In case you didn’t see it, Wired magazine ran an article about Jack Dorsey and Square this month. Throughout the article, they compare Jack Dorsey to Steve Jobs and Square with Apple. In a long opening – the first page is just about pouring tea! – they finally get to the crunch so here’s my shorter, edited version:

Square may be best known for its dongle, but Dorsey says that’s just the beginning. He envisions the company as a vast ecosystem that humanizes every act of commerce. Its current products and services have already made a lot of headway.

Dorsey first showed me his payment app in the summer of 2009. He took me to his apartment in a high rise overlooking the bustling plaza of the old US Mint. Hovering over the kitchen counter, Dorsey explained that he was going to empower everyone to accept cashless payments. He took a piece of white plastic shaped roughly like an acorn, jammed it into the earphone jack of his iPhone, and asked me for my credit card. When I produced it, he swiped it through a slot on the acorn. Then he had me sign the screen with my finger and enter my email. When I checked my own iPhone, I had a message noting that I’d paid Jack Dorsey $1. A Google Maps image marked the location of the transaction. Dorsey was beaming like a proud parent.

Its name—Squirrel—was not particularly descriptive. Squirrel came about in a strange way. When Dorsey was growing up in St. Louis, he had a summer internship with an entrepreneur and glassblower named Jim McKelvey. Even at 15, Dorsey was impressive and he became friends with McKelvey.

McKelvey remarked during a phone conversation that he had lost a recent sale—a $2,500 blown-glass bathroom faucet—because his customer could pay only with a credit card. As McKelvey recounted this tale to Dorsey—both of them with iPhones pressed to their ears—they realized that a business was literally at hand. Those smartphones had more processing power than entire banks did decades earlier. Why couldn’t they process credit card payments?

(That story has attained near-legendary status, like Pierre Omidyar’s Pez dispensers or Steve Jobs’ visit to Xerox PARC. But the details are in some dispute. As Dorsey tells it, the customer was in the store and wouldn’t run out to get cash. McKelvey, however, says the customer was calling from Panama, and he couldn’t accept American Express.)

Not long after that conversation, in February 2009, Dorsey, McKelvey, McKelvey’s wife, Anna, and a friend named Greg Kidd drove north of San Francisco to a Muir Beach restaurant called the Pelican Inn. They spent the evening debating whether they should start a company based on the idea that the world needed an easier way to make payments in person. Eventually they decided to do it. On the way home, they stopped at a 7-Eleven to buy some water. Dorsey and Anna, who stayed in the car, saw a squirrel run across the hood. It got Dorsey thinking. Squirrels dart around and collect acorns—it’s sort of currency for them! And like the word twitter, squirrel can also be used as a verb—people “squirrel” away their treasures! Dorsey could instantly envision acorn-shaped hardware—awesome branding!

Within 10 days, Dorsey and his team had whipped up a prototype. Robert Andersen, a product designer for Apple who’d written an early Twitter app, was one of the first to see a demo. “I thought it was really bizarre that you would swipe a card reader through an audio jack,” he says. Actually, it’s brilliant—a credit card’s magnetic strip stores information much like the tape does on an audiocassette. Dorsey’s team also designed the device to be powered by the energy generated during the actual swipe. As a bonus, the sound it made when the card zipped through the slot resembled the squeak of a squirrel.

But the most outrageous part was how easy it suddenly became for anyone to accept credit cards, using a device they already owned. The process through which businesses are authorized to accept credit card payments is notoriously arduous and slow, particularly for small merchants. The issuing banks demand multiple proofs of creditworthiness and pile on extra fees. Square itself had difficulty negotiating that red tape—it took longer to get approval from Visa and Mastercard to accept a swipe than it did to create a prototype for the entire payment system. “Our sign-up process takes literally two minutes,” Dorsey says. “You download an app, put in your name and address, answer three security questions, link your bank account, and you’re done.” Andersen saw the potential. Just as Twitter democratized broadcasting, Dorsey’s new company would democratize the credit card industry. He quit his job at Apple and signed on with Squirrel.

Small problem: There was already a payment system named Squirrel. The team repaired to the dictionary and found, not far from squirrel, a new name. A square is a fundamental shape that suggests heft. A square deal is a fair one. And when two parties settle a deal, they square up.

Square was positioned to disrupt the payments industry, but it wasn’t out to topple the credit card companies. Indeed, it could be a boon to them; payments that were once made with cash could now be made with credit cards. (Square charges 2.75 percent per swipe and gives the vast majority of that fee—the company will not say exactly how much—to the card issuers.) So Dorsey met with some of the biggest names in finance, like JPMorgan Chase CEO Jamie Dimon and Visa head Joe Saunders. The demo won over the bankers. “Jamie has a Square reader on his desk,” Dorsey says. And Visa became an investor.

Since then, Square has signed up more than a million merchants; it expects to process more than $5 billion in transactions over the next 12 months. One symbol of its ubiquity can be found in the lobby of its headquarters: Anyone can come in off the street and grab one of the Square payment dongles that sit in a glass bowl on the receptionist’s desk, like lollipops in a pediatrician’s office. They’re free. And just like that, you’re a credit card merchant.

In early 2011 Dorsey became captivated by the idea of using a wallet metaphor in a Square app. William Henderson, a former Apple operating system specialist who now works as a software engineer at Square, says, “Jack got so excited that he came to work one day with a stack of 10 leather wallets.” For hours, Dorsey and his team deconstructed every detail. He was especially fond of the Hermès. (He adores the brand and pronounces its name “air-MEZH,” as if he were raised in a duty-free shop.) The team designed a digital wallet that faithfully replicated its austere majesty, down to the stitching. It even carried a monogram, extracting initials from the user’s registration information and dropping the trailing dot after the second initial, just as Hermès does. The credit cards, which fit into their slots at slightly asymmetrical angles, were stamped with holograms that changed color when the screen was tilted.

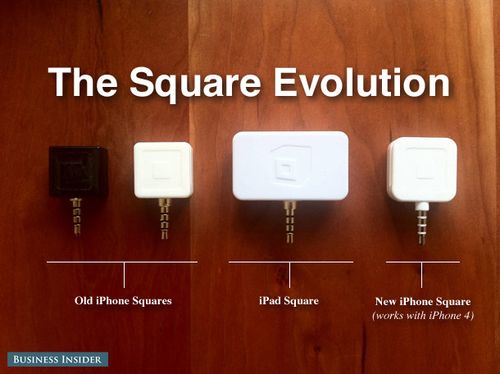

And, like Steve Jobs, Dorsey has a knack for disrupting entire industries and forcing them to follow his lead. The established companies that process merchant transactions—like PayPal and VeriFone—were caught off guard by Square. Now they’ve launched competing offerings. PayPal has created PayPal Here, with a stylish triangle-shaped card reader that the company says is more structurally sound than Square’s. PayPal president David Marcus thinks that all of PayPal’s 110 million users will eventually adopt it. VeriFone, the leader in credit card swiping machines, built a Square knockoff called Sail, which has a flap that extends down the back of the smartphone. (Intuit has offered its own mobile credit card system, called GoPayment, since 2009.)

The message from those giants seems to be, thanks, kid, we’ll take it from here. “There’s no question they’ve innovated,” PayPal’s Marcus says. “It’s been good for the ecosystem. And Jack is a good guy. But people need a multichannel solution.” Jennifer Miles, an executive vice president at VeriFone, adopts a similar tack: “Square took a sleepy industry that was doing things the same way for years and innovated. But that process is replicable.”

Dorsey is unimpressed. First of all, he thinks it’s wrongheaded to build those flaps on readers that plug into smartphones: “We don’t want to add things—we take things away to make them more simple,” he says. More broadly, Dorsey takes issue with the implication that Square is too naive to compete with the ultrasophisticated finance industry. “Yes, we’re naive,” Dorsey says. “But that’s a strength, not a weakness. We literally have fewer than five people in a company of 250 who have worked in the financial industry. So our approach is to engineer and create and build what we want to see.” (In any case, should Dorsey get stumped on some intricate issue of high finance, he can seek enlightenment from former Treasury secretary Larry Summers, who sits on Square’s board.)

Keith Rabois, a former PayPal exec and now COO for Square, has a harsher take on his old employer: “It’s sad that what qualifies as innovation there now is trying to replicate, piece by piece, something that someone else is doing.”

For VeriFone and PayPal there is a risk in mimicking another company’s products as the leader will always introduce new versions of its devices just as competitors catch up with its previous model. For example, Dorsey has already released the next iteration of Square—a swipe-free version. It began at an all-hands meeting in late 2010, when Dorsey issued a challenge to his staff: “I want to have a payment experience that’s so smooth that when I walk out I won’t be able to remember if I even paid.” Imagine if customers were checked in automatically via Wi-Fi any time they walked into a participating store. When they wanted to buy something, they could just give the merchant their name. They’d never even need to reach into their pocket!

The vision—swipeless pay, if you will—was a logical extension of Square’s mission of turning payment into an intimate experience. But instead of merchants doing all the work, this required customers to download an app too. They dubbed it Card Case. The first version—which featured the passionately designed digital wallet, including virtual credit cards for each participating merchant—launched in the spring of 2011. A few months later, while interviewing with Dorsey for a job at Square, an Apple iPhone product manager named Shuvo Chatterjee pointed out that, while he loved the service, the wallet metaphor didn’t really work. “I’m collecting those cards, but it’s not really scaling,” he said. “In my real wallet, I don’t have one card for every merchant I buy from.” Dorsey hired Chatterjee and made him the Card Case product lead. In March 2012, they released an update. The beloved Hermès wallet was gone, replaced by a cleaner interface that more effectively promotes discovery of new places. (Once you establish a relationship with a merchant, it’s like opening a bottomless ledger, one that can easily handle things like loyalty programs.) The app also acquired a new name, Pay With Square, an indication that it was no longer a side project but had become crucial to the company’s mission. No dongle required.

And the innovations don’t stop there as Square is continuing to expand the company’s offerings up the retail food chain. Earlier this year, Square saw the popularity of the iPad as an opportunity to expand its business beyond individuals to boutique-level merchants. It released Square Register, an app that makes it easy to use an iPad as a full-featured cash register. Vendors can set up buttons for each item they sell, much as McDonald’s lets cashiers simply press Shake instead of entering the price. It can also connect wirelessly to a cash drawer.

But Register’s real value is that it offers sophisticated analytics for free. Its users get data that allows them to identify which products are selling and when, and future versions will be even more powerful. “As a customer enters the vicinity of the establishment, a notification will spring open on the merchant’s screen,” says Megan Quinn, Square’s director of products (who has since left the company). “It will show the customer’s name and suggest their most likely order, based on an algorithm that knows past purchases and things that sell well at the store.”

Henderson, the engineering lead on Pay With Square, points out that the company collects all kinds of information about its users, data that might be invaluable to merchants and customers alike. “First of all, we know your location,” he says. “Second, we have a decent sense of your history. We know the kinds of places you’ve been and what you like. But we also know lots of other things—like if there’s a whole bunch of food trucks that pull up nearby, we’ll see the spike in activity and can point you to those trucks. I think you’ll see us get really good at this.”

Analytics and data-mining might provide Square’s real business model. So far, the company has charged a very small fee for each transaction, and merchants aren’t likely to pay much more. And while Square has been giving participating merchants access to analytics about their businesses for free, it is also aggregating that data, real-time information about what people are buying in every region of the country, complete with detailed demographics. It’s reasonable to think that might be very valuable in the near future.

Square is still focused on smaller merchants, but its executives believe that even tier-one retailers will use Square before long. “The Neiman Marcuses and the Walmarts will want to have an emotional attachment with their buyers, where anybody can walk in and pay with their name and have an electronic receipt,” Rabois says. “That’s what we’re going to deliver.”

In other words, Square aims to provide shoppers with an emotionally satisfying experience—and it is using the Apple playbook as its guide. “My challenge to our product team is to build the app that they themselves really want,” Henderson says. “That’s something I learned at Apple. That’s the reason it’s able to consistently surprise consumers.” Communicating the Apple way really isn’t too hard for Henderson, because “almost every one of my team at Apple now works for Square.”

The Square Economy

Square Card Reader

Who uses it: More than a million massage therapists, accountants, taxi drivers … anyone who wants to sell something.

How it works: Vendors plug the free dongle into a smartphone’s headphone jack. Customers swipe their cards and sign the screen with their finger.

Square Register

Who uses it: Shops and boutiques looking for an alternative to a cash register.

How it works: The iPad app, which connects to a cash drawer via Wi-Fi, lets vendors set up buttons for each item in their store. Square also provides merchants with free analytics.

Pay With Square

Who uses it: Customers and stores that like the idea of swipe-free payments.

How it works: When consumers download the app and walk into a participating business, their name and photo pop up on the store’s iPad. Customers pay by giving their name and can even add a tip later.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...