This is so good, I had to extract if for the blog in its own right.

Yesterday, I spotted a headline in the Daily Telegraph: “UK traders less distracted than German counterparts during World Cup”.

The article discusses a report published by the European Central Bank on Monday that provide in-depth analysis of global trading patterns during the 2010 World Cup.

Here’s the abstract from that report:

“Every four years, 32 national soccer teams compete in the World Cup. This tournament, which is organised by the world soccer association FIFA, attracts attention from millions of fans across the globe.

During the 2010 edition in South Africa, many matches were played during stock market trading hours. This presents us with a natural experiment to analyze possible fluctuations in investor attention. The paper presents three key findings.

First, we find strong evidence of decreased activity in stock markets during soccer matches at the 2010 World Cup. Trading activity dropped markedly, especially if the national team was one of the competitors. Compared to normal market circumstances, the median number of trades dropped by 45% if the national team was playing, while the volume dropped by around 55%.

Second, we show how goals scored by either team led to an even stronger decline in the number of trades and offered quotes. Also, we find that market activity was already significantly below the benchmark right before the match started, and continued to be lower during the 45 minutes after the match had ended.

Third, we show that also price formation was affected during the soccer matches, as the evolution of returns on national markets decoupled from those on global markets. Overall, there is a strong sense that stock markets were following developments on the soccer pitch rather than in the trading pit.

These results provide evidence for limited attention in financial markets, which in itself affects the price formation process.

Further tests show that inattention was particularly strong for relatively less salient information – there was a particularly strong decoupling of national from global markets as long as the price movements on the global market were relatively small.

Furthermore, the cross‐sectional dispersion of returns across the individual constituents of a country’s stock market index was substantially reduced, suggesting that the distraction coming from the soccer matches led to a reduced focus on firm‐specific as opposed to market and sector‐wide information.”

OK, so this is interesting as it means that trading, which is still dominated by the male of the species, is not so active when football, the game of the testosterone charge male of the species, take place.

Wow!

The ECB’s analysis goes into great depth, and shows that trading changes minute by minute during a World Cup Final Game.

For example, trading activity dips by 5% in the five minutes after a goal.

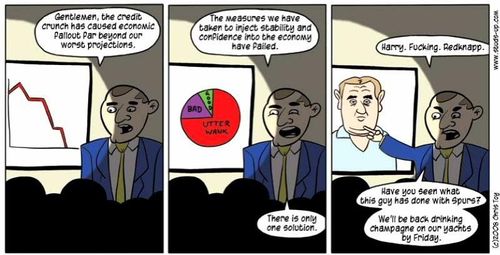

But what’s really interesting is when you look through the data and find that nations have different attitudes to this game.

The Danish don’t care much about it – theirs is the only nation where trading volumes increase during matches when their national team play – whilst the Brits see a decrease but nowhere near as much as the Germans dip.

Trading in German markets fell 60% when the national team were playing compared to only 21% in the UK (but our team is rubbish anyway).

Oh no, it's not Fabio Capello anymore is it ...

Source: Chris Toy's Studs-up

Mind you, it’s not as bad as the South Americans who really get into the soccer show.

For example, the Chileans near enough stop all trading when their team are playing, with a more than 83% drop in trading at these moments.

So here’s the world view of volume of trading during the World Cup by nation:

And if you really want to know more, then feel free to download a copy of the whole report: ECB World Cup Analysis.

Oh, and yes, it probably shows that the ECB hasn't a great deal else to be doing right now I guess.

From the Wall Street Pit:

The ECB's Trillion Euro Bet

Spreads on public debts in the Eurozone – with the exception of Greece – are falling hard and fast. This column argues that this is in large part because the ECB is now effectively guaranteeing Eurozone government debts. But it cautions that in doing so, the central bank is taking enormous risks.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...