Pew Research is always producing interesting reports, but

this one specifically caught my attention this week: 51% of US adults bank online.

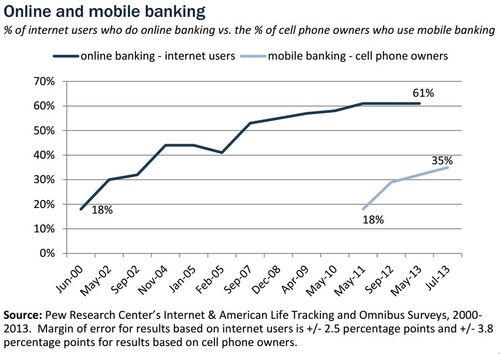

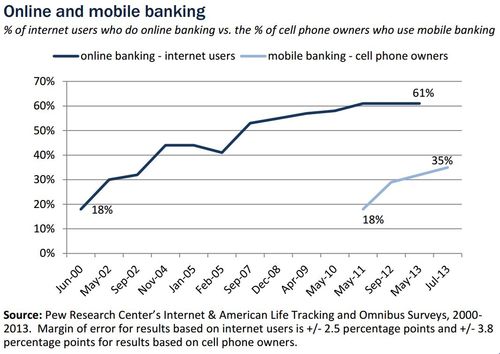

Over half of Americans are banking online or, if you

translate that into those who use the internet (about 80% of US adults), then 61% of internet users bank online.

More intriguingly is how rapidly that has translated into

mobile banking users: 32% of US adults, or 35% of cellphone owners, bank using

their mobile phones; and both types of digital banking are on the rise.

In 2010, 46% of US adults, or 58% of internet users, said

they bank online and, in 2011, 18% of cellphone owners said they have used

their phone to check their balance or transact business with a bank.

Unsurprisingly, almost all, affluent, educated consumers

bank online, although it is notable that it is the urban rather than rural

folks who are most likely to be banking online.

Combine this report with their April report: The Future of Money in a Mobile Age, and you have a great, free research tool to add some pertinent numbers to your

banking pressies!

Oh, and if you cannot be bothered reading the latter, here’s

the overview (courtesy of Mashable):

Experts believe that cash and credit cards could be a thing

of the past by 2020, a new study suggests.

A new study conducted by the Pew Research Center’s Internet

& American Life Project and Elon University’s Imagining the Internet Center

revealed that the majority of survey respondents believe swiping mobile phones

could replace cash and credit cards both online and in stores by smartphone and

tablet users within the next decade.

The study was conducted among a non-random sample of 1,021

technology stakeholders and critics in the mobile payments industry, from

executives and Google and Microsoft to professors at distinguished universities

nationwide.

About 65% of respondents said they believe that by 2020 most

consumers will have embraced and fully adopted the use of smart-device swiping

for purchases they make, nearly eliminating the need for cash or credit cards.

They also agreed that people trust and rely on personal hardware and software

for transactions, and cash and credit cards will have mostly disappeared from

many of the transactions that occur in advanced countries.

However, about 33% said they do not trust devices with Near

Field Communications technology (NFC) that allow users to swipe their phones to

make a payment at checkout and believe mobile payments will not gain a lot of

traction by 2020.

The report also found that embracing NFC technology will be

slow due to a combination of privacy fears, a desire for anonymous payments, a

lack of infrastructure to support widespread adoption and resistance from those

companies with a financial stake in the existing payment structure.

For those that believe mobile payments will become commonplace

soon, many referenced how the movement is already booming in many parts of the

world.

“The 2020 date might be a bit optimistic, but I'm sure that

this will happen," said study participant Hal Varian, chief economist at

Google. "What is in your wallet now? Identification, payment and personal

items. All this will easily fit in your mobile device and will inevitably do

so."

But not all experts were optimistic about the progression:

“As much as I'd like to see a money-free world, I'm afraid the opportunities

for the hackers and pirates are too great," said one respondent. "I'm

happy to buy my $2 Starbucks using my Android but I don't know that we will

ever feel secure enough to make much larger purchases that way.”

Hmmm ... maybe the guys should checkout Checkin by PayPal (now here in Richmond, UK):

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...