This year's social networking phenomena has to be Twitter.

Ever since Janis Krums posted the first photo of the US Airways plane landing on the River Hudson on Twitter, everyone has been talking about it.

From its creation in 2006, it has now become a mainstream tool for blackberriers, mobilers and netters.

What's it all about and how does this relate to banks?

Well, I've blogged about Twitter and banking a little bit before, but I haven't talked about Twitter. What prompted me to do so today is that, after a wee bit of investigation, there's some really interesting stuff out there about it.

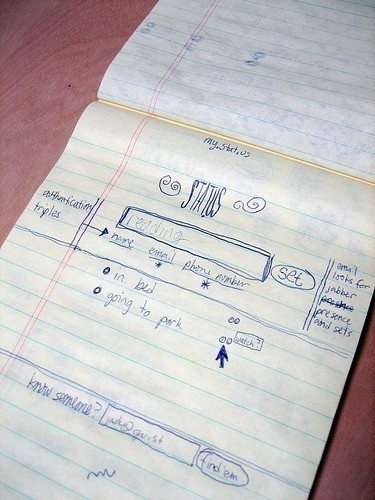

First, there is the transparent history of Twitter as demonstrated by founder Jack Dorsey's Flickr entry, where he posted his original sketch of how Twitter would work:

along with this description:

"On May 31st, 2000, I signed up with a new service called LiveJournal. I

was user 4,136 which entitled me a permanent account and street cred in

some alternate geeky universe which I have not yet visited. I was

living in the Sunshine Biscuit Factory in Oakland California and

starting a company to dispatch couriers, taxis, and emergency services

from the web. One night in July of that year I had an idea to make a more 'live' LiveJournal. Real-time, up-to-date, from the road."

The idea became Twitter: a simple method of telling folks what you are up to in 140 characters or less, along with pointing to any URL on the internet using tinyurl's.

Another reason for mentioning Twitter today is that there's an interesting two-part interview with founder Jack Dorsey in the Los Angeles

Times this week.

Part One talks about the origins of Twitter which is based upon vehicle dispatch control, as Jack mentions above on Flickr. The idea was based upon traffic controllers needing to know where everyone is at

any moment in time, and what they are doing.

That's what Twitter is, but for you and

your mates!

Part Two expands upon the themes of Twitter, and how "the mobile aspect of the service is really engaging, and you see that a

lot in these 'massively shared experiences' that we've done well at: natural disasters, man-made disasters, events, conferences, presidential elections."

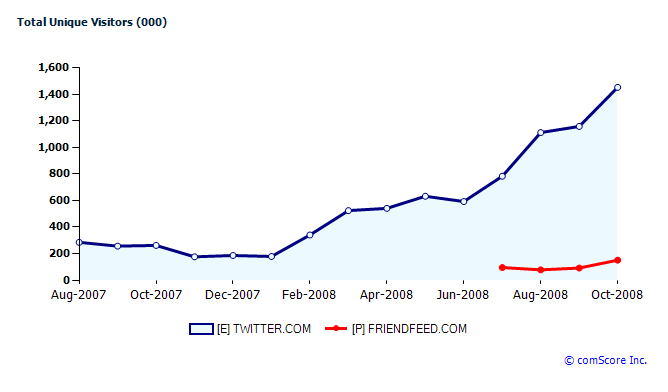

This partly explains the hockey stick moment of upward surge last year ...

... which was created by the US election, with everyone wanting to share news and views in real-time on the move, and that's what it's all about ... massively shared experiences.

A bit like the Massive Multiplayer Online Role Playing Games (MMOPRG's - an industry in itself), Twitter is all about massive movements of people sharing and socialising.

This is why there is already an industry being created around Twitter. For example, there are a number of new Twitter services that add value, such as Betwittered and Filttr. These services filter and present tweets in different formats for you, if you don't like the original that is or if you have too many folks to follow.

Equally, for those netty people out there, there are lots of accessories for twitterizing the internet. For example, Firefox has some great Twitter add-on's such as Twitterfox and Twitter Toolbar (there's a few more good ones over here).

And the relevance to banking?

Well, bearing in mind that most banks haven't got a blog yet, using Twitter to communicate with customers in a micro-blog will be a stretch. That doesn't mean some don't do this, such as Bank of America, or that new players aren't leveraging Twitter, such as Wesabe and Mint. Equally, there are decent twitterers in areas of finance, such as Islamic Finance, who are worth keeping up with.

For mainstream banks however, Twitter is still a stretch too far.

Mind you, using Twitter to supplant mobile payments with advice, news, views and an enriched service from the bank to help the customer in forecasting, budgeting, allocating between credit and debit ... now there's a thought.

BTW, for more stats and facts on Twitter usage by country and demographic, Twitter Facts is a must.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...