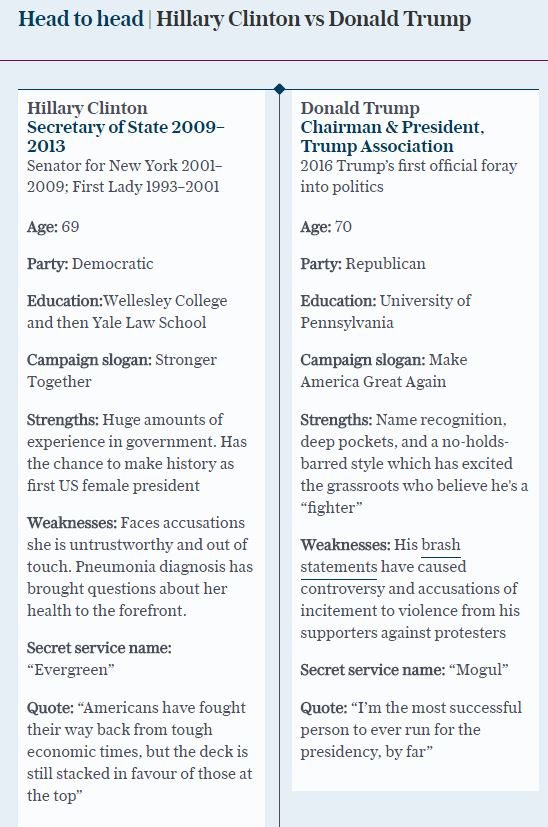

Today is the US election and what a terrible choice they have. You would think out of 320 million people to choose from, that they could have come up with a better two than these two. Anyway, I’m not American and it’s not my position to comment on these things, but I did pick up on several articles discussing what’s at stake, and they all seem particularly worried about Donald Trump winning.

- US election 2016: this is the global market turmoil that would be triggered by a Donald Trump victory ...

- Trump win a worry for Australia

- US elections impact Indian stock markets

- Opinion: The stock market could crash if Donald Trump is elected ...

There are many more, but it’s obvious the world – and the investor community – doesn’t want Donald Trump to win. We thought the same about voting to Leave the European Union and look what happened there (my GBP’s don’t go very far these days).

In the spirit of looking ahead to tomorrow’s results, here are a few choice snippets from different media.

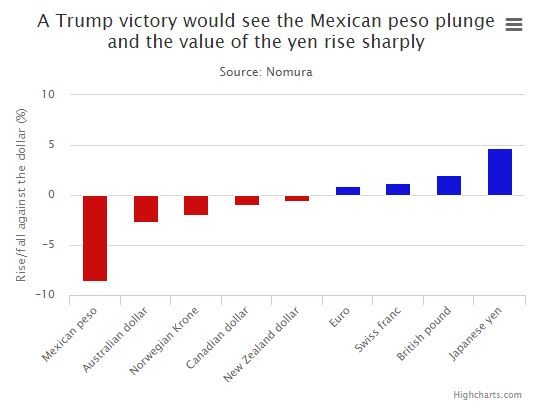

The Telegraph notes that analysts see a victory for Mr Trump, who has threatened to rip up existing US trade agreements, would hit the Mexican peso hardest amid fears that he could spark a global trade war …

Citi predict that a Trump victory could lead to a sell-off of between 3% and 5% in the S&P 500, compared with a small rise if Mrs Clinton clinches victory. That’s not surprising as the Stock Trader's Almanac says that In all of the election cycles since World War II, the Dow Jones industrials have posted bigger average returns under Democrat presidents.

In fact, there is a notable blip in this year’s election cycle as the stock markets have not kept up with their historical behaviours. The stock market has, for the most part, ebbed and flowed with the four-year election cycle for the past 182 years. Since 1833, the Dow Jones industrial average has gained an average of 10.4% in the year before a presidential election. By contrast, the first and second years of a president’s term see average gains of 2.5% and 4.2%, respectively.

The difference here is the Global Financial Crisis and its impact. That is why the Dow racked up an impressive 27% in the first year of President Obama’s second term, and 7.5% in year two. Last year, which was supposed to be the strongest of the cycle, saw the Dow industrials drop 2%.

Who knows what will happen this year?

Well, from an investment point of view, Merrill Lynch make an interesting statement:

“For most investors, the best way to prepare for possible market volatility in 2016 is to take a long-term perspective. That means staying focused on your personal goals and on broader economic trends reshaping U.S. and global markets.

“Mary Ann Bartels, Head of Merrill Lynch Wealth Management Portfolio Strategy, points to larger forces holding tremendous potential for markets and investors in coming years. ‘There are massive, long-term trends that will generate opportunities—and, in some cases, challenges—no matter what happens politically’, she says. ‘To name just a couple: The digital era, big data, cloud computing and cybersecurity will continue to change the world. And the baby boom generation alone represents a $15 trillion economy, generating demand for everything from health care to leisure to hospitality. These underpinnings of the economy are not going to change, whoever ends up winning the White House.’”

Anyways, if you think you know who will win tomorrow I’ll leave you with the view of PredictIt.org, who put the odds for a Clinton win at 66% … but that’s down from a high of 85% back on 25 October.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...