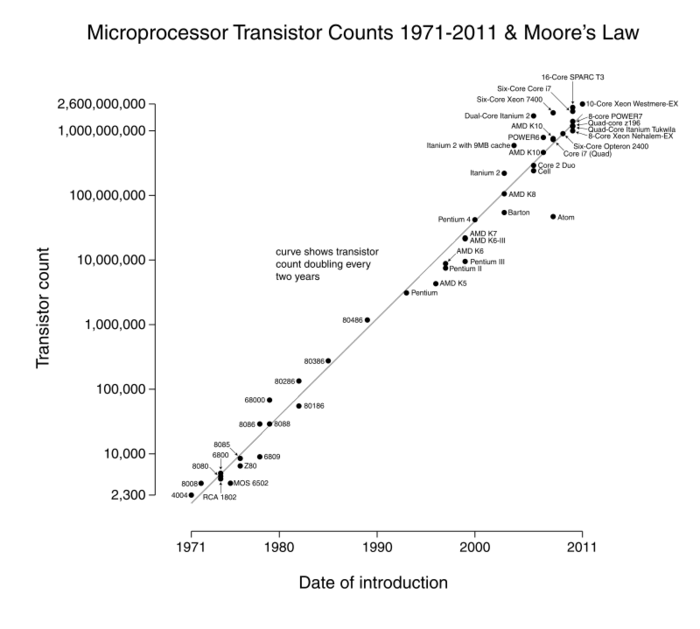

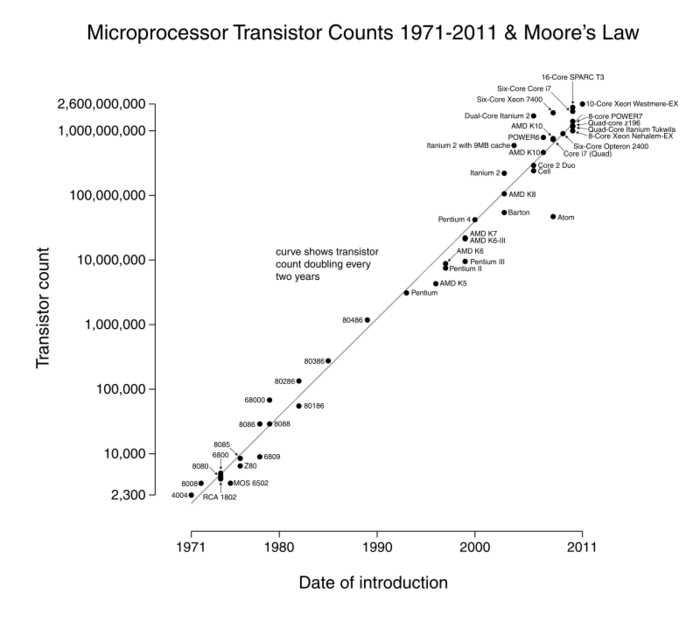

There’s the famous old law of computing observed by Gordon Moore fifty years ago that compute power will double every two years whilst the cost will halve. It’s stayed pretty much true, as evidenced by this chart:

But I have a new one. Mine applies to banking, although it could equally apply to any service-based business, and this is that the service level will improve 100% every two years whilst the cost of service will halve.

This is aligned with Moore’s Law obviously, but it’s an observation recently around how rapidly things are moving in the field of self-service. We talk about augmented service, mass personalisation and more, but it’s really more to do with putting the tools in the hands of the customer so the customer can do more themselves.

As we give the customer power, they are in turn seeing service improvements because they create their personalised space. Uber, airbnb, Starbucks and more are all illustrations of the power of self service, but there are more coming downstream. Take the idea of Apple Pay combined with the internet of things, as I blogged the other day, and you get the idea.

In fact, it is leading to a situation where dealing with a human for a banking service will become a sign of service failure. If the customer can personalise all their service needs using the tools they’ve been given, a bank should not need to deal with them directly over the telephone or in a branch.

This is the concept of Atom Bank, the UK’s first digital only bank launching next year, is developing. Atom Bank will not have a call centre or contact centre. Not for banking questions anyway. They will have a number you can call, but that number is purely to answer any technical queries you may have, not for banking transactions or questions.

This leads to the notion that the more you push service through automated digitalisation, the lower the cost overheads of the internal organisation. Hence, service levels double in efficiency every two years whilst costs halve.

Interesting notion, and I wonder whether anyone else has any anecdotes or illustrations of this idea.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...