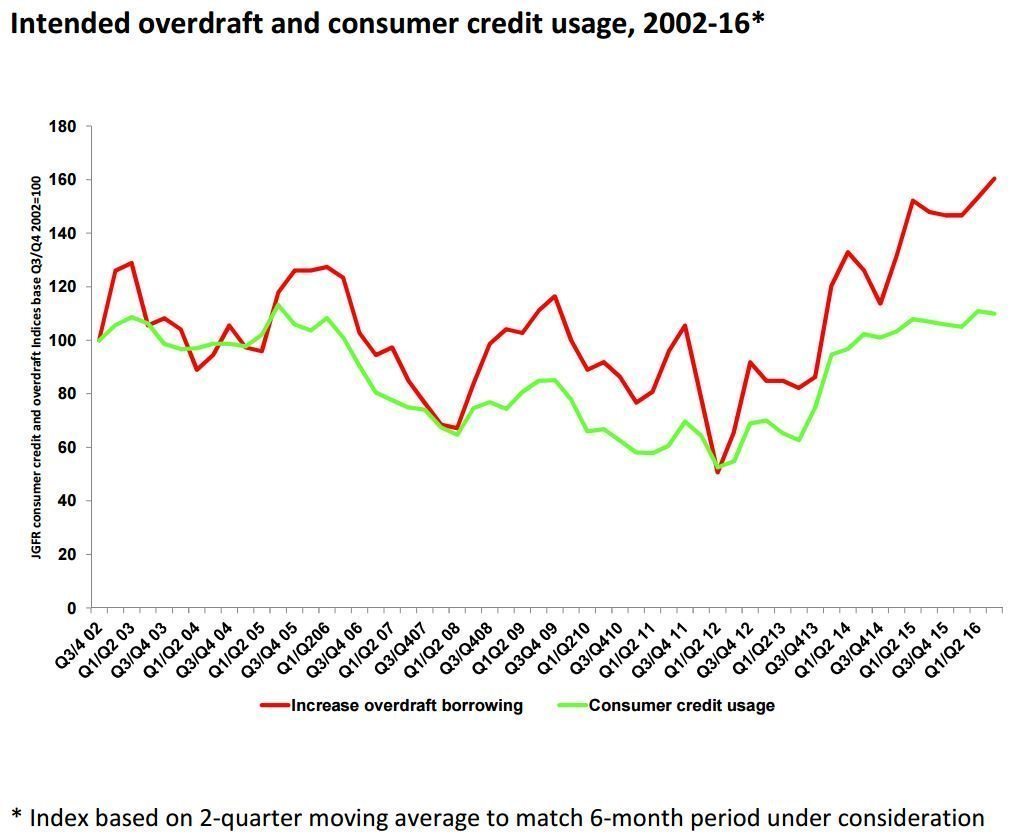

Much focus in the CMA report was on overdrafts and the penal charging structures on unauthorised overdrafts. A number of measures designed to reduce the charges faced by consumers, increase transparency on charges, and to help customers move banks to those more overdraft-friendly are proposed. No mention was made of debt education to highlight to consumers the dangers of compound interest on unauthorised borrowings or of switching to a personal loan.

The JGFR / GfK Financial Activity Barometer (FAB) monitors intended savings, investment, borrowing and debt repayment activities in the next 6 months.

Overdrafts are one of the featured borrowing products, intended to be used by around 4-5% of adults on average over the 14 years of the survey. More recently overdraft usage has increased to a record level that does back up the CMA findings of needing greater transparency, alerts and maximum monthly charges.

People borrowing by overdraft are the least confident of all intending borrowers and more likely to be in need of financial advice. With an economic downturn forecast this may be essential.

Among the measures to be implemented is much greater insight into relative performance of the high street banks that will be undertaken to provide customers with trustworthy information about service quality. Net promoter scores and similar satisfaction measures will be much watched.

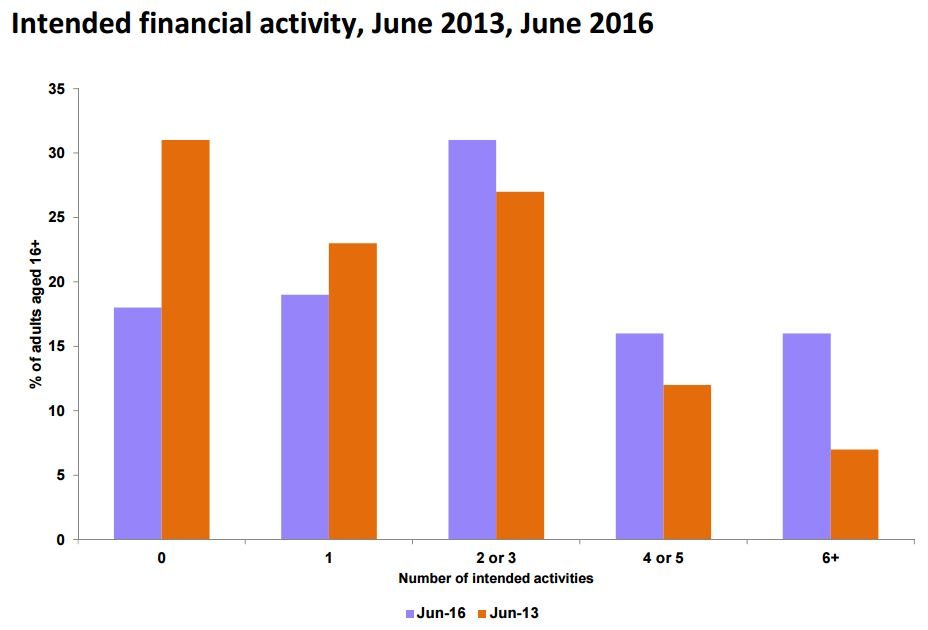

At the heart of Open Banking is transactional data, from which banks will be able to identify the active and profitable clients they seek, who may well pay for enhanced services with profiling to the fore. Evidence from the FAB shows that financial engagement (defined as undertaking one activity) and financial activity (2 or more activities) has risen sharply in the past 3 years.

The surge in financial activity may be the result of much improved household finances but also greater take up of online financial services. It provides much better prospects for financial services businesses with main financial services providers particularly well placed. Much will depend on the profile and activity of their customer bases. Of the major bank brands HSBC has consistently had among the most active customer bases.

But who will be overseeing this transformation and what are the costs / benefits?

The CMA report appears to signify a major shift in the responsibility and control of UK retail banking given the central role the CMA is taking, with the FCA seemingly given the task of providing research to support the measures. There are other bodies with roles to play including HM Treasury and the Bank of England. Turf wars over retail financial services seem inevitable.

Greater clarity on where responsibility lies for UK retail banking and also the costs to the public of the three examinations of UK retail banking in recent years would be welcomed. Bank customers, like energy customers, do not appear convinced of the costs/benefits of switching, despite the considerable efforts of competition authorities.

A visit by the CMA to the Treasury Select Committee would be a good starting point to hear more about the proposed financial services landscape.

Note: JGFR provides regular data sourced from GfK on the mood and financial activity of consumers with a database stretching back over many years. Contact j.gilbert@jgfr.co.uk

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...