Some years ago, I delivered a presentation as a keynote with the title: “All Bankers are Criminals”.

I actually didn’t mean “all”.

The chicken feed, battery farmed, commercial, transactional and retail bankers are pin-stripe suited, humble pie, nice guys.

I was talking about the evil animals of Wall Street and the City.

These jungle animals hunt you down, rip out your wallet and tear your money apart note-by-note.

OK, I exaggerate a little, but you get the idea.

The first time I gave this presentation was back in Summer 2005 at a European Conference, and repeated it again in Spring 2006, as an Associate Director of TowerGroup.

The theme of the presentation mainly came from Frank Partnoy’s excellent book Infectious Greed, which traces the growth of weapons of financial destruction: derivatives, as named by Warren Buffett in his 2002 shareholder letter.

It is quite clear from this book that unchecked investment markets will run free of scruples and morals. This is what happened with Frank Quattrone of Credit Suisse and the dotcom boom and bust, along with many other examples through history.

It is not necessarily as true when we talk about arbitrage strategies and the John Meriwether’s of this world. However, these people are far more dangerous because they create financial markets systemic risk that can bring down companies and countries.

For example, in case you are wondering who John Meriwether is, he was one of the first arbitrage players and built Salomon Brothers into the big swinging dick master of the universe world so brilliantly depicted in Michael Lewis’s book Liar’s Poker.

With his colleagues, the use of arbitrage instruments led to the downfall of Salomon Brothers – they were subsequently merged into Citigroup – and Meriwether went on to create Long Term Capital Management (LTCM).

In 1998 LTCM lost $4.6 billion in less than four months and became the leading case study for how systemic risk created by derivatives products, combined with massive leverage

and arbitrage risk-models, creates a financial deck of cards. A deck that can rise and fall in the blink of an eye, with the latter potentially ruining companies, markets, countries and governments, as happened in the most recent crisis.

Anyways, not to be dissuaded from his cause, Meriwether went on to found JWM Partners, another highly leveraged "relative value arbitrage" firm. Yet again, he built leverage through this hedge fund from its opening with $250 million under management in 1999 to a massive $3 billion firm by 2007. Of course, it was all just on paper as the latest crisis battered the fund, losing almost half of its value between September 2007 and February 2009. The deck of cards strikes again.

It closed in late 2009 and guess what? Meriwether’s about to launch yet another hedge fund, based upon just the same concepts.

To me, this is the criminality of the financial system in action. Firms that build highly leveraged derivatives instruments for short-term arbitrage, with unproven skills and massive risk.

Not that I’m calling Meriwether a criminal, as it’s all perfectly legitimate under SEC and FSA Rules.

Or it was.

It may be that the Goldman Sachs furore will change all this.

You see, Goldman Sachs, like Meriwether, is very good at taking leverage and risk and managing the markets to gain short-term profit.

Like Meriwether, Goldman Sachs succeeded in using these tools and instruments to generate massive profits. They achieved a record 131 trading days last year, in which the bank made at least $100 million net trading revenue each day.

Unlike Meriwether, Goldman Sachs managed to offload and hedge their risks back to others, such as AIG and IKB, such that when the markets collapsed their clients, suppliers and partners got burnt, but not them.

Nothing wrong with that, as it’s all perfectly legitimate under SEC and FSA Rules. Unless the SEC and FSA find Goldman Sachs guilty of fraud.

But how can they be guilty of a crime that was not a crime at the time it was committed?

There’s the rub.

I’m sure the SEC will aim to build a bulletproof case, and their cause is a worthy one: clean up the financial system.

Is it worthy to do this so publicly?

Not sure.

Is it worthy to name the defendant up front, when the burden of proof has yet to be proven?

Not sure.

The Goldman Sachs case is actually more like watching a rape trial in action, where the defendant is a shifty looking guy who probably seems guilty whether guilty or not.

For example, if you name someone like Jack Tweed in the UK, you might still associate him with being a rapist even though he was found not guilty.

The guilt sits there, and that’s what will happen with Goldman Sachs.

Whether guilty or not – and they’ve hired the best team possible to defend themselves, including “Master of Disaster” Mark Fabiani – we will always associate Goldman Sachs with something smelly for the foreseeable years to come.

Ho-hum.

At least all of this seems to inspire some humour. For example, in an April episode of hit comedy US TV series This American Life (TAL), they tell the story of a hedge fund that comes up with an elaborate plan to make money. It sponsors the creation of complicated and ultimately toxic financial securities while, at the same time, betting against the very securities it helped create.

TAL commissioned a Broadway song to go along with the story:

Bet Against The American Dream from Planet Money on Vimeo.

The only thing that really gets me, in finishing this blog entry, is Warren Buffett.

The Sage of Omaha has made his billions through prudent focus upon ‘value investing’. That means investing in strong and robust businesses like Coca-Cola, American Express, Gillette and the Washington Post.

So when he referred to derivatives as ‘weapons of financial destruction’ in his shareholder letter of 2002, I respected the man and his integrity of thought.

Now, having found Goldman Sachs under attack, he has stepped up to their defence, and I wondered why.

Warren Buffett is an intriguing character, as we all know. The friend of kings and kingmakers, he walks a path separate to most.

He knows the dangers of arbitrage, derivatives and leverage, because he had to step into Salomon Brothers in 1991 to clean up Meriwether and his colleagues mess.

An extract from Carol Loomis’s in-depth review of Buffett’s experience at Salomon’s:

“You may reasonably ask what was going on in Salomon's stock while all of this was transpiring. It was emphatically down, from above $36 per share on Friday to under $27 on Thursday, when the second press release rocked the market. But the stock was only the facade for a much graver matter, a corporate financial structure that by Thursday was beginning to crack because confidence in Salomon was eroding. It is not good for any securities firm to lose the world's confidence. But if the firm is "credit dependent," as Salomon was to an extreme, it cannot tolerate a negative change in perceptions. Buffett likens Salomon's need for confidence to a mortal's need for air: When the required good is present, it's never noticed. When it's missing, that's all that's noticed.

“Unfortunately, the erosion of confidence was occurring in a company grown enormous. Salomon in August of 1991 had bulged up to $150 billion in assets (not counting, of course, huge off-balance-sheet items) and was among the five largest financial institutions in the U.S. Propping the company on the right-hand side of the balance sheet was--are you ready?--only $4 billion in equity capital, and above that was about $16 billion in medium-term notes, bank debt, and commercial paper. This total of about $20 billion was the capital base that supported the remaining $130 billion in liabilities, most of these short-term, due to run off in one day to six months.”

The result meant that Warren Buffett had to actually take over physically as manager of Salomon Brothers for a nine-month period, and it was emotionally exhausting for him.

Switch to 2010.

Warren Buffett invested heavily in Goldman Sachs in September 2008 – when Lehman Brothers, Merrill Lynch and Morgan Stanley were all imploding – buying $5 billion of preferred stock at a 10 percent dividend. These investments earn him $950 a minute, or $500 million a year today. No wonder he claims to be in love with that investment.

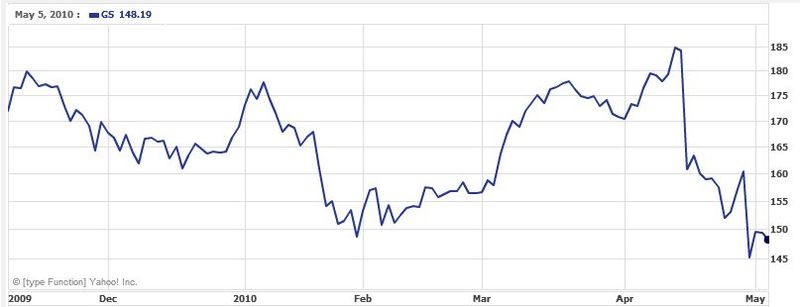

Trouble is that the alleged fraud at Goldman Sachs has really hit their share price. For example, Standard & Poor's downgraded Goldman

shares to "Sell" and lowered their target price by $40 to

$140 the other day.

Goldman Sachs shareprice, courtesy of Yahoo!, already down $40 ...

Thinking back to Salomon's - if the firm is "credit dependent," as Salomon was to an extreme,

it cannot tolerate a negative change in perceptions - Buffett must be seriously worried about Goldman Sachs losing its credit worthiness, especially as it depends on good credit.

Oh yes, and having called derivatives ‘weapons of financial destruction’, guess what? Berkshire Hathway, Warren Buffett’s investment firm, has a massive portfolio of derivatives investments. From the Wall Street Journal last week:

“Democrats took a step toward their goal of overhauling financial regulation, reaching a tentative deal to set restrictions on trading in exotic financial instruments known as derivatives. Among the considerations still in the balance: A big provision being sought by Warren Buffett in recent weeks ... the provision, sought by Berkshire and pushed by Nebraska Senator Ben Nelson in the Senate Agriculture Committee, would largely exempt existing derivatives contracts from the proposed rules. Previously, the legislation could have allowed regulators to require that companies such as Nebraska-based Berkshire put aside large sums to cover potential losses. The change thus would aid Berkshire, which has a $63 billion derivatives portfolio, according to Barclays Capital.”

Hmmm ... maybe that greed is infectious, although Morningstar Analyst Bill Bergman supports Mr. Buffett's exemption by stating that: "claiming Berkshire poses a risk to the financial system is a difficult

case to make."

Either way, the US movement towards an approval of a Financial Reform Bill to handle the issues of banks that are 'too big to fail' yesterday, takes it one step nearer to the American system taking a lead role towards a new financial architecture.

Derivatives are next ... and Warren Buffett, like Lloyd Blankfiend at Goldman Sachs and all of those current and former bankers and brokers who dealt in toxic derivatives across the world, must be worried.

Postnote: here is Berkshire Hathaway’s full commentary on derivatives from that shareholder letter back in 2002:

Charlie and I are of one mind in how we feel about derivatives and the trading activities that go with them: We view them as time bombs, both for the parties that deal in them and the economic system.

Having delivered that thought, which I’ll get back to, let me retreat to explaining derivatives, though the explanation must be general because the word covers an extraordinarily wide range of financial contracts.

Essentially, these instruments call for money to change hands at some future date, with the amount to be determined by one or more reference items, such as interest rates, stock prices or currency values. If, for example, you are either long or short an S&P 500 futures contract, you are a party to a very simple derivatives transaction – with your gain or loss derived from movements in the index. Derivatives contracts are of varying duration (running sometimes to 20 or more years) and their value is often tied to several variables.

Unless derivatives contracts are collateralized or guaranteed, their ultimate value also depends on the creditworthiness of the counterparties to them. In the meantime, though, before a contract is settled, the counterparties record profits and losses – often huge in amount – in their current earnings statements without so much as a penny changing hands.

The range of derivatives contracts is limited only by the imagination of man (or sometimes, so it seems, madmen).

At Enron, for example, newsprint and broadband derivatives, due to be settled many years in the future, were put on the books. Or say you want to write a contract speculating on the number of twins to be born in Nebraska in 2020. No problem – at a price, you will easily find an obliging counterparty.

When we purchased Gen Re, it came with General Re Securities, a derivatives dealer that Charlie and I didn’t want, judging it to be dangerous. We failed in our attempts to sell the operation, however, and are now terminating it.

But closing down a derivatives business is easier said than done. It will be a great many years before we are totally out of this operation (though we reduce our exposure daily). In fact, the reinsurance and derivatives businesses are similar: Like Hell, both are easy to enter and almost impossible to exit. In either industry, once you write a contract – which may require a large payment decades later – you are usually stuck with it. True, there are methods by which the risk can be laid off with others. But most strategies of that kind leave you with residual liability.

Another commonality of reinsurance and derivatives is that both generate reported earnings that are often wildly overstated. That’s true because today’s earnings are in a significant way based on estimates whose inaccuracy may not be exposed for many years.

Errors will usually be honest, reflecting only the human tendency to take an optimistic view of one’s commitments. But the parties to derivatives also have enormous incentives to cheat in accounting for them.

Those who trade derivatives are usually paid (in whole or part) on “earnings” calculated by mark-to-market accounting. But often there is no real market (think about our contract involving twins) and “mark-to-model” is utilized. This substitution can bring on large-scale mischief. As a general rule, contracts involving multiple reference items and distant settlement dates increase the opportunities for counterparties to use fanciful assumptions. In the twins scenario, for example, the two parties to the contract might well use differing models allowing both to show substantial profits for many years. In extreme cases, mark-to-model degenerates into what I would call mark-to-myth.

Of course, both internal and outside auditors review the numbers, but that’s no easy job. For example, General Re Securities at yearend (after ten months of winding down its operation) had 14,384 contracts outstanding, involving 672 counterparties around the world. Each contract had a plus or minus value derived from one or more reference items, including some of mind-boggling complexity.

Valuing a portfolio like that, expert auditors could easily and honestly have widely varying opinions.

The valuation problem is far from academic: In recent years, some huge-scale frauds and near-frauds have been facilitated by derivatives trades. In the energy and electric utility sectors, for example, companies used derivatives and trading activities to report great “earnings” – until the roof fell in when they actually tried to convert the derivatives-related receivables on their balance sheets into cash. “Mark-to-market” then turned out to be truly “mark-to-myth.”

I can assure you that the marking errors in the derivatives business have not been symmetrical.

Almost invariably, they have favored either the trader who was eyeing a multi-million dollar bonus or the CEO who wanted to report impressive “earnings” (or both). The bonuses were paid, and the CEO profited from his options. Only much later did shareholders learn that the reported earnings were a sham.

Another problem about derivatives is that they can exacerbate trouble that a corporation has run into for completely unrelated reasons. This pile-on effect occurs because many derivatives contracts require that a company suffering a credit downgrade immediately supply collateral to counterparties. Imagine, then, that a company is downgraded because of general adversity and that its derivatives instantly kick in with their requirement, imposing an unexpected and enormous demand for cash collateral on the company. The need to meet this demand can then throw the company into a liquidity crisis that may, in some cases, trigger still more downgrades. It all becomes a spiral that can lead to a corporate meltdown.

Derivatives also create a daisy-chain risk that is akin to the risk run by insurers or reinsurers that lay off much of their business with others. In both cases, huge receivables from many counterparties tend to build up over time. (At Gen Re Securities, we still have $6.5 billion of receivables, though we’ve been in a liquidation mode for nearly a year.) A participant may see himself as prudent, believing his large credit exposures to be diversified and therefore not dangerous. Under certain circumstances, though, an exogenous event that causes the receivable from Company A to go bad will also affect those from Companies B through Z. History teaches us that a crisis often causes problems to correlate in a manner undreamed of in more tranquil times.

In banking, the recognition of a “linkage” problem was one of the reasons for the formation of the Federal Reserve System. Before the Fed was established, the failure of weak banks would sometimes put sudden and unanticipated liquidity demands on previously-strong banks, causing them to fail in turn. The Fed now insulates the strong from the troubles of the weak. But there is no central bank assigned to the job of preventing the dominoes toppling in insurance or derivatives. In these industries, firms that are fundamentally solid can become troubled simply because of the travails of other firms further down the chain.

When a “chain reaction” threat exists within an industry, it pays to minimize links of any kind. That’s how we conduct our reinsurance business, and it’s one reason we are exiting derivatives.

Many people argue that derivatives reduce systemic problems, in that participants who can’t bear certain risks are able to transfer them to stronger hands. These people believe that derivatives act to stabilize the economy, facilitate trade, and eliminate bumps for individual participants. And, on a micro level, what they say is often true. Indeed, at Berkshire, I sometimes engage in large-scale derivatives transactions in order to facilitate certain investment strategies.

Charlie and I believe, however,

that the macro picture is dangerous and getting more so. Large amounts of risk, particularly credit risk, have become concentrated in the hands of relatively few derivatives dealers, who in addition trade extensively with one other. The troubles of one could quickly infect the others.

On top of that, these dealers are owed huge amounts by non-dealer counterparties. Some of these counterparties, as I’ve mentioned, are linked in ways that could cause them to contemporaneously run into a problem because of a single event (such as the implosion of the telecom industry or the precipitous decline in the value of merchant power projects). Linkage, when it suddenly surfaces, can trigger serious systemic problems.

Indeed, in 1998, the leveraged and derivatives-heavy activities of a single hedge fund, Long-Term

Capital Management, caused the Federal Reserve anxieties so severe that it hastily orchestrated a rescue effort. In later Congressional testimony, Fed officials acknowledged that, had they not intervened, the outstanding trades of LTCM – a firm unknown to the general public and employing only a few hundred people – could well have posed a serious threat to the stability of American markets. In other words, the Fed acted because its leaders were fearful of what might have happened to other financial institutions had the LTCM domino toppled. And this affair, though it paralyzed many parts of the fixed-income market for weeks, was far from a worst-case scenario.

One of the derivatives instruments that LTCM used was total-return swaps, contracts that facilitate

100% leverage in various markets, including stocks. For example, Party A to a contract, usually a bank, puts up all of the money for the purchase of a stock while Party B, without putting up any capital, agrees that at a future date it will receive any gain or pay any loss that the bank realizes.

Total-return swaps of this type make a joke of margin requirements. Beyond that, other types of derivatives severely curtail the ability of regulators to curb leverage and generally get their arms around the risk profiles of banks, insurers and other financial institutions. Similarly, even experienced investors and analysts encounter major problems in analyzing the financial condition of firms that are heavily involved with derivatives contracts. When Charlie and I finish reading the long footnotes detailing the derivatives activities of major banks, the only thing we understand is that we don’t understand how much risk the institution is running.

The derivatives genie is now well out of the bottle, and these instruments will almost certainly multiply in variety and number until some event makes their toxicity clear. Knowledge of how dangerous they are has already permeated the electricity and gas businesses, in which the eruption of major troubles caused the use of derivatives to diminish dramatically. Elsewhere, however, the derivatives business continues to expand unchecked. Central banks and governments have so far found no effective way to control, or even monitor, the risks posed by these contracts.

Charlie and I believe Berkshire should be a fortress of financial strength – for the sake of our owners, creditors, policyholders and employees. We try to be alert to any sort of megacatastrophe risk, and that posture may make us unduly apprehensive about the burgeoning quantities of long-term derivatives contracts and the massive amount of uncollateralized receivables that are growing alongside. In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...