Building on yesterday’s theme, I struggle when people (including myself, I must admit) shout out that banks are going to be disintermediated, I struggle when someone starts shouting out that Google, Facebook or Amazon will replace banks.

I struggle even more when rebels state that bitcoin is the future and down with the capitalists.

Maybe I’m too old or too jaded or just too darned cynical, as I’ve heard it all before.

Twenty years ago, everyone shouted that banks would be disintermediated. Everyone said that Microsoft, Virgin and Wal*Mart would take over. Everyone pointed at Beenz and Flooz as the new forms of money.

None of it happened.

Maybe it never will.

It is why I now talk about component-based banking, because I do believe the banking business model will change. But will banks disappear? No. They will adapt.

Banks will evolve to become integrators of the best bits of software out there.

They will find the APIs, apps and cloud-based data needed to integrate services into the best-of-breed components that suit the customer best.

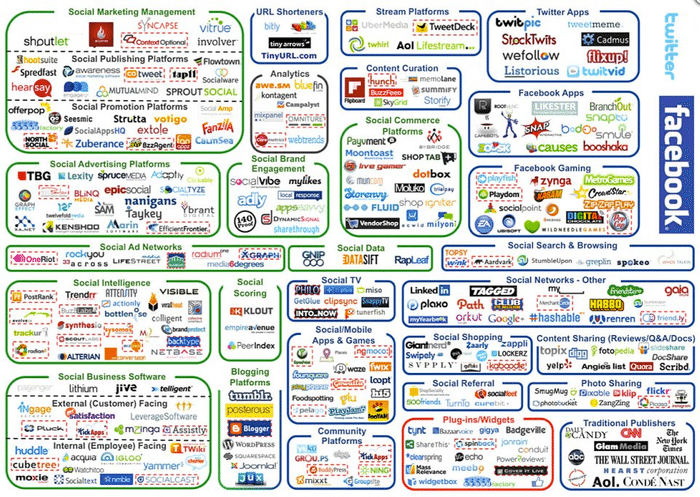

This will be in partnerships that create a complex ecosystem similar to the complex ecosystems we see out there for social media …

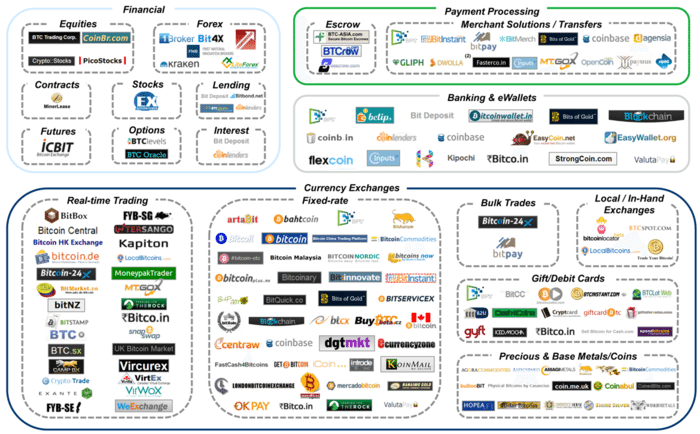

… and digital value exchange …

In other words, the business model is far more complex than it has ever been before, and will continue to gain complexity, but it is the financial firms that find simplicity in complexity that will prosper.

Meanwhile, as I struggle to accept that new players will disintermediate banks, I do believe that they will augment banking.

This is the point I was making yesterday when talking about Google.

Google, Facebook, Amazon and Bitcoin will end up as part of the new complex business model of component-based banking.

Banks will evolve to work out how they can find relevance to their end target audience though these intermediaries.

In other words, rather than being disintermediated, banks will identify new models for re-intermediation in a much more complex value chain.

This will be interesting to watch.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...