My presentations change every day, but I got a great new slide to illustrate the burning platform that banks sit upon. This is the one I was blogging about yesterday, and the one area I blog about incessantly (so much so that I bore myself). But there is a burning platform in all banks, and it’s called the legacy system. That’s another area I’ve blogged about incessantly, but that is the burning platform and here’s how I know and how it plays out.

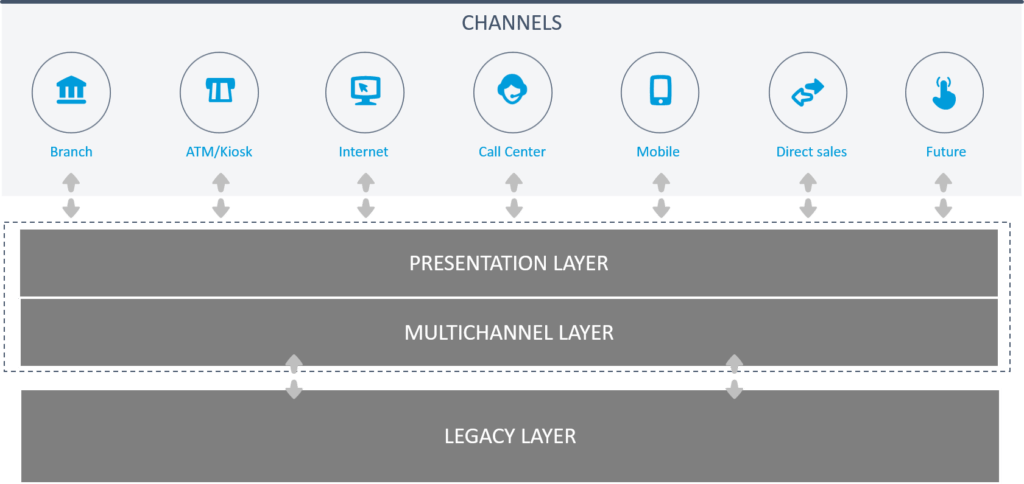

In my presentations, I have this slide …

… which I tell the audience I used in my NCR days in 1997 to sell the concept of The Multichannel Integrator. Back then, the emergence of internet banking was an issue, so we offered The Multichannel Integrator to overcome the issue. The issue was that banks offering internet banking services were worried about exposing their legacy core systems to the customer, so The Multichannel Integrator was a great way to hide the problem.

In other words, twenty years ago we knew that the systems we implemented twenty years before were a problem. Twenty years later, it's a much bigger problem. Twenty years later, we are still offering those presentation layers to stick lipstick on that legacy pig.

That’s how I know it’s a burning platform as, for every year that passes, the embers that were ignited by internet banking have been getting more fuel on the fire. Mobile banking; digital reach; new open platforms; blockchain, cloud and APIs; machine learning, apps and analytics; and more. All of these open, internet-based technologies have been attacking that proprietary internal legacy, and the longer it goes on, the hotter the problem is getting.

Now, give it another five to ten years, and a bank will be uncompetitive technologically in an open marketplace where all their competition and the start-ups that are taking the friction out of banking, will be offering agile, microservices innovations whilst the legacy bank system will be holding the bank back.

I liken it to a slow death through inertia. Twenty years of embers burning have turned into small flames today to a burning platform in the next five years to a burnt out bank within ten.

Of course, this is avoidable if the bank starts to change today but, bearing in mind a data rationalisation and core systems upgrade program takes about five years to complete, it's getting hotter and hotter every day.

This really came home to hit me the other day when walking along the beach in Bali (ed: yes, this conference life is tough folks). As I enjoyed the morning’s sunshine, I stumbled across this poor critter.

Now I’m guessing that this fish was doing pretty well. It was swimming along, eating well, avoiding predators and thinking life is good. It does this every day and has grown pretty fat and big, chewing off the fat of the coral shores. Just that each day, it’s been swimming closer and closer to shore and just didn’t realise it. Then, one day when a particularly strong tide is coming in, the poor sucker gets washed onto shore. It now knows there’s a problem, but what to do? So it wriggles to the left, wriggles to the right, and does this for a while … to no avail. It’s too late. The poor thing has been washed up and has no way to get back to life. It’s a dead fish.

Like a dead fish washed onto the shores, an incumbent bank will go the same way if it doesn’t open up and join the marketplace wave. This has been a requirement for twenty years, since the internet banking age arrived, but is now a burning platform as the opening of finance through FinTech has arrived. A bank that tries to swim against that tide is going to get washed up or burnt out, depending upon whether it’s a burning platform or a beached fish. Either way, the ending isn’t very nice, so c’mon, get on the wave, surf the open platforms, join the fireproofed marketplaces and get with the plan.

There is a bright future for those out there willing to engage; there’s also going to be a lot of dead fish for those who do not.

Postnote:

The other often used metaphor is of the boiling frog. The premise is that if a frog is put suddenly into boiling water, it will jump out, but if it is put in cold water slowly brought to a boil, it will not feel danger and will be cooked to death. The story is often used as a metaphor for the inability or unwillingness of people to react to or be aware of threats that rise gradually.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...