Now we move onto the third-generation internet, web 3.0. What is web 3.0? It's not been well defined or described. Many would say it's the internet of things, but I disagree. The internet of things is emerging, but it cannot exist until a bridge between the mobile social network and the internet of things has a strong underlying architecture for device-to-device commerce.

I call that the internet of value, and is covered in depth in my last book, ValueWeb. So, I'm not going to do a deep dive into the internet of value here. However, the internet of value discussion went along the lines of building an underlying real-time and near-free value exchange structure based upon mobile internet and shared ledgers. I’ve changed my mind about that since, in terms of how it's positioned in web 3.0 as yes, you need an internet of value for the internet of things but no, web 3.0 is not about just the internet of value.

The technologies discussed in ValueWeb are important, and included my initial outline of the new business model of the bank based upon front office apps linking through middle office APIs that are fed non-stop by intelligence from back office analytics engines using artificial intelligence and deep learning,

Again, I've blogged more recently about open banking and open marketplaces. This is based upon apps, APIs and analytics, with banks having the opportunity to be better positioned to be the digital platform that allows open marketplaces to operate using these technologies.

Banks have the opportunity to be the digital platforms that run the marketplaces, but only if they open up. Again, these are themes I'm regularly exploring on the blog, so I don't want to overdo it here but, generally speaking, I think web 3.0 is the internet of marketplaces, connecting those who need things with those who have things.

It's the internet of taxi firms that own no taxis, hotel chains that have no rooms and media companies who produce no content. The taxis, rooms and content are created by those who play in your marketplace as you have become their preffered digital platform. It is the people who need rides connecting to the taxi drivers registered on Uber; it is the people who need accommodation connecting to the people offering rooms through Airbnb; and it is the individuals creating and sharing content on social media through Facebook and more.

These marketplaces are the digital platforms for the sharing economy and many of us have struggled to find a good banking example. We have struggled because there isn't one, yet. Maybe the nearest you get to a digital platform supporting a marketplace is Ant Financial.

But this is because banks that have traditionally been closed and proprietary are struggling with opening up to become collaborative. But they are getting there and a wave of new start-ups are driving them there too. I've mentioned the names before, so I'm not going to again, but these companies are creating the Banking-as-a-Service (BaaS) structures that I blogged about back in 2009.

The idea of BaaS is that, like SaaS and other cloud structures, people can pull together the bank of their choice from a marketplace through apps, APIs and analytics engines.

Now, is your average Joe or Mary going to do this? Probably not, which is the real opportunity here for the collaborative open bank. After all, the collaborative open bank recognises that it controls nothing, can only build some decent functionality and needs lots of other players to play on their platform if they are going to be able to offer choice to their customers. So, an open bank offers their customers this choice but also offers to aggregate such services on the customers' behalf. After all, when faced with 1,000 different P2P services, which one do I choose? Why choose at all? Let the open bank do it for you.

That's the beauty of a marketplace. Do you choose the Facebook content you read or the Uber taxi driver you want, or let Airbnb Facebook or Uber do if for you? It depends how much time and interest you have. Same with banking.

Banks are creating an internet of value through web 3.0, but they are doing this because web 3.0 is the generation of open marketplaces based upon apps, APIs and analytics. This has allowed the Fintech revolution, which has forced the banks to follow. This is also a new development in my own thinking, as I continually return to my business model chart.

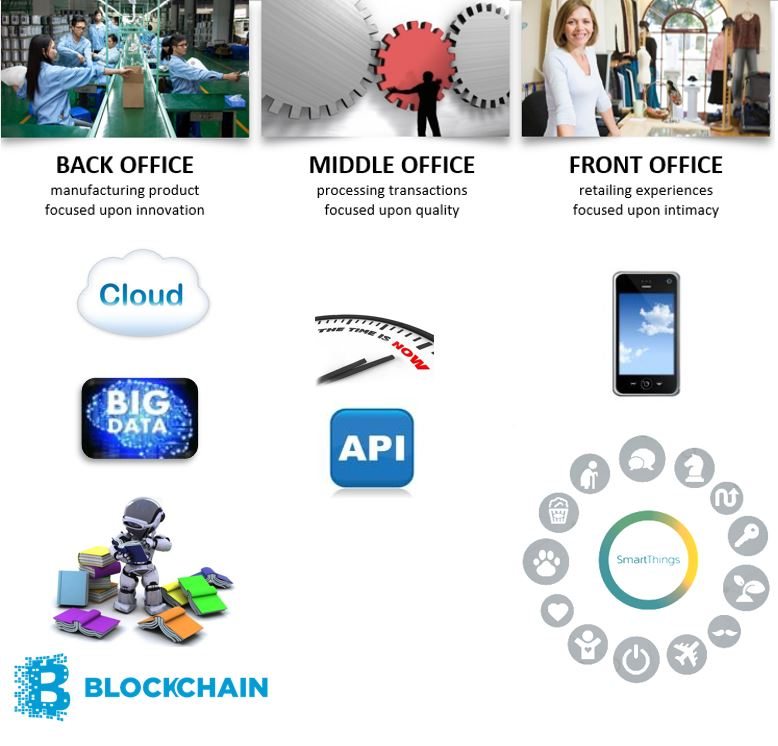

The chart shows the bank with a back-office manufacturing products and services; a middle office processing transactions and payments; and a front office retailing intimacy and experiences.

My assertion is that in the old, industrial era bank, all of this front, middle and back office structure was proprietary and internalised and has to now move to open and externalised. This is because smart devices are where the relationships are developed in the front office; plug-and-play software across the operations allow anyone to offer code through APIs to improve the middle office link between front and back office; and those APIs and apps are fed through data leverage based upon machine learning and artificial intelligence through the cloud.

As a result, the back office is all about analytics, the middle office about APIs and the front office is smart apps for smart devices.

The banks that can pivot from being monolith, vertically integrated, physically focussed structures to microservices, open market, digitally focused structures within the ten-year cycle of web 3.0, are the ones that will survive and thrive.

Meanwhile, if interested, this idea began eight years ago, so here's that blog about BaaS from 2009:

- BaaS: Banking as a Service, February 3, 2009

- BaaS: Banking as a Service (Presentation), February 15, 2009

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...