One of the more outspoken reactions to my post on payday firms came from Wonga.

Not surprising as my original headline was that “Wonga will wrestle with regulators”, and they will as the markets are pretty unregulated today. A point I made last Friday.

I also mentioned last Friday that the original reason I wrote this was because of two statements in a Wired Magazine cover on Wonga from May.

The first said that “within a year, Wonga had issued 100,000 loans, worth £20 million, earning about £15 million by charging interest at an eyewatering headline rate.”

The second was a letter from Steve Perry in Wired in June that said: “When I could no longer repay a Wonga loan, it took 50 days of ringing and emailing to get through – an £800 loan became a £1,700 repayment.”

Both lines made me angry, and hence led to this debate.

So, just to set the record clear, let’s look at Wonga in depth.

First, what is the Wonga business model?

Their business runs on super flexible, short-term loans, delivered via the internet in minutes.

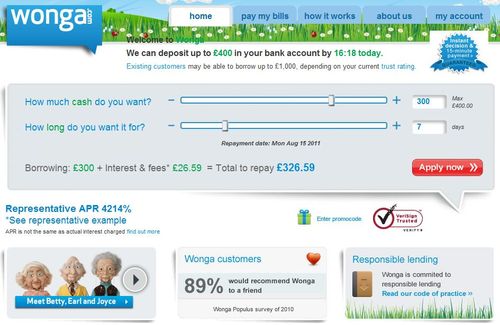

The offer is made using a simple calculation system on their homepage that lets you put in how much you want to borrow – up to £400 (or £1,000 for repeat customers) – for how long – up to 30 days maximum.

The interest is made clear to you as you enter this information. For example, £300 over 7 days racks up £26.59p in interest and fees whilst, over 30 days, this would be £95.89p. Bear in mind that £5.50 of these amounts are the transmission fees to move the money to your bank account in real-time, and the rest is the actual interest rate.

In other words, the real interest rate is around 360% APR or 1% per day average.

Although the APR on the homepage states that it is 4214%, this is purely a number required by law to show how much the loan costs over a year. As a result, the interest rate is compounded to represent how the Wonga loan period would look if spread across a year, even though the company does not offer annualised loans. So the fee and interest is compounded and added as a mathematical view of APR, rather than real view.

360% interest rates per annum may seem high, but it’s not competing with those long-term loans. Wonga doesn’t offer long-term loans although, if they did, it would be at 360% interest rates, which they admit themselves: “Even if we were to launch a year-long loan at the same interest rate we charge now, the APR would be much lower than the current figure, more like 360%, because there would be no artificial compounding involved.”

But Wonga doesn’t offer annual loans. Their maximum lending period is 30 days and, in that context, Wonga’s rates are a fraction of those charged by high street banks for unsecured overdrafts and credit cards, which are the markets they are most interested in taking business from.

So Wonga specialise in short-term loans to give you coverage for a few days when you most need it.

Their team shared some interesting stories with me in this context and it’s generally for people who don’t want a bank loan – as such loans tie you up for a long period of time with amounts that are reasonably fixed – or can’t get one due to poor credit history or a recent change of job or address, or need cash fast and it would take too long in the bank.

A few examples included a customer whose dog needed emergency treatment and they needed cash in minutes, and a guy who had lost his job and needed to buy a car to become a minicab driver but couldn’t buy the car through the bank as he was jobless. The latter is a Catch 22 – how can I start work if you don’t give me the loan?

The loans are incredibly short – typically a few days – and are high interest due to the costs of acquisition and processing.

Although the company does not publish public records – they are a private firm with £90 million of venture capital backing [Wonga Company Number is 06374235] – they point to similar firms in the USA such as Cash America and Advance America, who have to provide transparent reporting of returns under SEC filings.

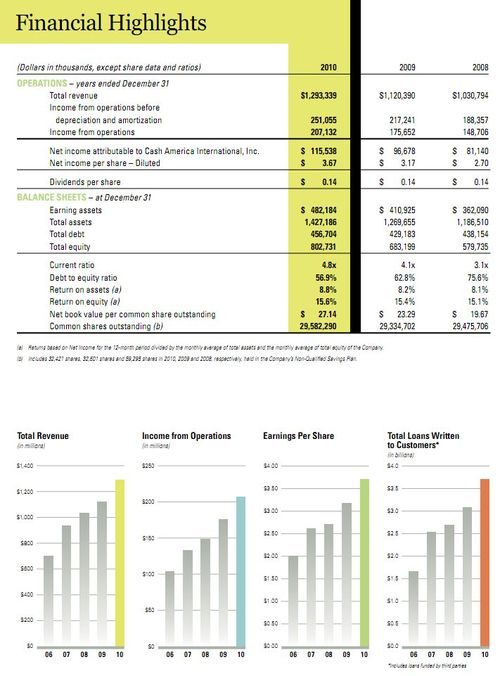

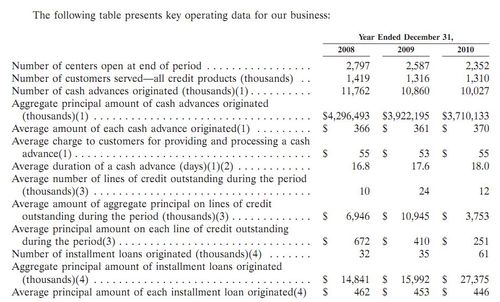

What this shows is that Cash America makes less than 10% net income on revenues of over $1 billion …

… whilst Advance America made a net income of $35.8 million on revenues of more than $600 million

This is because the business costs are high with cost of customer acquisition being the highest, followed by default rates which are also significant. Wonga say they have theirs under control by using sophisticated technologies to avoid high risk customers, but one US study found that as much as a quarter of a payday firm’s revenues can be attributed to defaults.

This does not even include marketing and processing costs, with the cost of data being a major overhead in the process too.

For example, Wonga use Experian and other credit agencies to real-time check customers during their online acquisition processing. That’s all at a cost and many other payday firms don’t use such sources for this reason. A typical payday firm would just ask to see your last salary and bank statements and would then approve. This is why their default rates are high and Wonga’s are lower.

But it makes the point that this is high risk, high volume, low margin business that is hard to make money unless you’re good.

It is also why Wonga claim they do not target vulnerable customers.

Why would you?

Vulnerable customers are more likely to default and less likely to pay back, so that’s not the market they want. Wonga make the specific point that, being a private firm backed by venture capital, it’s their money they are putting at stake, so they only want to target the right customers?

Who are the right customers?

Wonga want customers who sit between core bank lending markets and the unbankable markets.

These are often customers who have never used a payday loan firm – 75% of the customers have never used an online payday loan before – and they are often bank customers – every customer has a bank account and access to full banking services. This means that they also have access to traditional credit products, such as loans and credit cards, but often don’t trust themselves with such products. They would rather pay high interest on a short-term loan they can manage than lower interest on a long-term loan. This is because the short-term loan is easy and manageable, rather than escalating and invisible credit on a card or fixed for years on a bank loan.

Here’s a few more facts:

- 59% of Wonga’s customer are male, whilst 41% are female

- They are average wage earners (£22,000 per year) and aged typically between 21 and 40 years

- Most are tech savvy and are regular broadband and mobile users

- 14% of Wonga’s customers use an iPhone

- The average first-time loan is for £160 and the average loan across the customer base is £230

- As long as you demonstrate you are a responsible borrower, you can increase your maximum loan to up to £1,000 over time

- Wonga serviced their first customer in October 2007, and is now estimated to be making more than 100,000 loans per annum

- 3 years after launch Wonga.com had made in excess of 1.5 million loans to customers

These customer demographics prove that the customers aren’t necessarily the vulnerable and needy, but the sophisticated and informed.

They use the internet and mobile connectivity and like the flexibility of a short loan that avoids bank overdraft fees.

From a risk perspective, Wonga ensure the select the right customers, not the vulnerable ones, through their technology analytics and algorithms again, and means that most Wonga customers are actually not the normal payday loans customers.

In fact, as mentioned, the technology is something that impresses.

Not only does it credit check and money transfer in real-time, but it goes further by completing the whole process in under fifteen minutes typically.

That’s why Wonga actually describe themselves as a technology firms that offers financial services, which gives you a clue to their positioning right from the start.

They are also very transparent. Everything is clear up-front. For example, they calculate the total amount repayable upfront, showing the figures clearly and including all interest and fees. You might say that’s better than a bank?

There’s also a good guide to ‘responsible lending’ that’s accessible from their home page .

They also make it clear that “the only way costs can increase is if you fail to honour the agreement.”

So what happens if you fail to honour the agreement, like Steve Perry did? What’s your maximum liability?

Well, it appears Wonga are also semi-flexible on this point too. If they get a customer who is in trouble, they don’t just keep hammering them with fees and charges, but will apply penalties to a maximum of 360% interest.

At that point, it stops until some form of agreement or compromise can be made. For example, in Steve Perry’s case, Wonga waived the outstanding balance with Wonga’s head of communications, John Moorwood, saying to me:

“We lend our own money and we’re completely incentivised to make selective decisions and help people who can afford the service and are likely to repay a loan quickly. A typical loan is around a fortnight and a quarter of our customers repay early every month, which they can do without any catches.

“We decline the majority of first-time applicants and we also decline some returning customers, or limit their access to credit, based on the same checks and prior use of the service. Again, we have nothing to gain from helping someone who can’t afford the loan or is in serious financial difficulties. We don’t claim to be perfect, but we believe we are doing everything we can to make the best decisions possible, which has seen us win a number of respected risk-based awards judged by industry experts.

“The fact we’re achieving this aim of making the best possible decisions is supported by the very low rate of arrears and positive feedback from most customers, whom we survey and speak to regularly.”

Now, I can find loads of other complaints against Wonga that are similar to Steve Perry's from Debt Line, the Review Centre, UK payday reviews and more.

Most of the complaints are down to people who failed to payback on time, didn’t read the rules or ignored them, have been declined as a repeat customer due to their credit getting worse and related issues. The worst one is that Wonga charges rollover fees if funds are not in the customer's account on the morning of the due date, even though funds may be in the account later in the day.

Even so, none of these complaints appear to be about Wonga not doing what it says on the tin: we will lend you a short term loan at high interest rates and not charge you excessive fees unless you don’t pay back on time.

If you want more on this part of the operation, read the Payday Loan Master write up on the Wonga Scam from June 2011.

My conclusion on Wonga is that they are hard on customers who don’t play by the rules, but they make the rules clear upfront and it’s down to you to absorb or ignore them.

It's all about transparency.

In fact, Wonga regularly survey their customers on what they think and, in the last survey performed by Populus in January 2011 of 15,200 people, Wonga’s customers thought:

- Wonga is better than a bank overdraft, bank loan, credit card or other payday loan

- 77% thought Wonga’s service easy to use, compared to 7% with the banks

- When asked: “how well or poorly is information communicated when you use Wonga’s service?”, 66% think ‘very well’ and 30% ‘well’ – only 1% rated communications poor

- The Financial Ombudsman Service received 30 complaints in 2010 about Wonga, equivalent to 0.003% of their customer base of a million customers; by comparison, Barclays bank had 276,000 complaints which, with around 14 million customers, equated to 2% of their customer base

If you want to read more about Wonga, here are their documents:

Finally, I asked Wonga their views on interest rate caps, loan caps, and more qualification of the borrower and their other financial exposures, particularly for repeat customers.

They actually agreed with these recommendations, saying that more payday loan firms should be responsible lenders to ensure they don’t get a bad reputation. For example, they use Experian and credit scoring to ensure they avoid vulnerable and poor credit based customers. If every payday loan firm did, then they would all qualify borrowers better. The fact that most don’t, due to the costs of data access, makes this a vulnerability.

Wonga don’t agree with interest rate caps, as they think competitive market forces rule. As a result, they promote transparency of overall costs as being the way to go, as per their homepage, rather than regulatory limits on lending.

This is in line with a recent analysis by PriceWaterhouseCoopers of consumer credit – “UK consumer credit in the eye of the storm” – which states on page 19 that: “in the case of payday lending, an APR is fundamentally misleading. Annualising the interest cost of a product that is only offered as a short-term facility confuses the purpose of the loan and misrepresents the true cost. It’s similar to suggesting that the typically annual cost of a rental car might be close to £15,000, rather than a daily rate of £40. The total charge for credit may be a more beneficial measure for the consumer in this instance.”

The report goes on (page 16) to say that “while rate caps could reduce the cost of borrowing for some, there are a number of potential arguments against rate caps that should be considered:

- Reduce access to credit;

- Migration of interest rates towards the rate cap;

- Reduced competition and diversity of products;

- Introduction of, or increase in, ancillary fees and charges; and

- Growth in the unregulated market.”

The Office of Fair Trading came to a similar conclusion a year before:

“The OFT has also considered the case for price controls for pawnbroking, payday loans, home credit and rent-to-buy credit and concluded that they will not address the problems identified in the high-cost credit sector, which stem from both limited supply options and consumers' lack of ability to drive competition. The OFT is concerned that such controls may further reduce supply and considers there to be practical problems with their implementation and effectiveness. These problems include the potential for suppliers to recover income lost through price controls by introducing or increasing charges for late payment and default.”

Finally, going back to Wonga, they recognise that payday firms can rip-off customers and cite examples in the USA where some firms would actively try to rollover customers at least four times to ensure they recoup their customer acquisition costs. Wonga claim they do not do this but, as demonstrated by the Payday Loan Master, the most serious disputes between short-term lenders and their customers are when firms add fees claiming that funds were not in the customer’s account on the due date when the customer claims there were funds.

In this instance, Wonga has a zero tolerance approach to late payments and this is why they do have issues with customers who fail to meet the criteria of making sure they payback on payday.

In summary, I’m sure I’ll come back to this discussion again at some point, but Wonga fill a gap in the market for those who need short-term cash, want to avoid banks for various reasons and understand how the system works. They have very high customer satisfaction and recommendation levels, depend upon repeat customers, and have no interest in poor credit vulnerable customers as they will not pay back.

The net:net is that Wonga does not see themselves as bad company. However, they live with bad company in a too lightly regulated part of the financial markets. Regulation is required therefore, and we both agree that regulation needs to be clear, fair and to ensure that customers are effectively protected.

All in all, a good dialogue and much greater clarity about this market, its challenges and issues.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...