Stéphane Garelli was the keynote at last week’s conference on payments and, as usual, was stimulating, entertaining and thought provoking.

For those who are unaware, Stéphane made Davos what it is today and is a world authority on competitiveness. I’ve placed his full bio at the end of this entry for those who are unfamiliar with his full range of activities.

Interviewing Stéphane before his speech, I asked him what he thought we would be talking about this time next year?

“Unemployment and inflation” was his answer.

Massive unemployment which is already in play, and hyperinflation due to the capital injections and quantitative easing of the US, UK and developed economies.

Oh dear.

Then he said, as a result of inflationary forces, the stock markets would see another major bull run and will rally back to record highs soon enough.

Hurrah!

Here’s a summary of his presentation, including the bit I liked best: his favourite quotes.

A competitive outlook for 2009 and beyond

Many people got the world wrong, for example:

“I do not anticipate any serious problems among the large internationally active banks”

Ben Bernanke, 28 February 2008

“I do believe that the economy is growing”

George W. Bush, 15 July 2008

“In today’s regulatory environment, it is virtually impossible to violate the rules”

Bernie Madoff, 20 October 2007

They got it wrong and it has led to this massive global downturn. Is this finished? Well, to work that out, we need to consider what sort of recession we are in. There are four types of recession:

- a V-shaped recession,

- a W-shaped double dip,

- a U-shaped where the bottoming is a long-cycle rather than short cycle, and

- an L-shaped recession, which is Japan’s speciality.

The consensus is that this global recession is U-shaped, although Stéphane feels that we have more of an ECG-style U-shaped recession, with lots of false dawns before we get a recovery.

He also believes we have gone past the low-point and that recovery is on the way. As a result, “we shall see the best year on the stock exchanges ever”.

Boy, I hope so.

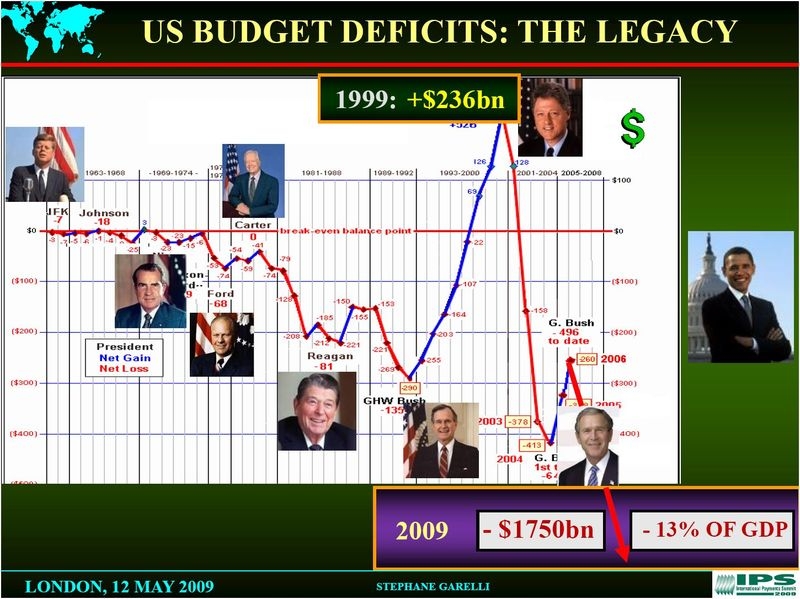

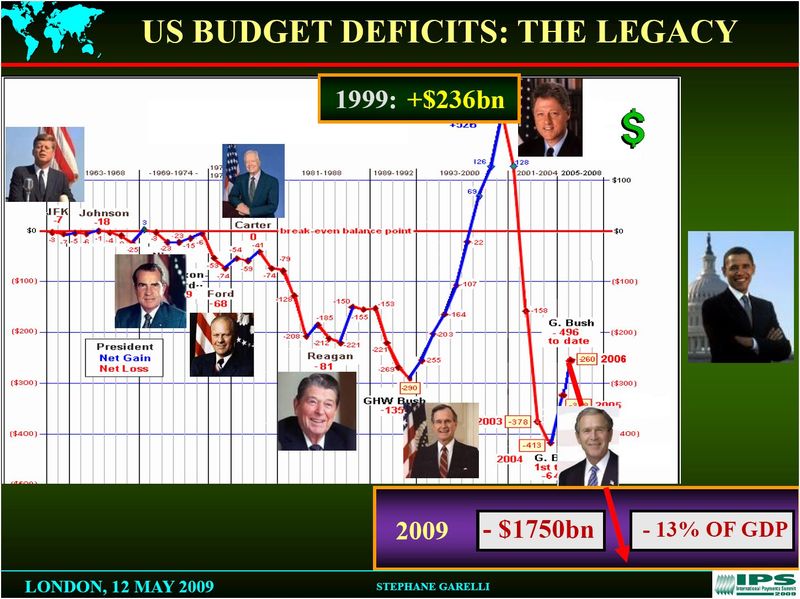

Stéphane then displayed some democrat views by using a slide that showed there was a $236 billion budget surplus when Clinton left office, leading to a $1,750 billion deficit (-13% of GDP) when George W left office (double-click picture to see a big version):

In other words, the Republicans built up a debt at a run rate of $3.7 billion a day … about 100 years worth of spending a dollar a second (my new unit of currency!).

The standard economic answer to fixing these issues of debt is to:

(1) flood the streets with money by just printing more (quantitative easing);

(2) pack the bad debt away in a bad bank;

(3) recaptialise the banks and take part ownership; and

(4) later on, resell the bad debt and/or the shares.

This is pretty much the route that the EU and USA have taken, and it may now be working, but not without issues.

For example, the US Paulson plan which went through Senate and Congress last October was originally 113 pages. This was rejected first time, because Congress folks were using it to negotiate tax breaks for their states. This is why the final version was expanded to 338 pages and included tax breaks for wind and solar energy, an excise tax on rum from Puerto Rico, an amortization for motor racing tracks and exemption taxes for wooden arrows in toys!!

Anyway, the result is that we have spent about $3.2 trillion (100,000 years spending a dollar a second) in stimulating the global economies and a further $2.7 trillion (85,000 years) in loan guarantees.

The question now is: will it / has it worked?

Yes, it has ... but it’s a fragile world and a fragile recovery.

Stéphane believes that the EU still needs a further $1 trillion stimulation to get back to stability; and the USA another $2.5 trillion, in terms of borrowing requirements for 2009. This is why the $ will stay weak for the remainder of this year; the € is more or less ok; and the £’s future is uncertain.

From a political viewpoint, this crisis has also been good for politicians.

“I think politicians have really enjoyed this crisis,” Stéphane said, “because, for the first time, they have a sense of purpose”.

That got the biggest laugh of the morning … until he added the line that : “a government is big enough to give you everything you want, are also big enough to take everything you have.”

This is why, after the crisis, there will be more regulation because governments are now in power and, just as Enron led to Sarbanes-Oxley, we now have another Enron but this time it is ten times worse … so expect ten times more regulation.

Stéphane had a lot more to say about unemployment and inflation, but his summary was that:

In the 1980s, we had to work smarter and all began re-engineering;

In the 1990s, we had to work cheaper so we outsourced everything; and

In the 2000s, we had to work globally so we moved everything offshore.

In the 2010s, we have to work more easily and so business simplification will be the focus.

Simplify products, services and processes to their essentials.

That is what the iPod has done for music - it's just one button! - and businesses need to do the same.

Simplify and you will win.

As I mentioned, he sprinkled his favourite quotes liberally throughout his speech. Here are a few of them:

“There are three kinds of people in the world – those who make it happen, those who watch it happen, and those who wonder what happened”

Ronald Reagan, 1911-2004

Michael Faraday (1791-1867), reply to William Gladstone, then British Minister of Finance, when asked of the practical value of electricity: "One day sir, you may tax it."

“The markets can remain irrational longer than you can remain solvent”

John Maynard Keynes, 1883-1946

“The real difficulty lies not in developing new ideas, but in escaping from the old ones”

John Maynard Keynes, 1883-1946

“Confidence is what you have before you understand the problem “

Woody Allen, 1935-

“He that is too secure is not safe”

Thomas Fuller, 1608-1661

“It is very wrong to be right before everyone else”

Michel Eyquem de Montaigne, 1533-1592

Stéphane Garelli is a Professor at both the International Institute for Management Development (IMD), and at the University of Lausanne, Director of The World Competitiveness Yearbook, the most renowned annual analysis of the competitiveness of nations and a reference for government and business leaders around the world.

He is Chairman of the Board of Directors of "Le Temps", and was formerly Chairman of the Board of the Sandoz Financial and Banking Holding, and member of the board of the Banque Edouard Constant.

The author of numerous publications in the field of competitiveness, international trade and investments, he is also a columnist in several magazines. He was permanent senior adviser to the European management of Hewlett-Packard, and before that Managing Director of the World Economic Forum and of the Davos Symposium. He is a member of a number of institutes, such as: China Enterprise Management Association, Board of the 'Fondation Jean Monet pour l'Europe', The Swiss Academy of Engineering Sciences, The Royal Society for the encouragement of Arts, Manufactures and Commerce and the Mexican Council for Competitiveness.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...