Super caffeinated, I prowled the exhibit hall for an hour or

so and bumped into lots of old and some new friends. There’s not a great deal of stuff happening,

although there are a few stands that stand out such as the Agricultural Bank of

China because the Chinese weren’t here last year. That was when SIBOS was in Osaka and there

was some spat over ownership of Japanese islands … or are they Chinese?

There’s a nice stand from the Azerbaijan bank Pasha.

I like the name Pasha Bank, as I have a passion for banking,

but do have slight concern when I see the bank is owned by the Azerbaijan president’s

father-in-law … but then my bank’s owned by the Prime Minister of Britain, so

why does that worry me?

Finally, I bump into the SEB booth and find the watch on my

wrist has disappeared, along with the belt on my trousers.

What’s going on?

Oh, they have a magician on their stand. He’s very impressive but I’m not sure I like

my trousers dropping around my ankles (although it does get a big laugh).

Ah well, time to find out about Big Data (not that old nugget

again) … yes, it’s the second big innotribe session and this one has a long

list of speakers:

- Neil

Bartlett, CTO and Head of Development of Risk Analytics, IBM - Daniel

Erasmus, Owner, Digital Thinking Network - Matthew

Gordon, Forward Deployed Engineer, Palantir - Walid

Jelassi, Transformation Consultant, HP - Piotr

Kulczakowicz, Vice President, Quantum4D - JP

Rangaswami, Chief Scientist, Salesforce - Simon Small, Founding

Director, ARRIA NLG - Kimmo

Soramaki, Founder & CEO, Financial Network Analytics

Kimmo, a Finnish entrepreneur, kicked off the session

talking about What is Data?

Seems like a simple thing, but maybe not as everyone in the

room defined it a different way.

Wikipedia give a good definition though:

“The word data is the plural of datum which is Latin for "something given".”

Maybe a better elaboration is that:

Data are typically the

results of measurements and can be visualised using graphs or images. Raw data,

i.e., unprocessed data, refers to a collection of numbers, characters and is a

relative term; data processing commonly occurs by stages, and the

"processed data" from one stage may be considered the "raw

data" of the next.

This leads logically to a dialogue around data versus

processed data versus information and knowledge, and Kimmo talked about how

data is dirty because it is so unstructured and meaningless but information is beautiful

because we translate the data into meaning.

Walid Jelassi talked about the impact of data interpretation

when twitter wiped $136 billion off the S&P 500 in ten minutes recently, due to a tweet from a strong market influencer.

The tweet related to an Associated Press breaking news item

saying that there had been two explosions in the White House and Barack Obama

had been injured.

The tweet turned out to be false – the twitter account for

the associated press had been hacked into – but you see the impact of real-time

newsfeeds from social media in action,.

In another spin on the view of data, Daniel Erasmus talked

about it being a matter of interpretation as illustrated by the cartoon map of

the world according to Ronald Regan.

Very funny, but data is processed to create meaning based

upon interpretation and it’s your interpretation that is creating the

meaning. Be aware of that.

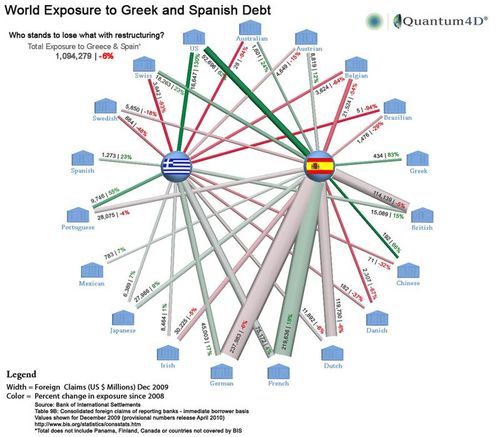

We then talked about visualisation tools, graphs, charts and

media and the many ways to look at that these days, with Piotr Kulczakowicz

showing us Quantum 4D’s visualisation tools and how they allow you to play with

complex data to find unknowns, such as who was exposed to who when the Greek

economy collapsed.

Piotr was followed by Simon Small who argued that data is

not what it’s about anyway. It’s about

words. It’s about language. It’s about taking the numbers and telling

stories. It’s using the analytics to

create understanding that we can articulate through language.

PJ then gave reflections across all the presentations,

talking about dirty data being cleansed and how language is also not consistent. You say toma-to and I say tom-a-to. He made us all smile by saying that it doesn’t

matter whether you say toma-to or tom-a-to, nor is it knowing that tomato is vegetable

or a fruit, but it is having the knowledge to know that you don’t put the tomato

in a fruit salad. That is turning data

into knowledge.

This led us into a dialogue about analytics and how to

analyse data.

We talked about how Facebook uses analytics to serve

relevant adverts to users (or not!), and Google using the network metric Page Rank to identify search

results.

This led to the proposition that the whole financial system Is

a set of networking interdependencies, and the data flows between these

connections are the criticalities today.

That is why we need to sift through the data, identify

relationships through interdependencies and time series, place a lens on the

data to filter out irrelevancies and highlight relevancies.

We talked about automated tools to trawl through all the

social media, video, audio, email, texts, transactions, documents, spread

sheets, presentations and stuff that we produce these days to find the nano-needles

in giant data haystacks that are relevant.

We talked about taking all this stuff and throwing into Hadoop,

a framework that transparently provides both reliability and data motion to

applications.

We then talked about how to take all of this mined data and

start to visualise it so we can see the interdependencies.

We talked about hierarchical and relational databases, and

it is quite clear that today we need neural databases that think like a brain

to take all of this analytics and make sense of it all.

We talked about a lot and, If this area is of real interest

to you, then you can come along to a FREE discussion I

am chairing on September 24th.

The meeting will debate the relevance of Big Data Analytics

in relation to AML and Fraud at Level 39, Canary Wharf, and features Forrester

followed by a panel discussion featuring myself, as moderator, and:

- Derek

Wylde, Global Head of Fraud Management, HSBC - Stephen

Foster, Director Anti-Money Laundering, Group Financial Crime, Barclays

Bank - Ram

Chinta, PolarisFT - Paul

Phillips, Hortonworks - Martha

Bennett, Principal Analyst, Forrester

The event is organised by Polaris and Hortonworks, and takes

place from 18:00 on September 24.

ANYONE WHO WORKS FOR A BANK CAN GET A FREE TICKET BY

REGISTERING HERE

Anyways, I’m now off to do more exhibit touring – must get

those free gifts! – and find out about the new cyberworld insecurities of

banks.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...